BOURSE SECURITIES LIMITED

19th August, 2019

SFC, GHL Advance

This week, we at Bourse take a look at the financial performance of two major players in the Non-Banking Finance sector, Sagicor Financial Corporation Limited (SFC) and Guardian Holdings Limited (GHL), for the six-month period ended June 30th, 2019. While SFC experienced meaningful growth from insurance operations, the driver of GHL’s performance was investment income, derived mainly from the US and Jamaican markets.

Sagicor Financial Corporation Limited (SFC)

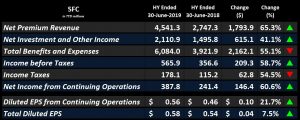

Sagicor Financial Corporation Limited (SFC) reported Total Diluted Earnings per Share (EPS) of TT$0.58 for the six-month (HY) period ended June 30th 2019, a 7.5% improvement from the EPS of TT$0.54 recorded in the prior comparable period. Diluted EPS from Continuing Operations improved 21.7% year-on-year (YoY), from TT$0.46 in HY 2018 to TT$0.56 in HY 2019.

The Group reported Net Premium Revenue of TT$4.54B in HY 2019, a significant 65.3% or TT$1.79B increase YoY. Net Investment and Other Income also climbed 41.1% from TT$1.50B to TT$2.11B. This revenue growth was accompanied by a 55.1% or TT$2.16B increase in Total Benefits and Expenses which amounted to TT$6.08B for the period. Income before Taxes improved from TT$356.6M in HY 2018 to TT$565.9M in HY 2019, a 58.7% increase. As a result, Income Tax Expense grew to TT$178.1M from TT$115.2M in the prior comparable period. The Effective Tax rate fell marginally YoY, from 32.3% to 31.5%. Overall, Net Income for the period amounted to TT$391.3M, 48.3% higher than the TT$263.9M recorded in HY 2018. Continuing Operations would have contributed TT$387.8M (+60.7% YoY) to Net Income, while Net Income from Discontinued Operations fell from TT$22.5M in HY 2018 to TT$3.5M in HY 2019.

Outlook

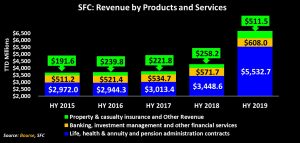

Over the past five comparable periods, revenues generated by SFC’s various products and services have continued on an upward trajectory. Revenue from Life, Health & Annuity and Pension Administration Contracts amounted to TT$5.53B in HY 2019 (up 60.4% YoY). These products remain the largest contributors (83.2%) to SFC’s Total Revenue. Banking, Investment Management and Other Financial Services contributed TT$608.0M to Total Revenue, a moderate 6.3% improvement YoY. Property and Casualty Insurance Products generated TT$178.4M in revenue, compared to the TT$157.4M in the prior comparable period. Other Revenue more than tripled YoY from TT$100.8M to TT$333.1M.

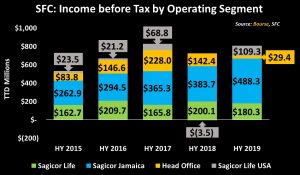

SFC’s Income before Tax (PBT) has recovered after the 2018 impact of provisions for the Government of Barbados debt restructuring. The Sagicor Life USA segment has returned to profitability, recording PBT of TT$109.3M as compared to the loss of TT$3.5M in HY 2019. This followed from the Group’s decision to cease reinsuring premiums to third parties as well as sales growth, but was tempered by the concurrent rise in Benefits and Expenses, particularly commissions. Sagicor Jamaica’s Operating Profit improved by TT$104.6M (27.3%) YoY, while The Sagicor Life and Head Office segments experienced declines in Operating Profits of 9.9% and 79.3% YoY respectively.

Alignvest Acquisition Update

The acquisition of SFC by Alignvest Acquisition II Corporation (AQY) appears to be progressing, with Shareholders of AQY and SFC having voted strongly in favour of the deal. The estimated timeline for completion of the transaction is the fourth quarter of 2019, subject to regulatory approval. Shareholders elected to receive an aggregate cash consideration of US$20M, less than 10% of the maximum pay-out offered of US$205M. According to Chairman, the new entity will retain net cash of US$420M upon completion of the transaction, positioning the new entity for growth going forward.

The Bourse View

SFC’s share price currently stands at $10.45 and has appreciated 16.1% YTD. The stock trades at a trailing price-to-earnings ratio of 10.6 times, lower than the Non-Banking Financial Sector average of 12.3 times (excluding NEL). SFC offers investors a trailing dividend yield of 3.2%, relatively in line with the sector average of 3.1% (excluding NEL). Semi-annual dividend payments are declared in USD, providing investors with an implied hedge against the depreciation of the TT Dollar. Importantly, SFC is set to be delisted from the Trinidad & Tobago Stock Exchange (as well as other current exchange listings) to be listed on the Toronto Stock Exchange in Canadian Dollars. On the basis of fair valuations, the prospect of converting a TT dollar asset into a ‘hard currency’ asset, improvements in performance and the upside potential for growth from the AQY transaction and future acquisition activity, Bourse maintains a BUY rating on SFC.

Guardian Holdings Limited (GHL)

Guardian Holdings Limited (GHL) reported Basic Earnings per Share (EPS) of $1.06 for the six-month (HY) period ended 30th June 2019, a 14.0% improvement over the prior comparable period.

For the HY 2019 period, Net Written Premiums of $2.31B increased 4.0% over last period’s $2.22B. Net Income from Insurance Underwriting Activities declined significantly YoY to $265.5M, a 31.9% ($124.1M) fall from last period’s $389.6M. In contrast, Net Income from Investing Activities outweighed the aforementioned fall with a 45.8% ($206.0M) YoY improvement from $449.9M in 2018 to $655.9M in 2019. As a result, Net Income from all Activities climbed 9.5% ($81.2M) YoY to stand at $938.2M. Despite a 7.4% ($36.37) increase in Operating Expenses, which amounted $530.0M for the period, Operating Profit advanced 17.1% ($49.4M) to stand at $337.9M for HY 2019. Taxation Expense rose 11.7% to $94.9M for the period however, the Group’s Effective Tax Rate for the period fell from 28.5% for HY 2018 to 27.2%. Overall, Profit for the Period grew to $247.7M, a 14.8% ($31.7M) improvement over the prior comparable period.

Outlook

Over the five-year period (HY 2015 – HY 2019), Total Net Income has demonstrated consistent YoY growth, increasing at an average of 9.4% each year. However, contributions from the Group’s two main sources of income, Insurance Underwriting Activities and Investing Activities, have fluctuated over the years. The impact of falling global interest rates would have materialized in contrasting ways in GHL’s business segments. The Group adjusted its actuarial reserving assumptions, causing a 31.9% or $124.1M YoY reduction in Net Income from Insurance Underwriting Activities. On the other hand, Net Income from Investing Activities would have been propelled as global markets rallied in expectation of monetary policy easing, in particular, that of the US Federal Reserve. GHL’s exposure to the US and Jamaican equity markets would have therefore positively contributed to the 45.8% improvement in this area.

Operating Profit for The Life, Health and Pension Business segment improved 37.2% ($97.0M) YoY during the HY 2019 period. The Property and Casualty Business segment experienced growth due to new business generation and organic growth, which fueled by a 27.0% or $35.2M increase in Operating Profit YoY. The Asset Management segment also improved from $19.4M in HY 2018 to $23.9M in HY 2019.

The Bourse View

At a current price of $18.00, GHL trades at a trailing P/E of 7.4 times, below the Non-Banking sector average of 12.3 times (excluding NEL). The trailing dividend yield is 4.0%, above the Non-Banking sector average of 3.1% (excluding NEL). On the basis of relatively attractive valuations, but tempered by the increased uncertainty in international capital markets and GHL’s reliance on the same, Bourse maintains a NEUTRAL rating on GHL.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”