NCBFG Q12023

- Earnings: Earnings Per Share declined 68.7% from TT$0.05 to TT$0.02

- Performance Drivers:

- Lower revenues from Insurance activities

- Decline in operating expenses

- Outlook:

- Economic normalization across operating jurisdictions

- Rating: Assigned at MARKETWEIGHT

AGL Q12023

- Earnings:

- Earnings Per Share (EPS) 18.2% higher from $0.88 to $1.04

- EPS inclusive of one-off non-cash adjustments: 139.8% higher from $0.88 to $2.11

- Performance Drivers

- Continued Segment Growth

- Improved Margins

- Outlook:

- Growth from Acquisition Activities

Rating: Assigned at MARKETWEIGHT

This week, we at Bourse review the performance of financial services giant NCB Financial Group Limited and trading stalwart, Agostini’s Limited (AGL) for their three months ended 31st December, 2022. NCBFG reported lower earnings as the Group grappled with lower net revenues from insurance activities. Meanwhile, AGL reported improved earnings owing to increased demand and successful acquisition activity.

NCB Financial Group Limited (NCBFG)

NCBFG reported Earnings Per Share (EPS) of TT$0.02 for the first quarter of 2023 ended December 31st 2022 (Q12023), declining 68.7% from the previous comparable quarter. Net Result from Banking and Investment Activities advanced 9.2% from TT$1.08B to TT$1.18B in Q12023. There was steady improvement in the core revenue lines, driven by growth in the loan and investment portfolio and increased transaction volumes. Net revenues from insurance activities totaled TT$116.5M, representing a decrease of 71.4% from the prior year, due to a one- off actuarial adjustment. Overall, Net Operating Income decreased 12.8% in Q12023 to TT$1.29B from TT$1.49B. Operating Expenses declined by 2.6% to TT$1.15B. Operating profit fell 52.1% in Q1 2023 to stand at TT$147.6M. Share of Profit of Associates moved from TT$12.6M to a loss of TT$0.40M. Profit Before Tax stood at TT$147.2M in Q12023, a 54.1% decline from TT$320.9M in the prior quarter. Taxation increased 2.9% to TT$87.8M in the current period. Net Profit Attributable to Shareholders came in 68.3% lower at TT$36.6M, relative to TT$115.6M in the prior comparable period.

Lower Operating Income

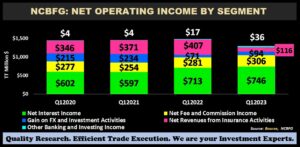

NCBFG reported a 12.8% decline to TT$1.3B in Net Operating Income for the first-quarter ended December 31st, 2022, predominantly impacted by the reduction in net revenues from insurance activities.

Net Interest Income, the largest component of Net Operating Income (57.5%), expanded 4.7% as the Group recorded growth in its interest earning portfolios. NCBFG’s loan portfolio and customer deposits increased 8.0% and 5.0% respectively. Net Revenues from Insurance Activities (9.0% of Net Operating Income) contracted 71.4% from TT$407M in Q12022 to TT$116M in Q12023. This decline was primarily due to a ‘one-off actuarial adjustment’ in its Life, Health and Pension (LHP) insurance segment and additional reserve movements in its subsidiary, Guardian Holdings Limited (GHL) as they hold a 61.77% stake in the Trinidad-based insurer. Net Fee and Commission Income (23.6% of Net Operating Income) climbed 8.9% to TT$306M from TT$281M in Q12022, mainly due to higher transaction volumes. Gains on Foreign Currency and Investment Activities increased 31.6% to TT$94M likely due to increased gains from security dealings. Other Banking and Investing Income rose 113.7% to TT$36M, led by gains in other operating income.

Operating Profit by Activity

Only one of NCBFG’s seven operating segments recorded year-on year improvement. General Insurance (35.6% of Operating Profit) expanded 150.9% from TT$43M to TT$109M. Life and Health Insurance & Pension Fund Management (15.1% of Operating Profit) saw the largest decrease from TT$366M to TT$46M, representing an 87.4% fall. Treasury and Correspondent Banking (25.3% of Operating Profit) saw a 10.1% decline year over year. Corporate and Commercial Banking (19.4% of Operating Profit) displayed a similar decrease of 15.7%. Consumer and SME Banking Wealth experienced a loss of TT$26M as a result of higher operating expenses and allocated costs. Asset Management and Investment Banking (9.7% of Operating Profit) fell 69.9% to TT$30M and Payment Services (accounting for 3.5% of operating profit) dropped 15.7% to TT$11M.

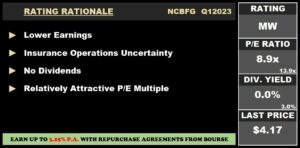

NCBFG’s trailing earnings per share increased from TT$0.25 in Q12022 to TT$0.49 in Q12023. As a result of this and an 8.6% fall in share price year-to-date, the Group’s Price-to-Earnings (P/E) multiple has adjusted from 31.8 times in Q12022 to a relatively fair multiple of 8.9 times in Q12023. Historically, NCBFG would have traded at a ‘pre-COVID’ earnings multiple of around 16.0 times (during 2017-2019).

The Bourse View

NCBFG is currently priced at $4.17 and is down 8.6% year-to-date. The stock trades at a Price to Earnings ratio of 8.9 times, below the Banking sector’s average of 13.9 times. The Group made the decision to not declare an interim dividend payment in its latest earnings release.

Widespread economic recovery is expected across its tourism-based operating territories which could serve as a tailwind for growth in the subsequent periods. However, the current inflationary environment coupled with tight liquidity conditions and high interest rates could weigh on the demand for loans, tempering the increase. On the basis of a relatively attractive P/E multiple valuation, but tempered by the noticeable absence of dividends and some uncertainty from the near-term impact of its insurance operations, Bourse assigns a MARKETWEIGHT rating on NCBFG.

Agostini’s Limited (AGL)

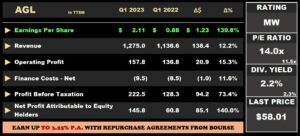

Agostini’s Limited reported an Earnings Per Share of $2.11 for the three months ended December 31st 2022 (Q12023), 139.8% higher than $0.88 reported in the previous period. Revenue expanded 12.2% to $1.28B from a previous $1.14B. Operating Profit rose 15.3% to $157.8M, compared to $136.8M in Q1 2022. Finance Costs increased 11.6% to $9.5M. Profit Before Taxation climbed 73.4% from $128.3M to $222.5M, helped by a $77.0M Net Gain on Acquisitions. Taxation Expense was $42.3M relative to a prior $37.9M. Profit Attributable to Owners of the Parent stood at $145.8M, 140.0% higher than $60.8M reported in the prior period.

PBT Expands

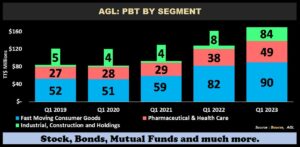

Fast Moving Consumer Goods (FMCG), which accounted for 40.3% of PBT, grew 9.0% year-on-year, supported by revenue growth in each of its operating markets.

Pharmaceutical & Health Care, (22.1% of PBT) improved 28.9% from $38M in Q1 2022 to $49M in Q1 2023. According to the Group, its acquisitions of Collins Limited and Carlisle Laboratories Limited is expected to be transformative to its pharmaceutical strategy and financial performance of the segment.

Industrial, Construction and Holdings, which contributed 37.6% of PBT, expanded a noteworthy 951.6% over the period. This is likely due to a one-off non-cash gain on acquisitions.

Margins Improve

AGL’s Operating and Profit Before Tax margins both continued to improve, accompanying revenue growth in Q1 2023. Operating Profit Margin grew to 12.4% in Q1 2023 from 12.0% in Q1 2022, reflecting the Group’s continued efforts to improve its operations and cost management initiatives. This filtered into Profit Before Tax Margin, which jumped to 17.4% relative to 11.3% in the prior period.

The Bourse View

At a current price of $58.01 and having appreciated 16.0% year to date, AGL trades at a Price to Earnings Ratio of 14.0 times, above the Trading Sector average of 11.5 times. The stock offers a trailing dividend yield of 2.2%, below the sector average of 2.3%. The Group continues to grow its three core areas of operations through strategic acquisitions and organic growth. Additionally, AGL’s ability to consistently improve its margins may serve as an indicator for longer-term sustainable growth. On the basis of acquisition activities and improving margins but tempered by relatively elevated valuations, Bourse assigns a MARKETWEIGHT rating to AGL.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”