HIGHLIGHTS

Local Markets

- Inflation Moderates: Headline Inflation 0.1% (Nov-24)

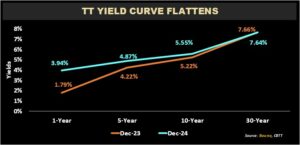

- Local Yield Curve Flattens, 1-Year rates rise

- 1-year: 3.94%

- 10-year: 5.55%

International Markets

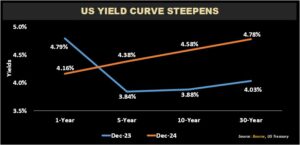

- US Yield Curve Steepens

- 1-year: 4.16%

- 10-year: 4.58%

Investor Considerations:

- TT: A good time for repos, deposits?

- Liquidity

- Risk Tolerance

- Return Objectives

This week, we at Bourse review a much-changed landscape for fixed income investors, with key movements having taken place across both TTD and USD interest rates in FY2024. How might fixed income markets further evolve in 2025 and how can investors seeking fixed income returns take advantage of the current and expected conditions? We discuss below.

Local Fixed Income Market

TTD Yield Curve Flattens

TTD interest rates experienced a disproportionate increase in short-term rates relative to longer-term rates, resulting in a so-called flattening of the Government of the Republic of Trinidad and Tobago (GORTT) yield curve. The 1-year GORTT benchmark yield climbed 215 basis points (bps) from 1.79% in December 2023 to 3.94% in Dec 2024. In contrast, the 10-year GORTT yield increased by a much more moderate 33 bps from 5.22% to 5.55% over the comparable period, while 30-year yields were relatively stable. Increased demand for liquidity, attributable to factors including but not limited to increased activity in the GORTT’s bond issuance pipeline during 2024, would have been the primary driver for increased short-term yields. Conditions are likely to persist into 2025, with continued GORTT issuance likely required to meet expenditure needs.

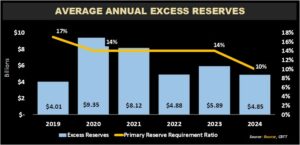

Reserve Requirement Cut, Excess Reserves Boosted

In response to tighter liquidity conditions, the Central Bank of Trinidad and Tobago (CBTT) reduced its primary reserve requirement – the percentage of deposits liabilities commercial banks must hold in a non-interest earning cash reserve account with the CBTT – from 14% to 10% in July 2024, with the last adjustment (from 17% to 14%) taking place in 2020 in response to COVID-19 uncertainty. The policy adjustment released approximately TT$4 billion of liquidity into the banking sector to meet short-term needs. Excess reserves went from TT$3.4 billion in July 2024 (averaging $3.8 billion in the first seven months) to TT$6.0 billion in December 2024, increasing by 54% over the 5-month period (FY2024 excess reserves averaged $4.8 billion). Further cuts to the reserve requirement are not expected in 2025.

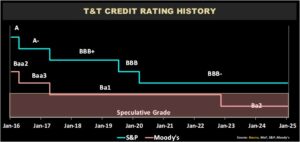

T&T Credit Ratings Stable

Trinidad and Tobago’s credit rating has trended downward over the 10-year period 2016-2025. Moody’s ratings affirmed Trinidad and Tobago’s rating at ‘Ba2’ with a stable outlook on December 16, 2024, 2 notches below the investment grade category.

S&P ratings agency affirmed Trinidad and Tobago’s credit rating at ‘BBB-‘ rating with a stable outlook in September 2024. The agency noted that the country expects moderate fiscal deficits and a slowly rising debt burden with continued low growth. Further highlighted in the report are the expectations of energy exports to support external balances, as major gas fields become operational. This is tempered by an anticipated decline by S&P in hydrocarbon production in the near term.

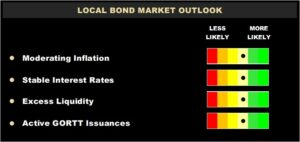

Local Fixed Income Outlook

Inflation has been moderating in Trinidad and Tobago, with Headline inflation at a relatively low at 0.5% in November 2024, according to data published by the Central Bank of Trinidad and Tobago (CBTT). According to the November Monetary Policy Report, published by the CBTT, domestic inflation is expected to be contained during FY2024/2025. With inflation primarily being import-driven, the CBTT’s Monetary Policy Committee repo rate has remained relatively unchanged since March 2020 at 3.50%. Moving into 2025, the benchmark policy rate should be relatively stable.

International Fixed Income Market

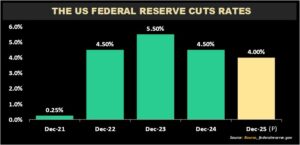

Fed Rate Cuts Continue

The US Federal Reserve (the Fed) commenced cutting interest rates in the latter half of 2024, after holding rates steady at 5.25-5.50% since July 2023 and increasing rates at the start of 2022. The Fed began with a larger cut of 50 bps in September 2024, followed by two 25 bps cuts in each November and December bringing the Fed Funds range to 4.25%-4.50%. Consensus estimates suggest two more 0.25% rate cuts in 2025, which would bring the target range to 3.75%-4.00% by the end of the year.

Steepening of US Yield Curve

With the commencement of rate cuts, the US Treasury Yield curve started to normalize following an extended period of inversion (an instance in which short-term rates exceed longer-term rates). Shorter-term rates have declined in reaction to rate cuts, while longer-term rates have remained relatively rangebound, resulting in a so-called steepening of the yield curve. 1-year US Treasury yields fell 63 bps from 4.79% in December 2023 to 4.16% in December 2024. The 10-year US yield, meanwhile, widened 70 bps in the same period, closing at 4.58% in December 2024.

T&T-related USD Bond yields Decline

T&T-related USD-denominated bond yields have been relatively rangebound over the past 12 months. For example, Trinidad and Tobago, TRITOB 4.50% 2026, is currently trading at a yield of 5.50% 60 bps above the 52-week low of 4.9% and 70 bps points below its high of 6.2%. Bond yields could narrow further with the anticipated US interest rate cuts, holding all other factors constant.

International Bond Market Outlook

The International Monetary Fund released its World Economic Outlook in January 2025, with global growth forecast at 3.3% in both 2025 and 2026. Global inflation is estimated at 4.2% in 2025, then expected to decline in 2026 to 3.5%. The anticipated disinflation is premised on falling energy prices and de-escalation of global tensions.

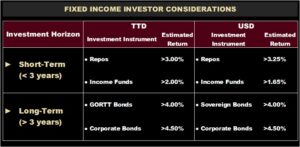

Fixed Income Investor Considerations

The current configuration of fixed income markets presents several opportunities for investors. Higher short-term TTD rates continuing into 2025 open the door for short-term, risk-averse investors to benefit from more attractive fixed income returns without committing funds for extended periods.

In the short-term space, TTD income fund returns have generally increased over the past several months and is expected to remain elevated. As an example, the TTD Savinvest Income Fund ‘TTSIF’, managed by Bourse, offers investors an annualized return of 2.25% p.a. For investors who are able and willing to place TTD short-term funds for fixed periods, investment options such as Repurchase Agreements and Fixed Deposits currently offer rates in excess of 3.00% p.a. Longer-term fixed income investors looking at bonds can consider both GORTT and corporate options available. Though GORTT bond issuance will likely continue via private placement, investors can access corporate and GORTT bonds like NIF (Corporate), J314 (GORTT) and others traded over the Trinidad & Tobago Stock Exchange (TTSE).

Likewise, USD fixed income investors have an array of options available in the evolving environment. Shorter-term, investors in 2024 would have enjoyed attractive yields offered by US Treasuries. Looking ahead, short-term US Treasury yields are likely to continue declining as the Federal Reserve continues cutting rates. USD income mutual funds continue to offer relatively attractive returns, while USD Repurchase Agreements currently offer rates in excess of 3.25% for investors capable of placing funds for fixed, short-term periods.

USD fixed income investors with a longer-term horizon may want to consider locking in yields at more attractive levels, in the event that medium-to-long term bond yields begin to tighten with falling benchmark US rates. For USD-oriented bond investors, the menu of available options is considerably wider. Investors are able to select appropriate investment opportunities by tenor, credit rating, payment seniority, industry and other preferences.

As we head move further into 2025, fixed income investors appear to have a great opportunity to optimize their portfolio, with solutions that allow for balancing return objectives with risk tolerance, investing time horizon and liquidity needs. As always, it makes good sense to consult an experienced advisor, like Bourse, to make more informed investment decisions for your portfolio.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”