HIGHLIGHTS

Local Markets

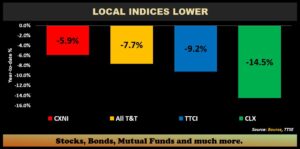

- 9M2023 Performance:

- TTCI ↓ 9.2%

- All T&T ↓ 7.7%

- CLX ↓ 14.5%

- CXNI ↓5.9%

- Performance Drivers:

- Resilient Earnings

- Weak Investor Sentiment

- Outlook:

- Cooling inflation levels

International Markets

- 9M 2023 Performance:

- US Markets – S&P 500 ↑ 11.7%

- European Markets- Euro Stoxx 50 ↑6.0%

- Asian Markets – MXASJ ↓ 2.7 %

- Latin American Markets – MSCI EM ↑ 8.1%

- Performance Drivers:

- Geopolitical Tensions

- Cooling Inflation

- Financial Market Uncertainty

- Outlook:

- Financial Market Volatility

This week, we at Bourse recap the performance of local and international stock markets for the nine months ended September 30, 2023 (9M2023). T&T’s equity markets have continued to confront weaker investor sentiment, resulting in lower equity prices. On the contrary, U.S. equities have broadly advanced despite lingering inflation and the increasing prospect of ‘higher for longer’ US interest rates. Will markets maintain trend into the final quarter of 2023, or could new developments and/or changes in investor sentiment change their course? We discuss below.

Local markets lower

For the nine-months ended September 30, 2023 (9M 2023) all major indices on the Trinidad and Tobago Stock Exchange (TTSE) closed the third quarter of 2023 lower. The All Trinidad and Tobago Index (All T&T) edged down 7.7%. The Cross Listed Index (CLX), which includes some of the top publicly traded regional companies, fell 14.5% during the current review period. The Trinidad and Tobago Composite Index (TTCI) declined 9.2% to close at 1,209.63. Overall volume leaders on the First Tier Market for the first nine-months of 2023 were MASSY Holdings Limited (MASSY) and National Enterprises Limited (NEL), totalling 38.4M and 10.6M shares traded, respectively.

Major Movers

Agostini Limited (AGL)advanced 36.0%, impacted by revenue growth through strategic acquisitions and increased geographical diversification within the Group relative to 38.5% reported for 9M 2022. First Caribbean International Limited (FCI) increased 28.4% for the first nine-months of 2023, benefitting from increased profitability margins owing to prevailing interest rate environment. Prestige Holdings Limited (PHL) increased 27.4% for 9M 2023, with new store openings and improving margins contributing to earnings growth. Ansa McAL Company Limited (AMCL) rose 12.4%, while One Caribbean Media Limited (OCM) advanced 12.0%.

Major decliners for 9M 2023 included Guardian Holdings Limited (GML 29.2%), Guardian Media Limited (GML 31.6%), NCB Financial Group Limited (NCBFG 39.3%), Trinidad and Tobago NGL (NGL 44.4%) and West Indian Tobacco Company Limited (WCO 51.5%)

Comm Services, Technology boost US stocks

US equity markets, as gauged by the S&P 500, rose 11.7% for the nine months September 30, 2023. The performance was led by gains in Communication Services (XLC) (36.6%), Technology Select Sector (XLK) (31.7%), Consumer Discretionary (XLY) (24.6%), Financial Sector (XLF) (24.6%), Energy Sector (XLE) (3.3%). Analyst expectation have been shifting from recession bets towards a “soft landing”. This optimistic outlook is underpinned by relatively encouraging employment and consumer spending data. The increasingly likely plateauing of rate hikes – notwithstanding the reality of rates remaining higher for longer – could also be influencing investor sentiment.

Sectors facing losses included Utilities (XLU 16.4%), Real Estate (XLRE 7.7%) and the Consumer Staples sector (XLP 7.7%), adversely affected by inflation and the high interest rate environment resulting in these sectors being relatively less attractive.

Europe in positive territory

European markets, as gauged by the Euro Stoxx 50, increased 6.0% in 9M2023 relative to a 24.8% decline in 9M2022. Relatively resilient corporate earnings and slowing eurozone inflation could potentially pave the way for the European Central Bank (ECB) to put an end to interest rate hikes. Italy was the best performing market in the region, advancing 17.7%. Spain and France markets expanded 13.2% and 8.9% respectively for the period under review. Germany, Europe’s largest economy also advanced 5.6% in first nine months of the year.

Asian Markets Mixed

Asian equity markets (excluding Japan) declined 2.7% in 9M2023. Taiwanese equities outperformed its peers, advancing 9.9% in 9M2023, led by strong performance in the bellwether electronics sector, particularly large-cap semiconductor stocks. Indian equities continue to remain resilient despite global challenges, up 7.8% underpinned by robust domestic demand, strong public infrastructure investment and a strengthening financial sector. China equities declined 9.2%, in 9M2023 continuing to point to a lackluster economic recovery. Hong Kong shares were also sharply lower in the third quarter, down 10.2%, with trading of shares in embattled Chinese property company Evergrande suspended in Hong Kong in September following sharp price falls.

Latam markets improve

Latin American equities advanced 8.1% for the first nine months of 2023. Notably, Mexican equities advanced, driven by improvement in Mexico’s industrial production levels. Brazilian equities advanced 11.6%, despite persistent headline inflation. Chilean stocks grew 5.5%, tempered by headwinds of high interest rates and above-target inflation. Colombia equities gained 3.7%.

Investment Outlook

Domestic Outlook. Investor sentiment remains relatively fragile, despite forecast real GDP growth for T&T in both FY2023 and FY2024. Moderating inflation and continued stable domestic interest rates should be supportive of investor confidence, notwithstanding a fairly muted energy production outlook. Recently, The International Monetary Fund’s (IMF) World Economic Outlook forecast T&T real GDP growth of 2.5% and 2.2% in 2023 and 2024 respectively, broadly consistent with Ministry of Finance estimates of 2.7% in each year.

International Outlook. Despite S&P 500 being currently in positive territory year-to-date the Index retreated 3.6% in the third quarter (July-September 2023). While markets have overcome multiple hurdles to advance thus far, risks to continued advances remain with above-average interest rates and ongoing geopolitical tensions, which could potentially disrupt commodity, credit, and equity markets.

Despite recent headwinds, the economy has remained resilient. The IMF, in its October 2023 World Economic Outlook reiterated a global growth forecast of 3.0% 2023, with 2.9% growth expectations in 2024.

Growth in emerging and developing Asia is projected at 5.2% in 2023, falling to 4.8% to 2024. The revision reflects a lower forecast for China, which was revised downward to 5.0% percent in 2023 and 4.2% in 2024. Growth in India is projected to remain resilient, at 6.3% in both 2023 and 2024.

Investor Considerations

Locally, the combination of (i) falling stock prices and (ii) relatively resilient earnings data has led to an overall improvement in equity market valuations. For investors with a longer-term time horizon, conditions remain attractive for adding quality assets to a portfolio. Opportunities to acquire attractively-valued stocks are apparent within the Banking and Conglomerate sectors.

Diversification across asset classes remains a useful approach to reducing overall portfolio risk. We reiterate the tried and tested long-term investment approach, focusing on companies with (i) solid business models, (ii) sustainable competitive advantages, (iii) attractive valuations and (iv) credible growth prospects remain a valuable option.

As always, it makes good sense to consult with an expert investment adviser such as Bourse to make the most informed investment decisions.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect, or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”