Local Markets

- Q12023 Performance:

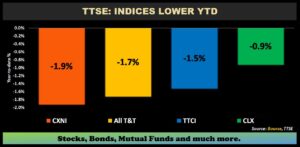

- TTCI ↓ 1.5%

- All T&T ↓ 1.7%

- CLX ↓ 0.9%

- CXNI ↓1.9%

- Performance Drivers:

- Inflationary Pressures

- Outlook:

- Economic Normalization

International Markets

- Q12023 Performance:

- US Markets – S&P 500 ↑ 7.0%

- European Markets- Euro Stoxx 50 ↑9.4 %

- Asian Markets – MXASJ ↑ 3.0 %

- Latin American Markets – MSCI EM ↑ 3.6%

- Performance Drivers:

- Inflationary Pressures

- Financial Market Uncertainty

- Outlook:

- Economic NormalizationThis week, we at Bourse recap the performance of local and international stock markets as at the end of the 1st quarter of 2023 (Q12023). Despite a cautiously optimistic outlook at the start of 2023, equity markets continued to face considerable uncertainty, fueled by persistent inflation, geopolitical tensions, recessionary concerns, financial system instability and a cloudy path for policymakers. With investor sentiment challenged in the first quarter, could the outlook improve in the near-term, or will uncertainty continue to drive weakness across investment markets? We discuss below.

Local markets Regress

All major indices on the Trinidad and Tobago Stock Exchange (TTSE) closed the first quarter of 2023 lower. The All Trinidad and Tobago Index (All T&T) contracted 1.7% for Q1 2023. The Cross Listed Index (CLX), comprising some of the largest publicly-listed regional companies was marginally down 0.9% for the period. Resultantly, the Trinidad and Tobago Composite Index (TTCI) declined 1.5% to close at 1,312.35. MASSY Holdings Limited (MASSY) followed by National Enterprises Limited (NEL) were the volume leaders on the First Tier Market for Q12023, with 17.6M and 6.9M shares being traded respectively.

In addition, the Caribbean Exchange Index (CXNI), used as a gauge of the Caribbean regions’ overall market performance traded down 1.9%.

Major Movers

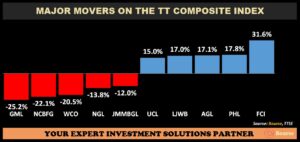

FirstCaribbean International Bank Limited (FCI) advanced 31.6%, supported by improving revenues and earnings, with relatively attractive valuations. According to the Group, the Bank continues to make steady progress in executing its client-focused strategy with its digital transformation initiatives. Prestige Holdings Limited (PHL) appreciated 17.8% during the quarter, benefitting from increased economic activity with a recovery in its profitability margins. Agostini’s Limited (AGL) increased 17.1% for Q12023, with acquisition-driven expansion and improving margins contributing to earnings growth. LJ Williams Limited (LJWB) rose 17.0%, while Unilever Caribbean Limited (UCL) rebounded 15.0% following a 20% decline in its price over the course of 2022.

Major decliners for Q12023 included Guardian Media Limited (GMLâ 25.2%), NCB Financial Group Limited (NCBFG, â 22.1%) West Indian Tobacco Company Limited (WCOâ 20.5%), Trinidad and Tobago NGL (NGL â 13.8%) and JMMB Group Limited (JMMB â 12.0%).

Tech, Communication boost US stocks

US stocks, as gauged by the S&P 500 Index, rose 7.0% at the end of Q12023 during a highly volatile quarter. After a 28.4% decline in FY2022, the Technology Select Sector SPDR Fund (XLK), advanced 21.3% as at Q12023, followed by the Communication Services Sector Select SPDR (XLC) Fund, up 20.8%. This has been fueled by their (relative) safe haven statuses, following the collapse of Silicon Valley Bank on March 10th, 2023 and two other U.S. lenders, as contagion fears in the banking industry pushed investors towards ‘Large Cap’ tech stocks. On March 22nd, 2023, the Federal Reserve hiked the target federal funds rate by 0.25%, but softened its tone on further increases, saying “some additional policy firming may be appropriate”.

On the contrary, the Financials also endured a weak Q12023, as bank failures and increasing concerns of more systemic troubles cut investor appetite for financial sector stocks. The Financial Select Sector SPDR Fund (XLF) was down 6.1% in Q12023. The Energy Select Sector SPDR Fund (XLE) declined 5.3% in Q12023, with softer energy commodity prices year-to-date halting the stellar run experienced during 2022.

European Markets Broadly Higher

European markets, as gauged by the Euro Stoxx 50 increased 9.4% in Q12023 relative to a 5.2% decline in Q12022. Despite positive returns, markets remain on alert amid global turmoil in the banking sector and the emergency rescue of Swiss lender Credit Suisse by its once-rival UBS. The European Central Bank raised interest rates by 0.50%, sticking with its fight against inflation despite investors’ call to hold back on policy tightening – stating that the Euro Zone banks were ‘resilient’. Italy was the best performing market in the region, increasing 15.9% evidenced by its business and consumer confidence indicators rising in March and beating market expectations. France and Germany equities expanded 14.7% and 14.6% respectively for the period under review. England markets recorded lower growth compared to peers, up 4.3% in Q12023.

Asian markets mixed

Taiwan equities outperformed in Q12023 advancing 12.8% led by technology sector gains, while South Korean markets rose 7.0%. Chinese stocks increased 6.4%, stemming from the unwinding of its zero-COVID policies, supportive measures in the property sector and a loosened conditions on China’s tech companies. Some analysts view China as a relative safe haven, in light of the recent upheaval in the U.S and European banking sectors and given its growth premium, financial soundness, and policy discipline. Asian equity markets (excluding Japan) rose 3.0% in Q12023 relative to a 5.5% decline in Q12022. Indian equities lagged against its peers, dipping 2.4% in Q12023 attributed to a range of factors including continuous Foreign Portfolio Investor (FPI) selling, the reopening of the Chinese economy, a sell-off in Adani Group stocks and the depreciation of the Indian Rupee.

Latam markets advance

Latin America markets expanded 3.6% in Q12023 with political risk a key influencer of investor confidence. Mexico was the best performing market, advancing 20.7% in Q12023, driven by corporate ‘nearshoring’ as foreign companies relocate in Mexico to bring supply chains closer in the face of disruptions arising from Russia’s invasion of Ukraine and trade frictions with China. Chilean stocks grew 8.1% in Q12023, with analysts expecting reduced macroeconomic risks in Chile evidenced by lower interest rates and decreasing political risks. Brazilian equities dropped 3.5% compared to a 34.6% growth in Q12022, given the overhang of domestic political and fiscal uncertainty cast by the newly-elected President Luiz Inácio Lula da Silva. Colombia rounded out Q12023 as the worst performing Latin American market, down 6.2%, likely due to political risk associated with the Government of President Gustavo Petro.

Latin America markets expanded 3.6% in Q12023 with political risk a key influencer of investor confidence. Mexico was the best performing market, advancing 20.7% in Q12023, driven by corporate ‘nearshoring’ as foreign companies relocate in Mexico to bring supply chains closer in the face of disruptions arising from Russia’s invasion of Ukraine and trade frictions with China. Chilean stocks grew 8.1% in Q12023, with analysts expecting reduced macroeconomic risks in Chile evidenced by lower interest rates and decreasing political risks. Brazilian equities dropped 3.5% compared to a 34.6% growth in Q12022, given the overhang of domestic political and fiscal uncertainty cast by the newly-elected President Luiz Inácio Lula da Silva. Colombia rounded out Q12023 as the worst performing Latin American market, down 6.2%, likely due to political risk associated with the Government of President Gustavo Petro.Investment Outlook

Domestic companies are likely to continue combatting operating margin pressures, with raw material prices and other input costs remaining elevated. According to the Central Bank of Trinidad and Tobago (CBTT) headline inflation accelerated to 8.7% in December 2022, driven by external and domestic supply side factors. However, external factors such as falling shipping costs and cost management initiatives by companies suggest profitability margins across industries could be set to stabilize. This is more likely for companies with stronger ‘pass through’ pricing power, a factor usually dependent on the nature of goods and services offered. Stronger consumer lending – evidenced by growth in the loan portfolios of most locally-listed banks, could also be a signal improving economic activity. The International Monetary Fund (IMF) in its Staff Report on March 16th, 2023 estimated T&T’s GDP to have expanded by 2.5% in 2022, supported by the non-energy sector and is expected to increase a further 3.2% in 2023. Noteworthy, however, has been the considerable decline in energy prices (Henry Hub Natural Gas â53.2% and WTI crude oil â 6.7% year-to-date) which, – when combined with tepid domestic energy production data – could weigh on revenue projections for FY2023. This, in turn, could adversely impact planned spending (particularly in the area of Capital Expenditure).

International Markets, while broadly positive across regions, are expected to remain volatile, as central banks continue to hike interest rates in an effort to tame inflation. According to the US Federal Reserve, the recent events in the banking system are likely to result in tighter credit conditions for households and businesses and may weigh on economic activity and inflation.

The IMF reiterated that 2023 would be another challenging year, with global growth slowing to 2.9% due to lingering pandemic effects, the war in Ukraine and monetary tightening. The IMF called for continued vigilance, as risks to financial stability have increased given the upheaval in the banking environment.

For emerging markets, the IMF expects a strong economic rebound in China, with GDP growth of 5.2% in 2023. China is expected to account for one third of global growth in 2023. Emerging markets (EM) remain a major source of global growth, given the less robust outlook for developed economies. India is expected to grow 6.8% in 2023.

While the economic outlook for EM remains resilient, EM financial markets tend to be characterized by higher volatility relatively to their developed market peers. This could be further compounded by increasingly sensitive geopolitical relations between the US, West and EM countries.

Investor Considerations

Despite heightened uncertainty in international equity markets, investors have seemingly continued to climb the proverbial wall of worry. While markets have advanced at the end of Q12023, it has been a period characterized by wide swings in asset prices. Investors seeking shelter from heightened volatility could opt to reallocate their portfolios to lower-risk securities, settling for lower returns in exchange for principal preservation. This includes moving to cash or near-cash holdings such as income mutual funds, repurchase agreements where investment capital is subject to little or no capital risk. For investor willing and able to tolerate the large movements currently pervading equity markets, focusing on companies with (i) resilient profitability, (ii) demonstrable competitive advantages and/or market share and (iii) healthy free cash flow continues to be a useful approach.

As always, it makes good sense to consult with a trusted investment adviser such as Bourse to make the most informed investment decisions.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”

- Economic NormalizationThis week, we at Bourse recap the performance of local and international stock markets as at the end of the 1st quarter of 2023 (Q12023). Despite a cautiously optimistic outlook at the start of 2023, equity markets continued to face considerable uncertainty, fueled by persistent inflation, geopolitical tensions, recessionary concerns, financial system instability and a cloudy path for policymakers. With investor sentiment challenged in the first quarter, could the outlook improve in the near-term, or will uncertainty continue to drive weakness across investment markets? We discuss below.

Latin America markets expanded 3.6% in Q12023 with political risk a key influencer of investor confidence. Mexico was the best performing market, advancing 20.7% in Q12023, driven by corporate ‘nearshoring’ as foreign companies relocate in Mexico to bring supply chains closer in the face of disruptions arising from Russia’s invasion of Ukraine and trade frictions with China. Chilean stocks grew 8.1% in Q12023, with analysts expecting reduced macroeconomic risks in Chile evidenced by lower interest rates and decreasing political risks. Brazilian equities dropped 3.5% compared to a 34.6% growth in Q12022, given the overhang of domestic political and fiscal uncertainty cast by the newly-elected President Luiz Inácio Lula da Silva. Colombia rounded out Q12023 as the worst performing Latin American market, down 6.2%, likely due to political risk associated with the Government of President Gustavo Petro.

Latin America markets expanded 3.6% in Q12023 with political risk a key influencer of investor confidence. Mexico was the best performing market, advancing 20.7% in Q12023, driven by corporate ‘nearshoring’ as foreign companies relocate in Mexico to bring supply chains closer in the face of disruptions arising from Russia’s invasion of Ukraine and trade frictions with China. Chilean stocks grew 8.1% in Q12023, with analysts expecting reduced macroeconomic risks in Chile evidenced by lower interest rates and decreasing political risks. Brazilian equities dropped 3.5% compared to a 34.6% growth in Q12022, given the overhang of domestic political and fiscal uncertainty cast by the newly-elected President Luiz Inácio Lula da Silva. Colombia rounded out Q12023 as the worst performing Latin American market, down 6.2%, likely due to political risk associated with the Government of President Gustavo Petro.