| HIGHLIGHTS

Local Market

US Market

|

Stock Markets to Grow in 2021?

Where could stock markets go in the year ahead? This week, we at Bourse provide an outlook on the potential direction of the local stock market in 2021, within the context of a highly uncertain environment. We also share collective forecast for the US stock market, which is also subject to a fairly clouded outlook. The theme that seemingly is most prevalent for 2021 is that of modest recovery, with both economies and investor sentiment anticipated to gradually improve. We discuss the possible drivers of growth in the 2021 investment environment and what investors might expect in the year ahead.

After recording stellar growth in 2019, economic pressures brought about by the COVID-19 pandemic led to a reversal of fortunes for the local stock market in 2020. The Cross Listed Index (CLX), dominated by Jamaican giant NCB Financial Group, saw the largest decline of 18.4% following a 19.0% improvement in 2019. Similarly, Trinidad and Tobago Composite Index and the All Trinidad and Tobago Index (ALL T&T) lost 9.9% and 5.2%, respectively.

Local Market Drivers Suggest Modest Growth

With conditions expected to generally improve in 2021, local market influencing factors could include:

- The gradual resumption of economic activity, which could lead to (i) improved corporate earnings, (ii) potentially higher dividend payouts and (iii) improved investor sentiment.

- The potential prolonged impact of COVID-19, which would have inevitably left an as-yet unquantified amount of permanent damage to some facets of the economy.

- Higher cost of living. The MoF’s fuel market liberalization policy, the implementation of property tax, the likelihood of increased utility rates and implicit foreign exchange scarcity-driven price increases could result in weaker consumption patterns and reduced disposable income, potentially altering investor demand.

- The potential recovery of energy prices in the coming months, stemming from the stabilization of prices in the second half of 2020 and into early 2021.

- Local energy production challenges, as evidenced by plant shutdowns/idling and recent rumblings between producers, consumers and allocators of energy resources in the domestic landscape.

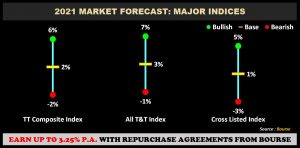

Local Stocks to Stabilize

Having considered the broad market drivers and evaluated the prospects of each of the major stocks listed on the Trinidad & Tobago Stock Exchange (TTSE), the forecast for 2021 is stabilization to modest growth. The All T&T Index – comprising stocks domiciled in Trinidad & Tobago – is forecast to advance 3%, while the T&T Composite Index is projected to appreciate 2%. The Cross-Listed Index, which includes Jamaican and Barbados-based companies listed on the TTSE, is estimated to remain fairly stable with growth of 1%. While the worst of COVID-19 is expected to have passed, above-average uncertainty in the coming year leads to a wider margin of error of ±4%.

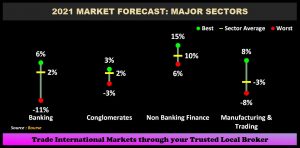

Non-Banking Finance Could Star

Banking: The Banking sector, the local market’s largest sector by market capitalisation accounting for roughly 57% of total market value, is forecast to appreciate 2% in 2021 as credit losses moderate and revenues stabilize. Economic conditions imposed by the COVID-19 virus in 2020 led the sector contract 10% relative to 2019 levels. However, with economic conditions expected to continue normalising into 2021, Banking performance could improve. There is an increased likelihood of dividend recovery, which could enhance the income-generating allure of bank stocks to investors. Stocks within the sector are forecast to range from -11% to 6% in individual price changes.

Conglomerates: Being the second largest sector by market cap accounting for roughly 14% of total market value, the Conglomerate Sector is estimated to appreciate 2% in 2021. Stocks in the sector are estimated to record price movements of +3% to -3%. Massy Holdings Limited’s (MASSY) Integrated Retail and GraceKennedy’s (GKC) Food Trading segments both benefitted from stronger demand for consumer staples in 2020. With economies on the path of continued normalisation, demand across these segments could abate in 2021. Both Ansa McAl Limited (AMCL) and MASSY will be closely focused on vehicle sales trends. The two largest publicly-listed automotive distributors will be seeking to find innovative methods of spurring demand in this segment. The absence of the traditional Carnival season could potentially weigh on AMCL’s Manufacturing, Packaging and Brewing business segment, while MASSY will be anticipating positive results from its stake in the recently commissioned Caribbean Gas Chemicals Limited (CGCL) plant.

Non-Banking Finance: The Non-Banking Finance Sector is forecast to deliver growth of around 10%, with sector member performance ranging from +6% to +15%. Underpinning this performance is prospect of improvements in international investment markets and potentially higher insurance premiums. In terms of acquisition benefits, Guardian Holdings Limited (GHL) is expected to expand its insurance operations through the recently concluded acquisition of the insurance portfolio of parent company NCB Financial Group. Ansa Merchant Bank Limited (AMBL) is increasingly well-positioned for its foray into commercial banking via the acquisition of the local operations of Bank of Baroda.

Manufacturing and Trading: The Manufacturing I Sector declined 15% in 2020, with pandemic pressures posing challenges to the profit performance of these entities as well as impacting sentiment. Notably, the Manufacturing II Sector had a stellar year delivering a 48% increase in 2020, through improved sentiment for Trinidad Cement Limited (TCL). TCL benefitted from the completion of restructuring exercises, as well as the imposition of import duties and a lowered import cap on cement which will inevitably reduce competitive pressures on the domestic producer. Heading into 2021, the Manufacturing and Trading Sectors are expected to modestly depreciated by 3%, with continued COVID-19 regulations such as the cancellation of Carnival expected to produce challenges to revenue growth, particularly for companies which benefit from seasonal shifts in demand. Member performance is estimated to range from +8% to -8%.

Energy: The last year has been particularly volatile for Trinidad and Tobago NGL Limited (TTNGL), with lower energy prices weighing on its profitability as well as investor sentiment. Consequently, the Energy Sector closed the year 29.0% lower than 2019. TTNGL could stand to improve as energy and derivative prices recover in 2021. However, the impact from potentially lower domestic gas production volumes could offset any gains from improved pricing. For 2021, TTNGL is forecast to produce a modest increase in price within a range of +2% to +6%.

International Markets Looking Up

The US market was a model of resilience in 2020, advancing a notable 16% despite the extreme volatility brought about by COVID-19 earlier in the year. Entering 2021, a number of factors could set US markets up for another year of overall gains including:

- The continued normalization of economic activity which could benefit cyclical stocks. Additionally, it may lead to the improvement of prevailing unemployment rates.

- Though widely viewed as ‘ambitious’ in terms of the suggested pace, aggressive COVID-19 vaccination programs could accelerate an at least partial resumption of ‘normal’ life, even as countries move into another round of lockdowns.

- With a unified Democratic government set to run US affairs, market participants are projecting continued and even strengthened fiscal stimulus in the new year. This likely being a supporting factor of investor sentiment in 2021.

- New strains could stir concerns amongst investors, though early reactions suggest it has prompted limited worry.

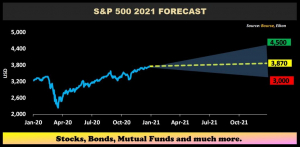

The median forecast for the S&P 500 Index is a 3% appreciation in 2021 from its December 2020 closing level of 3,756.07. The highest 2021 target by US analysts is currently 4,500 (or 20% up), while the gloomiest forecast is a level of 3,000 (or 20% lower).

Investor Considerations

While uncertainty is a part of investing, being selective in your investments can make the difference when it comes to investment success. In an ever-changing investment environment, be prepared to make adjustments if and when necessary, i.e., should your portfolio (and its components) move out of line with investment goals. Investors are able to access international and local markets with an array of providers, including Bourse. 2021 could turn out to be an eventful next few months, as investors react to a rapidly evolving investment landscape.