SFC, JMMBGL Stumble

| HIGHLIGHTS SFC 6M 2020 · Earnings: Earnings Per Share fell 159.1% from US$0.34 to a loss per share of US$0.20 · Performance Drivers: o Lower Net Premium Revenue amid economic pressures o Higher Impairment Losses/ Other Investment Expense o One off Cost from Internal Reinsurance Transaction · Outlook: o Possible headwinds to organic growth amid adverse economic conditions o Potential increases to Credit Impairment Losses o Growth from potential acquisition activities · Rating: Maintained at NEUTRAL. JMMBGL Q1 2021 · Earnings: Earnings Per Share fell 42.7% from $0.03 to $0.02 · Performance Drivers: o Year-on-year decline in Operating Revenue o Higher Impairment Loss on Financial Assets · Outlook: o Potential increases to Impairment Loss on Financial Assets o Possible headwinds to organic growth amid contractionary economic conditions · Rating: Maintained at NEUTRAL. |

This week, we at Bourse review the financial performance of Toronto-listed Sagicor Financial Company Limited (SFC) for the six-month period ended, 30th June, 2020 and JMMB Group Limited (JMMBGL) for the three month ended 30th June, 2020. SFC reported a loss on account of lower revenue growth and higher impairment losses. JMMBGL recorded lower earnings on account of similar factors.

Sagicor Financial Company Limited (SFC)

For the six-month period ended 30th June, 2020 SFC reported a Fully Diluted Loss Per Share of US$0.20, a 159.1% reversal from an EPS of $0.34 in the prior comparable period.

Net Premium Revenue, the Group’s core revenue driver closed the period at US$627.6M a 7.4% decline from US$677.8M reported in HY 2019. Other Investment Income and Credit Impairment Losses however shifted into negative territory (US$76.5M) from a previous gain of US$64.8M. Interest Income improved 4.8% year-on-year (YoY), providing some support to the top-line. Nevertheless, Total Revenue fell 18.5% moving from a prior US$984.2M to US$801.7M. Total Benefits in the period declined 19.2% to US$516.8M. Meanwhile, Total Expenses in the period increased 4.2% to US$279.6M likely impacted by consolidated costs from SFC’s acquisition of Advantage General Insurance Limited. Income Before Tax moved from US$84.5M to a loss of US$20.1M in HY 2020, influenced by reduced revenue. Income Taxes fell 39.4% in the period. Overall, Net Income for the Period declined 161.4% from US$58.9M in HY 2019 to a loss of US$36.2M in HY 2020.

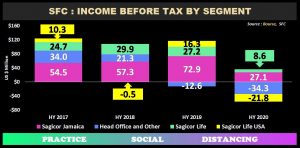

Operational Segments Face Headwinds

Sagicor Jamaica continues to be the Group’s largest contributor of Income Before Tax; this comes despite a 62.8% decline in performance in the period under review. The adverse shift in Sagicor Jamaica’s performance comes amid contractions in regional and global financial markets as well as COVID-19 related economic pressures which escalated Credit Impairment Losses and limited opportunities for revenue growth. Although, the segment was able to report some additional Income due to the Group’s (60%) majority holding of Advantage General Insurance Company Limited (effective 30th September, 2019) this did little to offset the compounding impact of COVID-19.

Sagicor USA slipped from an Income Before Tax of US$16.3M in the prior period to a Loss Before Tax of US$21.8M in the current. In addition to performance pressures resulting from COVID-19, the segment suffered a one off loss of US$2.9M associated with the decision to move a portion of its life insurance business to its Bermuda subsidiary (Sagicor Reinsurance Bermuda Limited). According to SFC, the transaction resulted in insurance risks associated with certain life products and US$195M of financial instruments supporting those liabilities, being transferred to the subsidiary party. Excluding this transaction, Net Income reported by the segment rose 28% in Q2 2020 reflective to the same period a year ago.

Operating Jurisdictions Contract

USA is SFC’s largest segment by revenue, accounting for 35% of the Group’s top line performance in the current period. However, in the last six months the US economy has recorded a dramatic change as lockdown measures reduced productivity and led to declines in disposable income for a sizable proportion of the US population. These factors have shifted consumer spending and ultimately curtailed SFC’s revenue generating abilities. The US economy is expected to contract 8.0% by year end 2020 according to the International Monetary Fund.

Jamaica is SFC’s largest regional market, accounting for 34% of Revenue in HY 2020, also recording a 13.4% YoY decline in performance. The depreciation of the Jamaica dollar relative to that of US dollar (13.5% YTD) was an influential factor in the region’s performance, this coinciding with contractions in the Jamaican capital market and adverse economic conditions weighed on performance.

Harsh lockdown measures in Trinidad and Tobago as well as Barbados were noted by the Group to have an adverse impact on revenue generation.

Committed to Growth

Currently SFC earns roughly 11% of its revenue in Trinidad and Tobago. With the Group expected to complete its acquisition of the insurance portfolios of CLICO and British American Trinidad in coming periods, growth is likely to stem from the region. Group President Dodridge Miller stated that SFC is exploring acquisition opportunities, particularly in traditional insurance operations. The Group’s commitment to M&A activity is underpinned by its strong financial position, currently US$2.1B in total capital with US$295.0M in cash resources.

Share Buyback

In mid-June 2020, SFC announced its intention to engage in a share buyback program allowing it to repurchase up to 3 million of the Group’s common shares. The program was aimed at improving liquidity for shareholders and creating opportunities for capital appreciation. Thus far, the Group has reported the purchase of 963,000 shares in the open market at an aggregate value of US$3.9M. SFC’s stock price has climbed 6.7%, likely aided by the ongoing buyback program.

The Bourse View

Sagicor Financial Company Limited is currently priced at CAD6.20 and trades at a Price to Earnings ratio of 34.7 times relative to a peer average of 17.2 times. The stock offers investors a trailing dividend yield of 4.7% relative to a sector average of 5.3%. SFC’s largest operational markets Jamaica and US are expected to record economic contractions of 8.0% (IMF) and 5.1% (Bank of Jamaica) respectively. This is likely posing a threat to the performance of the Group in the near term. On the basis of consistent dividend payments and growth potential amid its sizable capital base but tempered by its relatively high valuations and its susceptibility to ongoing adverse economic conditions Bourse maintains a NEUTRAL on SFC.

JMMB Group Limited (JMMBGL)

JMMBGL reported an EPS of TT$0.02 for the first quarter ended June 30th 2020 (Q1 2021), 42.6% lower than TT$0.03 reported in the prior comparable period. Net Interest Income expanded 10.4%, from TT$99.7M to TT$110.1M. Gains on Securities Trading declined 39.5% YoY to TT$59.4M, while Foreign Exchange Margins from Cambio Trading were 29.1% lower. Resultantly, Operating Revenue net of Interest Expense declined 14.5% from TT$265.3M to TT$227.0M. Operating Expenses were marginally higher at TT$168.5M, while Impairment Losses on Financial Assets grew from TT$7.0M to TT$7.7M (up 10.5%). JMMBGL recorded a Share of Loss of Associate of TT$0.4M from its SFC holding. Profit Before Taxation fell 40.0% to TT$50.3M from a prior TT$83.8M. Overall, Profit for the Period closed 30.3% lower, at TT$50.8M. Net Income Attributable to Equity Holders of the Parent declined 30.8% YoY.

Operating Revenue Lower

JMMBGL reported a 14.5% decline in Operational Revenue at the end of Q1 2021. Net Interest Income, which represents 48.5% of Operating Revenue, increased 10.4% attributable to an 8% growth in the loan and investment portfolio. However, this was not enough to offset reductions in trading based revenue. Gains on Securities Trading (Operating Revenue: 26.2%) reported a YoY decline of 39.4%, owing to disruptions in the financial markets and reduced trading activities. Foreign Exchange Margins from Cambio Trading followed a similar trend, falling 29.1% YoY led by reduction in Foreign Exchange on account of slowdown in the Tourism Sector and Remittances. Growth in managed funds and collective investment schemes supported the Fees and Commission segment, however muted business activity led to a marginal decline of 2.2%.

Sagicor Slips

Pressures faced by Sagicor Financial Corporation Limited (SFC) in Q2 2020 resulted in a TT$0.4M loss for JMMBGL, which holds a 22.5% equity stake in SFC. SFC’s performance was attributed higher expected credit losses and one off costs arising from an internal reinsurance transaction. JMMBGL expects that SFC will reverse this loss in coming periods and positively impact on performance.

In FY 2020 JMMBGL reported a Gain on Acquisition of Associate of TT$131.8M and currently values its Interest in Associated Companies at TT$1.65B, compared to a market value of TT$1.08B. Further declines in SFC’s price performance on the Toronto Stock Exchange in addition to adverse shifts in profitability may pose a threat to JMMBGL’s bottom line in the form of in a Loss on Revaluation of Associate.

The Bourse View

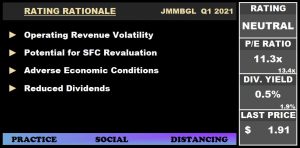

JMMBGL is currently priced at $1.91 and trades at a trailing price-to-earnings (P/E) ratio of 11.3 times, below the average of the Non-Banking Financial sector average of 13.4 times. JMMBGL, which falls under the mandate of the Bank of Jamaica, can only pay dividends to shareholders owning 1% or less of the Group’s shares. The stock offers a trailing dividend yield of 0.5%, below the sector average of 1.9%. With continued uncertainty surrounding COVID-19, contractions in economic growth and the depreciation of the Jamaican Dollar, JMMBGL is likely to face some challenges in the upcoming periods. However, the Group could be supported by meaningful (though less likely) recovery in capital markets. On the basis of operating revenue volatility, potential downward revaluations from JMMBGL’s equity stake in SFC, adverse economic conditions and reduced dividend payment, Bourse maintains a NEUTRAL rating on JMMBGL.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”