HIGHLIGHTS

- Banking Sector Performance Drivers

-

- Resilient Earnings

- Modest Revenue Growth

- Stable Profitability Margins

- High Dividend Visibility

- RFHL: Price Target Range: $124.00- $128.00, Rating: OVERWEIGHT

- CIBC: Price Target Range: $7.70 – $8.00, Rating: MARKETWEIGHT

- FCGFH: Price Target Range: $47.00 – $51.35, Rating: OVERWEIGHT

- SBTT: Price Target Range: $55.98 – $59.00, Rating: MARKETWEIGHT

- NCBFG: Price Target Range: $2.46 – $2.55, Rating: MARKETWEIGHT

This week, we at Bourse focus on the Banking Sector of the Trinidad & Tobago Stock Exchange (TTSE), the largest sector by value or market capitalization representing over 50% of listed stocks. Despite a few challenging years in terms of stock prices, Banking sector companies have been on the more consistent side of financial performance and dividend payments, characteristics which are typically valued by investors. With a broadly positive sector 2025 outlook on the basis of resilient economic activity and modest revenue growth, are Banking stocks suitable for your investment portfolio? We discuss below.

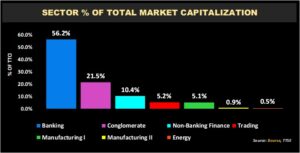

Local Market Composition

Banking is by far the largest sector of the TTSE market, comprising 56.2% or $57.5B of index value, followed by the Conglomerates (21.5%), Non-Banking Finance (10.4%), combined Manufacturing and Trading (11.2%) and the Energy sector (0.5%).

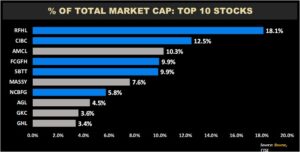

At an individual security level, it should be of little surprise that all banking sector stocks feature in the top 10 largest companies on the TTSE by market value.

Sector constituents include Republic Financial Holdings Limited (RFHL), leading the overall Trinidad and Tobago Composite Index (TTCI) with a market value of $18.6B, representing 18.1% of total market capitalization. CIBC Caribbean Limited (CIBC) follows with a market value of $12.8B (12.5% of market capitalization). First Citizens Group Financial Holdings Limited (FCGFH) and Scotiabank Limited (SBTT) each account for 9.9% of total market capitalization with a market value of $10.2B and $10.1B respectively. NCB Financial Group Limited (NCBFG) has a market value of $5.9B (5.8% of market capitalization). To put the sheer size of banking stocks values into perspective, consider this: at $18.6B market capitalization, RFHL’s market value is greater than the combined value of regional conglomerate giants’ Ansa McAL Limited (AMCL) at $10.5B and MASSY Holdings Limited (MASSY) at an $7.8B value.

Given the significant size of the banking sector relative to the overall market, the fortunes of banking stocks have a significant impact on the overall direction of the TTSE indices.

2025 Banking Sector Forecast

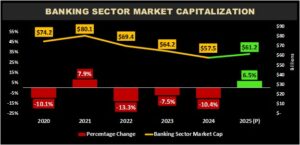

Banking stocks faced price declines in 2024 like the rest of, despite generally stable-to-improving financial performance. There were declines with FCGFH falling 17.5%, NCBFG ↓ 29.7%, RFHL ↓ 7.7% and SBTT ↓ 17.8%. The lone banking stock to record an increase was CIBC, which grew by 15.1%. TTSE data showed that the market capitalization of the Banking Sector contracted 10.4% in 2024, falling from $64.2B to $57.5B.

The Banking Sector is expected to advance by an estimated 6.5% in 2025, based on Bourse’s forecast of individual banking stocks for the year ahead. Banking Sector constituents are forecast to range in price movements between -4% to +21% for 2025.

Banking sector performance for 2025 is premised on several industry-level drivers including (i) resilient economic activity, (ii) modest revenue growth, (iii) stable profitability margins and (iv) high dividend visibility.

- Resilient economic activity – A resilient economic outlook, both locally and regionally, should continue to support loan growth and banking-related activity for financial institutions.

- Revenue growth – While there is likely to be variability across banks regarding revenue growth rates, revenue growth is expected to be generally positive. With U.S interest rates projected to decline over the year, banks with larger USD loan portfolios may experience some compression in net interest margins, impacting Net Interest Income (NII).

- Stable profitability margins – Banks continue to generally control non-interest expenses well leading to relatively stable profitability margins.

- High dividend visibility – Banks continue to be one of the most consistent and relatively predictable stock sectors in terms of dividend payouts to investors. Barring major international events (ex. COVID-19), bank stocks dividends are expected to remain a reliable source of investor cash flow in 2025.

The Dividend Value Driver

Diving deeper into the dividend story, banking stocks remain one of the most consistent sources of dividend income for a stock portfolio.

As an example, an illustrative portfolio was set up comprising one share of each banking company/group. The total dividends from the portfolio in 2024 amounted to $11.35, up 10% from $10.36 in 2023. The same illustrative portfolio in 2025 is forecast to deliver dividends of an estimated $11.97, attributable to forecast earnings growth and relatively consistent dividend payout ratios.

Combined with forecast stock price movements the banking sector average dividend yield is forecast to be 4.6% relatively consistent with its dividend yield in 2024. Notably, sector constituent CIBC offers the additional advantage to investors of obtaining dividends in US dollars while investing in TT.

Are banking stocks right for you?

The banking sector’s size and resilient growth make a reasonably compelling case for being a valuable addition to any equity investment portfolio. Notwithstanding the generally improved financial performance, a broad repricing of the local equity markets in the past several years has led to lower banking stock prices. This combination of lower prices improved financial performance and stable-to-growing dividends has created an opportunity for investors with a longer-term horizon to acquire banking stocks at reasonably attractive valuations. Banks have and should continue to be a ‘blue-chip’ component of any investment portfolio, with the potential to deliver a mix of capital appreciation and dividend income across economic cycles.

Some locally-listed banking stocks, such as RFHL, CIBC and NCBFG also offer investors “built-in” diversification benefits, operating across multiple geographic regions and business segments (banking, investment services, insurance etc.).

As always, investors should consult a trusted and experienced advisor, such as Bourse, to make more informed investment decisions.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”