| HIGHLIGHTS Local Markets

International Markets

|

Stocks Advance in Q12021

This week, we at Bourse recap the performance of local and international stock markets for the first quarter of 2021. With global vaccine campaigns gaining momentum, stimulus intact and the economies rekindling growth, stocks have continued their upward march from the lows of 2020. Will positive market sentiment be sustained? We discuss below.

Local/Regional Stocks Gain

With increased economic visibility in 2021 thus far, local and cross-listed stocks have started to recover. The Trinidad and Tobago Composite Index (TTCI) improved 1.5% in Q12021 following a 9.9% decline in 2020, buoyed by the Cross-Listed Index (CLX) which advanced 3.9% in Q12021 (FY2020: -18.4%). After retreating 5.2% in 2020, the All T&T Index (ATT) advanced 1.0% over the first quarter of 2021.

Major Movers

GraceKennedy Limited, which reported commendable revenue and profit growth in pandemic-stricken 2020, was the best performing stock for Q12020 appreciating 28.3%. GKC also announced its acquisition of the insurance operations of Scotiabank Eastern Caribbean. Guardian Holdings Limited advanced 22.9%, helped by news of the Group’s decision to re-list on the Jamaican Stock Exchange as well as an improvement in its earnings. Trinidad Cement Limited climbed 20.0%, as positive regulatory-related developments in the industry bolstered investor confidence. First Citizens Bank Limited and Agostini’s Limited appreciated 8.6% and 8.4% respectively, with both stocks announcing major acquisition initiatives in the quarter.

Trinidad and Tobago NGL Limited, the sole component of TT Stock Exchange’s Energy Tier, depreciated 12.5% making it the biggest decliner. Dividend favorite West Indian Tobacco Company Limited slipped 7%, followed by LJ Williams and Scotiabank Trinidad and Tobago Limited which were down 6.7% and 6.4% respectively. Rounding out the top five decliners was cross listed stock JMMB Group Limited, which decreased 6.2%.

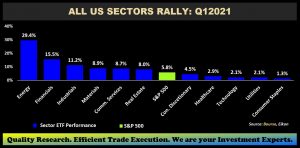

Energy, Financials boost global stocks

US stocks as measured by the S&P 500 Index advanced 5.8% at the end of Q12021, after rallying 16.2% in 2020. Underpinning the positive momentum in the US are factors including continued expansionary monetary and fiscal policy initiatives implemented by the Federal Reserve and the US government. After stumbling to a near-halt in 2020, the first quarter of 2021 marked a resurgence for the energy industry. The Energy Select Sector SPDR Fund (XLE), the worst-performing sector in 2020 (down 36.3%), was the best performer in Q12021, up 29.4%. This reversal in performance came amid (i) surging oil prices, (ii) lower production influenced by the ‘Texas Freeze’ and OPEC production cuts and (iii) optimism surrounding economic recovery as vaccination campaigns progress. On the contrary, the technology sector, represented by the Technology Select Sector SPDR (XLK), which outperformed the broader market in 2020 (up 41.6%), eked out a 2.1% gain in Q12021 as valuation concerns grow.

International Markets Broadly Higher

Vaccine inoculation programs and less rigid lockdown measures throughout Europe and the UK reinstated some confidence in the region, following a 22.3% contraction in the Q12020. As such, European markets rebounded by 1.7% in Q12021. Italy and France, which once accounted for the largest number of COVID-19 cases in Europe in 2020, were the best performing market in the region, advancing 6.5% and 5.0%, respectively in Q12021. After ending 2020 with the sharpest decline of 12.0%, England, expanded by 4.7% amid improved stability around BREXIT and as the first country to initiate its vaccine campaign. Spain repeated its performance as the worst performing market in Q12021, declining 2.1% (Q12020: 30.1%).

Asian Equity markets (excluding Japan) advanced 4.7% at the end of Q12021 following a 20.6% decline in Q12020. Taiwan and Hong Kong were the best performing markets, increasing 12.1% and 6.4%, respectively. India’s markets (Q12020: down 35.9%) improved 5.5% for the period under review as fiscal authorities channelled relief and liquidity and other policy support, lifting momentum. China – the only major economy to return to its pre-covid GDP in 2020 (up 2.3%) – was the worst performing market in Q12021, up 1.1%.

Latin America continued to face challenges associated with the covid-19 pandemic, with the region’s financial markets declining 6.1%. Brazil, Latin America’s largest economy, has continued to report a record number of new infections and a growing death rate. At the close of the quarter, the Brazilian market was down 9.6% in USD terms. Mexico, Latin America’s second largest economy, has been more resilient recovering 4.3% at close of March. A key contributor to the rebound prospects of the economy is its buoyant export revenue. An estimated 80% of all Mexican goods exported are purchased by the US, making Mexico an indirect beneficiary of US fiscal spending.

Will Local Markets Perk Up?

In its most recent World Economic Outlook published in April 2021, the IMF revised up global economic growth projections from 5.5% (Outlook: January 2021) to 6.0% for 2021. The IMF estimated that Trinidad and Tobago shrank 7.8% in 2020 and is forecast to grow 2.1% in 2021. The 2021 growth forecast was revised downward from its January 2021 projection of 2.6%. Despite generally improved energy prices, production challenges continue to plague the domestic energy sector, with natural gas production falling 15.1% in 2020. The recent announcement to idle another two domestic methanol plants could further adversely affect already-dented investor confidence. A misfiring energy sector could have ripple effects on foreign exchange generation, compounding an already sensitive situation.

International Stocks get Green Light

Most economies, with some notable exceptions, are trending towards economic recovery as emphasized by the IMF’s upward revision of economic growth. This optimism predominantly stems from the restarting of economic engines, as lockdowns gradually decrease amid vaccine rollouts. The US is expected to expand by 6.4% in 2021, primarily driven by the most recently approved US$1.9T Covid-19 rescue package and the freshly unveiled US$2.3T Infrastructure Package under the Biden Administration. This commitment to fiscal support is anticipated to fuel the country economy’s recovery efforts.

Europe, on the other hand, is expected to face hiccups along the part to recovery owing to staggered, uneven distribution of vaccines and continued lockdown measures in the bloc’s largest economies Germany, Italy and France among others. Improve trade relationships between the UK and the EU is anticipated to support recovery efforts. The Euro Area is estimated to grow by 4.4% (IMF: April 2021), in 2021, lower than the previously estimated growth of 5.1% (IMF: January 2021). Meanwhile, the UK is forecast to record economic growth of 5.3% in 2021.

Stricter restrictions in India instigated by a second wave of Covid-19 cases and jagged vaccine distribution could present impediments to growth. The leisure, recreation and transportation sectors are likely to face headwinds from the measures whilst the agriculture, construction, manufacturing and utilities sector may record limited consequences. Dependent on the effectiveness of containment measures and the Reserve Bank of India’s pledge to assure liquidity in addition to cheaper funds and vaccine progress in upcoming periods, India is expected grow by 12.5% (IMF) in 2021. China’s growth has been revised up from 8.1% to 8.4% (IMF) for 2021 as effective containment measures, liquidity support, large scale capital investment and rapid productivity growth continues to facilitate strong growth in the world’s second largest economy.

The IMF is its most recent outlook upgraded its growth forecast for Mexico to 5.0% relative to a previous 4.3%, while Brazil’s forecast was shifted to 3.7% from a prior 3.6%. With fresh calls for a reinstatement of lockdown measures in Brazil investors are concerned that a resurgence in cases may present a threat to the country’s recovery. Recently published data shows that some investors have shifted favour to Mexico, an economy anticipated to benefit for US growth.

Investor Considerations

While the domestic economy is anticipated to partially recover in 2021, the pace and magnitude of recovery is still likely to be heavily dependent on the energy sector.

Notwithstanding the tenuous macroeconomic environment, investors should still be able to find pockets of opportunity locally. Companies which are more likely to grow in the current environment will have one or more of the following characteristics:

- Engage in acquisition in the domestic market to (i) ‘buy’ market share and/or benefit from cost and distribution synergies.

- Engage in acquisitions across regional/international market to (i) earn foreign exchange, (ii) enter faster growing economies and/or (iii) diversify business risk by geography.

- Introduce or enter new products/lines of business to enhance revenue generation

- Employ modest Financial Leverage, and/or

- Run efficient operations, as evidenced by stable operating margins.

International markets (particularly the US equity market) continue to prosper, for now, on broadly-positive investor sentiment fuelled by extraordinary government spending and loose monetary policy. At the close of Q12021 the S&P 500, ended at 3,973 before crossing the 4,000 milestone on the first day of April. With consensus year-end targets for the S&P500 Index at 4,100, US markets may be set to take a breather as they search for more good news, economic or otherwise.

Following a period of robust market performance, international investors might consider taking some gains off the table and reallocating to lower-risk asset classes including USD investment grade bonds, repurchase agreements and/or USD income mutual funds. Investors intent on staying in international equities could consider taking broader market exposure through equity index exchange trade funds (ETFs). Otherwise, reviewing your portfolio of stocks periodically to determine whether they are below, at or above consensus price targets is a worthwhile exercise, to get an idea of whether you should be making any changes to your holdings. Investors should consult a trusted and experienced advisor, such as Bourse, to make better informed decisions.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”