HIGHLIGHTS

MASSY FY 2021

- Earnings: Earnings Per Share 12.8% higher, from $8.02 to $7.11

Continuing Operations: EPS 73.6% higher, from $3.75 to $6.51

Discontinued Operations: EPS 55.1% lower, from $3.36 to $1.51

- Performance Drivers:

- Increased Revenues

- Sale of Non-Core operations

- Outlook:

- Geographical Diversification

- Portfolio Restructuring

- Economic Uncertainty

This week we at Bourse, review the financial performance of Massy Holdings Limited (MASSY) for the fiscal year ended September 30th 2021 and provide our perspective on the Group’s future fortunes prior to it cross-listing on the Jamaican Stock Exchange on January 27th 2022. Has all momentum from the proposed stock split and cross-listing initiatives already been priced into MASSY, or is there more to come? We discuss below.

MASSY Earnings Up

Massy Holdings Limited (MASSY) reported Earnings Per Share (EPS) of $8.02 for Fiscal Year 2021 (FY 2021), 12.8% higher than an EPS of $7.11 reported in FY 2020. Revenue from Continuing Operations increased 8.6% to $11.1B from $10.2B in the prior period. Operating Profit after finance costs expanded 43.7% to $878.6M, helped by an 8.6% decrease in finance costs. Profit Before Tax (PBT) increased 40.7% year-on-year(YOY), from $660.3M in FY 2020 to $928.9M in FY 2021. Income Tax expense decreased to $250.9M ($6.3M or 2.4% lower). MASSY’s Effective Tax Rate on Profits before Tax from Continuing Operations was 27.0% in FY2021, noticeably lower than the 38.9% rate recorded in FY2020. This is expected to normalize in subsequent periods to 30-32%, provided by MASSY at a recent broker meeting. Overall, Profit Attributable to Equity Holders stood at $788.5M, a 13.2% increase compared to $696.4M reported in the previous period.

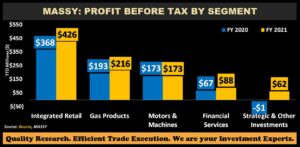

Improving Segment Performance

MASSY’s Financial Services segment (9.5% of PBT) posted the best year-on-year percentage gain, increasing 31.3% as the Group was able to record substantial investment gains from its international investment portfolio. The Financial Services segment also benefitted from a 17.0% increase in Gross Written Premiums for Massy United Insurance Ltd, along with lower loan loss provisions for Massy Finance GFC Ltd and increased remittance flows from its Money Services Businesses particularly in Guyana, Trinidad and St Lucia.

Integrated Retail (45.9% of PBT) advanced 15.8% on account of improving operating margins, while the Group’s Motors & Machines segment remained flat despite triple digit growth in its Colombian market.

Gas Products (23.2% of PBT) expanded 11.9% during the period, aided by a downward adjustment in turnaround costs and improved share of results from its Joint Venture Company, Caribbean Industrial Gases. The segment’s performance was also supported by increased Nitrogen and Carbon Dioxide demands in Trinidad & Tobago for industrial purposes, while healthcare-driven demand for Oxygen was also noted.

Geographic Diversification Improves

MASSY has been increasing its exposure across the Caribbean and Latin America as part of its regional diversification strategy. Trinidad and Tobago, while declining, remains MASSY’s core PBT generator by jurisdiction contributing 43.1% in FY 2021 compared to 47.6% in FY 2020. Guyana has grown in prominence in contributing to MASSY’s PBT, contributing 21.0% or $202.4M in 2021. Barbados also improved its relative contribution, accounting for 10.8% of PBT in 2021 versus 8.0% in 2020. Colombia advanced from 3.4% to 7.0% in 2021, driven by strong operations to the Motors and Machines Portfolio and the Gas Products Portfolio.

Cross-Listing, Stock-Split sends MASSY higher

Investors will be wondering ‘What’s next?’ for MASSY’s stock price after its meteoric rise during the course of 2021. After closing 2020 at a price of $60.99, MASSY’S share price experienced modest growth of 6.6% up to May 9th 2021. Following the Group’s announcement on May 10th 2021 of its intention to cross-list on the Jamaican Stock Exchange (JSE), shares of MASSY sharply rallied 56.1% to $95.19 on December 16th 2021.

In perhaps an attempt to facilitate a successful cross-listing by ensuring MASSY’s stock price is ‘accessible’ to the retail investor in Jamaica, the Group announced a proposed 20-for-one share split on December 17th 2021, to be voted on in its annual meeting on January 21st 2022. The split, once approved, would place MASSY’s shares within an ‘affordable’ price range on the Jamaican Stock Exchange (JSE) of the equivalent of J$110-120per share. This would be comparable to companies such as NCB Financial Group (NCBFG) and GraceKennedy Limited’s (GKC) trading prices on the JSE.

The cross-listing and stock-split news was also accompanied by improved earnings in FY2021, though this improvement (on its own) may not have been enough to catalyse MASSY’s share price when considering the stock’s historical valuation multiples. MASSY’s share price closed 2021 at $105.00 (up 72.2% YTD) and ended trading on Friday at a price of TT$106.00. Taking a closer look at MASSY’s Price-to-Earnings (P/E) multiple – the price an investor pays for every dollar of profits/earning generated by a company – it would appear that MASSY’s stock has become relatively more expensive, going from a P/E of 8.6 times in February 2021 to a P/E of 13.2 times as at Friday’s close.

Cross-Listing Considerations

On its own, a cross-listing does little to add value to a company’s financial performance.

For MASSY, cross-listing on the JSE should bring benefits including a (i) wider investor audience and (ii) the ability to raise equity capital in a new jurisdiction and a different currency. It could also (iii) aid the Group in its portfolio reallocation initiatives, as it seeks to shed assets earnings sub-optimal returns (below the Group’s Weighted Average Cost of Capital) and redeploy capital into existing and/or new businesses.

For Investors in Trinidad & Tobago, MASSY’s cross-listing will be welcomed as a potential route to exit a TT-dollar investment (if investors choose to sell their MASSY stock) and access a major currency such as the US-dollar. A caveat to this benefit, however, is the prevailing discount on cross-listed stocks trading in Jamaica on the JSE relative to their equivalent trading prices in T&T on the Trinidad & Tobago Stock Exchange (TTSE). At present, cross-listed stocks on the JSE trade at an average discount of approximately 28% relative to TTSE prices. Currently, Guardian Holdings Limited (GHL) trades at a 26.2% discount, while NCB Financial Group Limited (NCBFG) trades at a 29.7% discount relative to TT market prices. GraceKennedy Limited (GKC) and JMMB Group Limited both trade at discounts of 30.2% and 28.0% respectively. Were this relationship to hold, it would mean that MASSY, at its current TTSE price of TT$106.00, would trade in an equivalent range (pre-stock split) of TT$74- $78 upon cross-listing on the JSE.

For Investors in Jamaica, the cross-listing represents an opportunity to more easily own a part of one of the largest publicly-listed Conglomerates in the Caribbean region with positive long-term growth prospects. Jamaican investors could, however, approach MASSY’s cross-listing somewhat cautiously in the initial stages, particularly with the recent cross-listing experience of another T&T-based group (Guardian Holdings Limited or GHL) in mind. Investors would recall that GHL’s price, after an initial pop on the JSE, fizzled out and is currently trading at J$505.61; (i) below its JSE debut price of J$582, (ii) well below the Invitation for Subscription Price (J$746.96) of a significant block of shares made available in Jamaica by GHL’s parent company NCBFG’s wholly-owned subsidiary NCB Global Holdings Ltd. and (iii) at a 26.2% discount to the current TTD-equivalent price on the TTSE.

Is MASSY Overpriced, or Undervalued?

The sharp increase in price of MASSY over a relatively short space of time, combined with a flurry of non-performance related news to digest surrounding the stock has prompted one major question by investors: “Is MASSY overpriced, or undervalued?” Like all situations with many variables to consider, the answer to this question depends on each investor’s outlook.

MASSY appears to have become more expensive from a valuation perspective, relative to its own recent P/E trading multiples. The stock’s P/E multiple – inclusive of discontinued operations – is currently trading at a level of 13.2 times. This is roughly 40% above its average multiple of 9.4 times over the 2018-2020 period (when the multiple ranged from 8.5x to 10.5x). Put differently, an investor assigning MASSY’s average 2018-2020 multiple – in the absence of cross-listing or stock-split announcements – to its current earnings per share of $8.02 might value the stock at around TT$76, or a 28% discount to its closing price on Friday 21st January of TT$106. This would suggest that MASSY’s valuation might currently be somewhat extended, by its own historical standards. Over the short-term, MASSY’s earnings may need to do some ‘catching up’ to justify its current price. In addition, the current pandemic continues to weigh on many regional economies, including MASSY’s main profit-generating engine of Trinidad & Tobago.

Taking a longer-term view of MASSY, several positive drivers emerge, including:

- MASSY’s data-driven approach to improving returns on assets and/or equity through ongoing reallocation of capital across its portfolios and businesses.

- Continued geographical diversification, in particular expansion into the promising economy of Guyana which is growing in prominence as a contributor to the Group’s profitability.

- Improving profitability margins, evidenced by improvements in PBT margins (from Continuing Operations) from 7.3% in FY2018 to 8.3% in FY2021.

For the shorter-term investor, MASSY may be less likely to produce much joy, especially after climbing 72% in the prior year. For the investor with a longer time horizon, however, there appear to be compelling reasons to include MASSY as a core portfolio holding.

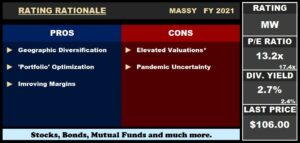

The Bourse View

At a current price of $106.00, MASSY trades at a trailing P/E of 13.2 times, below the Conglomerate sector average of 17.4 times. It should also be noted that MASSY’s P/E ratio ex-discontinued operations stands at 16.3 times.

The stock offers investors a trailing dividend of 2.7%, just above the sector average of 2.4%. The Group declared a final dividend payment of $2.30 per share paid on January 14th, 2022. Collectively, MASSY’s total dividend payment for the current fiscal year 2021 amounted to $2.85, 14.0% higher than 2020. Investors won’t have to wait too long to see how MASSY is welcomed onto the Jamaican Stock Exchange (JSE) from a trading perspective, with the stock set to debut on the JSE on January 27th, 2022.

On the basis of continued geographical diversification and improving profitability but tempered by elevated valuations and prevailing economic uncertainty. Bourse assigns a MARKETWEIGHT rating on MASSY.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”