BOURSE SECURITIES LIMITED

10th April, 2017

SFC: Earnings Advance, Dividends Increase

This week, we at Bourse review the 2016 full-year performance of a closely monitored stock, Sagicor Financial Corporation Limited (SFC). SFC’s stock price has advanced 18.4% year-to-date, moving from a price of $7.73 to its current $9.15. We highlight some key areas of the performance and provide a brief outlook.

Sagicor Financial Corporation Limited (SFC)

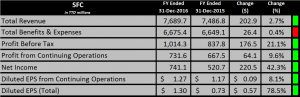

SFC reported fully diluted Earnings per Share from continuing operations of TT$ 1.27 for the year ended December 2016, an improvement of 8.1%.

SFC’s Total Revenue climbed by TT$ 202.9M. Total Expenses and Benefits moved up TT$ 26.4M. This led to Profit Before tax of TT$ 1,014.3M, 21.1% higher than 2015. An increase in deferred tax liabilities moved the effective tax rate from 20% in FY2015 to 28% in FY2016. Overall, Profit from Continuing Operations increased from TT$ 667.5M to TT$ 731.6M, up 9.6%.

Outlook

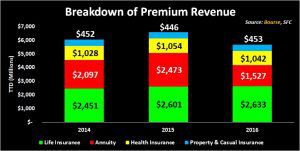

SFC’s Premium Revenue declined 14.0% year-on-year (YOY) in 2016. A closer look at the numbers revealed that all sources of premium revenue were relatively flat, except for Annuity Revenue, which declined 38.3% YOY. This decline was attributable to lower annuity business in the USA segment. The fall in Premium Revenue of $919M was accompanied by a decrease in Premium Expense of $852M, leading to an overall fall in Net Premium Revenue of $67M or 1.5%.

SFC’s Net Premium Revenue accounted for 59% of Total Revenue in 2016, while Net Investment Income contributed 31%. Gains realized in the Group’s international investment portfolio supported the increase in Net Investment Income. The Fees and Other Revenue segment benefited from higher foreign exchange gains amounting to $66.1M.

Looking ahead, the Net Premium Revenue segment will be of key importance to the Group’s total revenue. Lower annuity business in the USA segment could weigh on this segment if not addressed. In 2016, Interest Income accounted for 80% of Investment Income while Net Investment Gains accounted for 17%. Gains on investment may be subject to volatility. The Group will need to effectively management and balance the international portfolio in light of rising interest rates in the United States.

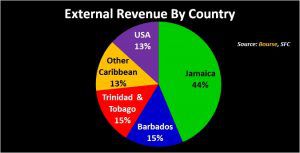

With respect to geographic diversification, Jamaica accounts for 44% of Group revenue. This could be a positive driver for SFC, given the country’s improving economy and investor confidence. SFC’s low exposure to Trinidad and Tobago, as well as Barbados, could limit the impact of lower economic activity from these territories.

The Bourse View

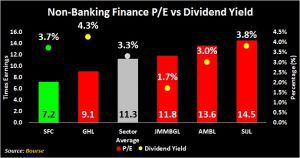

At a current price of $9.15, SFC trades at a trailing P/E of 7.2x, below the Non-Banking Finance sector average of 11.3x (excluding NEL). SFC also trades at a market to book value of 0.76x, below its sector average of 1.21x (excluding NEL). Importantly for investors, SFC pays its dividends in TTD, but declares dividends in USD, providing an implicit hedge against further depreciations in the TTD. The Group boosted its final dividend to US$ 0.025 in FY2016 from US$ 0.02 in FY2015, which takes trailing 12-month dividends to US$0.05 or TT$ 0.34 per share. The stock offers investors a trailing dividend yield of 3.7%, above the sector average of 3.3% (excluding NEL). On the basis of i) continued improvements in performance, ii) a relatively low valuation, iii) an attractive dividend yield and iv) an implicit hedge against the TTD, Bourse maintains a BUY rating on SFC.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”