BOURSE SECURITIES LIMITED

October 30th, 2017

Fixed Income Market Review

This week we at Bourse review the year to date performance of both local and international fixed income markets. We review the path of interest rates in both markets as well as other key drivers influencing bond prices. Lastly, we take a look at forthcoming investment opportunities for fixed income investors.

TT Dollar yields on the Rise?

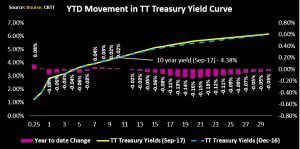

There has been relative stability in Trinidad and Tobago (TT) Treasury yields for the year thus far. The 1-year Treasury yield declined marginally from 2.81% in December 2016 to 2.72% in September 2017 while the 10-year TT Treasury yield moved from 4.36% to 4.38% over the same period. Several drivers may have led to this firmness in Treasury yields, such as the level of commercial banks excess reserves and government borrowing.

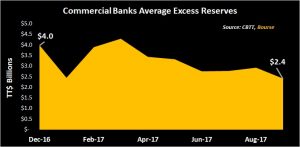

Commercial banks excess reserves is the portion of total deposits held by a bank in excess of what is required by the Central Bank. Excess reserves stood at TT$2.4 billion as at September 2017, 40% below the December 2016 level of TT$4.0 billion. However, despite this decline, the persistent level of excess liquidity in the financial system may have put downward pressure on bonds yields.

In contrast, continued borrowing by the government in order to finance the 2016/2017 budget deficit (TT$12.6 billion) may have pushed yields marginally higher. The government raised TT$6.6 billion in domestic financing in 2017 through both public and private issues.

As the government continues to borrow, there will be a need for more attractive rates in order to compete for funds in the private sector. At present, Trinidad and Tobago holds an investment grade rating (BBB+) and stable outlook from credit rating agency Standard and Poor’s and a non-investment grade rating (Ba1) and stable outlook from Moody’s. Given the sharp increase in the country’s Net Public Sector debt to GDP ratio from 38.9% in September 2012, to 62.6% in September 2017, additional borrowing by the government may put these ratings under further pressure. In this case, investors will require higher interest rates as an incentive to hold more of the government’s debt.

TT Dollar Investor Opportunities

In an attempt to finance the estimated TT$4.76 billion budget deficit for Fiscal 2018, the Honourable Finance Minister noted the government’s intention to raise TT$4.5 billion through domestic borrowing. This should present opportunities for local investors with a conservative to moderate risk profile, seeking a medium to long-term investment. The most recent public auctions by the government included a TT$1 billion 6-year 3.80% coupon bond issued at a yield of 3.80% (December 2016) and a TT$1 billion 8-year 4.10% coupon bond issued at a yield of 4.10% (February 2017).

Investors may also benefit from positive real returns, as the differential between the 10-year TT Treasury yield (4.37%) and the Headline Inflation rate (1.30%) was 3.07% as at August 2017. However, any uptick in the Headline inflation rate will erode investors’ purchasing power.

Another challenge facing TT dollar investors is the possibility of a depreciation in the TT dollar. Year to date, the TT dollar declined 0.6% from TT$6.7617 per USD on 29 December 2016 to TT$6.7993 per USD as at 25 October 2017. Notwithstanding this modest decline, the continued shortfall of foreign exchange supply from the energy sector is likely to negatively impact the TT dollar going forward. Investors can therefore seek to hedge their foreign exchange risks by investing in stocks which provide an implicit or explicit hedge against a depreciation in the TT dollar, such as First Caribbean International Bank (FCI), Grace Kennedy (GKC), Sagicor (SFC) and Trinidad and Tobago NGL (NGL).

USD Interest Rates Set to Climb

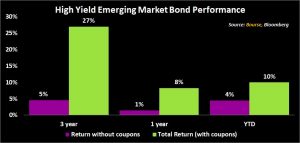

The US Federal Reserve (the FED) commenced a shift towards monetary policy normalization, by completing three 25 basis point rate hikes in December 2016, March 2017 and June 2017. Counterintuitively, US bond markets were un-phased by this, with the 10-year US Treasuries trading at an average yield of 2.30% compared with the high of 2.60% seen after the US election in November 2016 . Such low yields offered by developed markets continue to entice investors with a higher risk appetite to switch to higher yielding emerging market (EM) US dollar denominated bonds. As a result, emerging market US dollar investment grade and high yield bonds posted year-to-date total returns of 7.0% and 10.0% respectively as at October 27th 2017.

With global central banks turning more hawkish, volatility is expected to pick up in 2018 providing opportunities for investors. Currently, markets are pricing in a third rate hike by the FED at its December 2017 meeting, with a probability of 87%. Additionally, the FED is forecasting three 25 basis point hikes in 2018 which would take the FED Funds Rate from its current range of 1.0%-1.25%, to 2.0%-2.25% by the end of 2018. Moreover, the gradual removal of stimulus, such as the unwinding of the FED’s balance sheet and the tapering of assets purchases by the ECB, may put downward pressure on bond prices. Geopolitical events such as the ongoing tensions between the US and North Korea with respect to its nuclear missile programs and the most recent tensions in Spain over the independence of Catalonia, will also continue to generate volatility in the bond markets.

However, despite this volatility, the improved outlook for global growth is likely to boost fundamentals of emerging market countries, positively impacting dollar-denominated emerging market bonds. As such, risk-averse investors with a conservative to moderate risk tolerance may want to consider acquiring investment grade emerging market bonds because of the stronger credit profile. EM investment grade bonds provided total returns (capital gains and coupon interest) of 11% and 3% over a 3-year and 1-year period.

Investors with a higher risk appetite may prefer high-yield bonds. EM high yield bonds provided total returns of 27% and 8% over a 3-year and 1-year period. Therefore, an investor who acquired US$100,000 in EM high yield bonds one-year ago, would have benefited from US$8,000 in total returns which includes both price movements and interest earned over the period.

Investor Considerations

Emerging market investment grade and high yield bonds maturing in 5-7 years currently offer returns in the range of 4.0%-5.0% and 5.0% to 6.5% respectively. This compares favourably to other USD denominated instruments such as money market mutual funds which offer returns as high as 1.5%.

As with any other investment, an investor’s risk tolerance and time-horizon must be considered prior to making a decision. Moreover, it is recommended that investors adopt a hold to maturity approach, meaning that investments are purchased with the intention of holding the asset to maturity. Though the market value of the asset may fluctuate over the holding period, the investor’s yield to maturity is fixed as the full principal amount is repaid at maturity, assuming the issuer’s credit profile is maintained.

Investors are also encouraged to consult a trusted and experienced advisor, such as Bourse, to make a more informed investment decision.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

For more information on these and other investment themes, please contact Bourse Securities Limited, at 628-9100 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”