BOURSE SECURITIES LIMITED

14th January 2019

Will stock markets advance in 2019?

This week, we at Bourse take a closer look at where local and international equity markets could be headed in 2019. As highlighted in our previous article entitled ‘Equity Markets Lower in 2018’, several factors would have contributed to lower returns across markets. We discuss how some of these factors might roll over into 2019 and what could be the impact both locally and internationally.

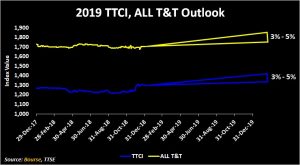

TTCI, ALL T&T to push higher

Based on currently available information, Bourse projects the overall direction of the Trinidad and Tobago Composite Index (TTCI) to be positive in 2019, advancing in the order of 3% to 5%. This comes on the heels of a 2.9% improvement in 2018. The All T&T Index – which comprises of locally listed companies – is also expected to increase by 3% to 5%.

Sector Outlook (ALL T&T Index)

Banking

After advancing 6.2% in 2018, Banking sector stocks are forecast to improve 4.4% in 2019. The announcement of acquisitions (yet to be completed) within the sector would have been the main driver of performance in the past year. Earnings would have been impacted by the debt restructuring of the Government of Barbados bonds. Going forward, acquisitions are expected to have a positive impact on the earnings of some banks in 2019. Otherwise, modest growth in net interest and other income could support earnings.

Conglomerates

The two local conglomerates posted improved earnings in 2018, driven by a combination of revenue growth and cost containment. Despite the improvement, the sector declined 9.5% during the year. Looking ahead, acquisitions and the commencement of production in major projects could provide a boost to earnings for the stocks in this sector. Bourse forecasts a 2.2% improvement in 2019.

Non-Banking Finance

The Non-Banking Finance sector declined 7.4% in 2018. Of note, the proposed takeover of GHL by NCBFG and its resultant changes could impact the performance of GHL. NCBFG has indicated its intentions identify synergies between the Groups, with an aim to boost operational performance. Overall, the sector is expected to improve marginally by 2.2%.

Energy

Trinidad and Tobago Natural Gas Limited (TTNGL) – the sole stock in the Energy sector- improved 9.8% in 2018. This was driven mainly by improved product prices for TTNGL. With oil prices falling 32.1% since its peak of US$76.41/bbl in October 2018, TTNGL’s earnings could experience some headwinds in the near term. This sector is expected to increase by 2.1%. Notwithstanding, several factors could push TTNGL’s stock price performance higher in 2019 including (i) an improvement in global energy commodity prices, (ii) increased natural gas production and exports and (iii) payment of dividends in US dollars.

Manufacturing and Trading

As expected, the Manufacturing sector remained subdued in 2018, declining 7.1%. The sector continued to grapple with lower economic activity and foreign exchange challenges. Similarly, the Trading sector ended the year 1.3% lower. Looking ahead, mixed returns across stocks in the sector could lead to an overall improvement of 7.4% in 2019. The Trading sector is expected to be flat (-0.1%).

Market Drivers

As highlighted above for several sectors, economic activity is expected to remain subdued in the near term, driven by increased unemployment and subsequently lower consumer spending. This could, in turn, push investor confidence lower, weighing on stock valuations (multiples). We hold the view that weak economic activity will be outweighed by the positive impact of acquisitions announced during 2018, some of which are to be completed in 2019. Persistent excess liquidity combined with the lack of alternative investment opportunities could preserve the attractiveness of local stocks as an investment option. Dividend preservation could also play a role in supporting the market, with most companies reasonably well-positioned to maintain dividend payments.

Several factors influencing international markets in 2018 are expected to roll over into 2019. At the head remains the outcome of the trade negotiations between the U.S. and China. Any meaningful resolution could have a positive impact for equity markets. The recent rhetoric by both sides indicate a willingness to reach a deal, although negotiations continue. Another concern for investors is slowing global economic growth. Early signs from China showed that growth slowed by more than expected in December 2018. Economic data out of the U.S. has also been mixed. On a positive note, U.S. interest rates appear to be stabilizing compared to expectations in recent weeks. After four interest rate increases in 2018, recent comments by the Chairman of the U.S. Federal Reserve (F.E.D.) indicate a willingness to ‘listen’ to financial markets carefully and adjust the path of interest rates as necessary. Markets could also be supported by policy stimulus – particularly in China – as the Government responds to slower growth. At the start of 2019, China’s government cut the required reserve ratio (RRR) by 1.0% in an attempt to reduce financing costs. Policymakers are also expected to increase fiscal support through infrastructure spending and tax cuts.

Investor Considerations

While uncertainty is a part of investing, being selective in your investments can make the difference when it comes to investment success. In an ever-changing investment environment, be prepared to make adjustments if and when necessary, i.e., should your portfolio (and its components) move out of line with investment goals.

Investors are encouraged to consult a trusted and experienced advisor, such as Bourse, in order to position their portfolios for the year ahead.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”