BOURSE SECURITIES LIMITED

13th January, 2020

Will local stocks advance in 2020?

This week, we at Bourse consider the fortunes of local equity markets in 2020. Our previous article entitled “Equity Markets Rally in 2019” highlighted several factors which would have influenced markets last year. We discuss possible drivers of the local investment environment in 2020 and provide an outlook on the various market sectors.

TTCI, ALL T&T could advance

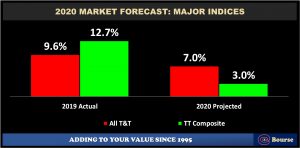

Based on currently available information, our forecast for the Trinidad and Tobago Composite Index (TTCI) is a positive one in 2020, with an increase in the order of 3% following the 12.7% advance in 2019. The All T&T Index (which consists of locally listed companies) is forecast to appreciate 7%, following the 9.6% improvement in 2019.

Sector Outlooks Generally Positive

Banking

Accounting for just under 60% of total market value and by far the most valuable sector, Banking sector stocks are forecast to advance by around 2% on average in 2020 following a 15.5% increase in 2019. Improving earnings, in addition to completed and announced acquisitions drove performance in 2019. These acquisitions could increasingly influence improved financial performance in 2020. Investors should be selective in choosing banking stocks to add to their portfolio, with stock price movements in the sector projected to range from -9% to +16%. Bank dividend yields are expected to remain attractive, with little change anticipated to dividend policy or pay-out ratios.

Conglomerates

Making up 14% of the value of the local market, the Conglomerate sector appreciated 14.3% for 2019 through cost management initiatives coupled with fairly modest expansion in revenue generation. The sector is expected to increase 6.5% on average, with stock price changes ranging from -5% to +12% in 2020. Despite MASSY and AMCL being primarily exposed to the lacklustre Trinidad & Tobago and Barbados economies, both groups have delivered resilient financial performances. MASSY could be positively impacted by its involvement in the new energy producer that is Guyana, as well as the operationalization of energy-related projects. AMCL, meanwhile, continues to improve through investments focused on increasing operational efficiencies and inorganic growth via acquisitions.

Non-Banking Finance

The Non-Banking Finance sector advanced 7.9% during 2019. A driver of performance in 2019 for a majority of companies within the sector was increased income from investing activities, with strong performance recorded across international financial markets. Questions remain as to whether this performance can be repeated. In the coming year, the sector is forecast to advance 5.0%, with price changes ranging from +4% to +6%. Notably, Sagicor Financial Corporation (SFC) was acquired in 2019 and was subsequently de-listed from the TTSE and listed on the Toronto Stock Exchange (TSX).

Manufacturing and Trading

The Manufacturing I and II combined sectors climbed 12.3% in 2019, with WITCO’s 30% advance more than offsetting double digit declines in UCL, GML and TCL. Looking ahead, the sector is expected to gain around 2.3% as consumer spending improves with increases in government spending and minimum wage adjustments. Stock price changes in the sector are forecast to be within a range of -4% to +4%.

The Trading sector closed 2019 11.2% higher, attributable to cost containment initiatives, and moderately higher revenue generation. The sector is expected to increase just under 1% in 2020, with forecast sector stock price changes ranging from -11% to +2%.

Energy

Trinidad and Tobago Natural Gas Limited (TTNGL), the only stock in the Energy sector, fell 17.7% in 2019 on account of downward pressure resulting from lower prices of Natural Gas Liquids (NGLs) and increased supply-side competition. TTNGL implemented a number of strategies this past year in an attempt to re-ignite growth including increased condensates processing, cost management initiatives and exploring opportunities within the Caribbean, North America, Asia and Africa. These initiatives, coupled with any rebound in product prices, could potentially improve the NGL’s stock price in 2020, with a forecast increase of 4-7% in the sector.

2020 Local Market Drivers

Investors will be paying keen attention to the local stock market on the heels of its commendable performance in 2019. 2020 Market drivers could include:

- Continued acquisition activity, which is likely to positively impact investor sentiment for companies seeking to (i) build market share, (ii) diversify by geography or (iii) diversify by business activity.

- Increased spending. At the consumer level, increases to the minimum wage could increase consumption. At the government level, looming national elections in Trinidad & Tobago could accelerate spending and, by extension, economic activity.

- Income-focused investing. Investors seeking income in an environment relatively starved of fixed income opportunities would have benefited from holdings in dividend stocks during 2019, enjoying both income and capital appreciation. The introduction of several fixed income opportunities on the horizon (NIF II, VAT bonds, Government Housing bonds etc.) is uncertain, but could play some role in influencing the direction of equity markets in 2020.

While uncertainty is a part of investing, being selective in your investments can make the difference when it comes to investment success. In an ever-changing investment environment, be prepared to make adjustments if and when necessary, i.e., should your portfolio (and its components) move out of line with investment goals.

Investors are encouraged to consult a trusted and experienced advisor, such as Bourse, in order to position their portfolios for the year ahead.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”