BOURSE SECURITIES LIMITED

04th December, 2017

Securing your financial future

This week, we at Bourse discuss one of the most important investment topics individuals confront: securing your financial future. Advances in medicine, more health-conscious lifestyles and the evolving terms/structures of sovereign pension and retirement necessitate a more proactive approach to how individuals position themselves – and their families – for life. We share some perspective on the importance of planning for the future, taking a closer look at the available options that can assist individuals in achieving financial security.

Are You Prepared for the Future?

After spending a career accumulating assets, it is important to determine if their assets will be sufficient to meet your lifestyle requirements. Making the transition out of the workforce requires a different outlook than simply depending on a state income (NIS, Senior Citizens Grant, Government Pension etc.) or simply accumulating funds in a bank account. Preserving and building one’s wealth to meet planned and sometimes unplanned expenditure are among the major considerations when planning for the future. Without a reliable stream of income, individuals may find it more difficult adjusting to life after work.

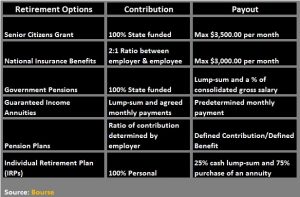

Exploring Your Options

Senior Citizens Grant & National Insurance Benefits

The National Insurance Board of Trinidad and Tobago (NIB) offers a retirement supplement payable for life, to persons who have made the total minimum requirement of 750 contributions. However if an individual had not made the minimum contribution, a lump-sum grant of $3,000.0 minimum would be instead. Senior Citizens Grant offers a retirement benefit of up to $3,500.00 at age 65, however this benefit is not an entitlement. An individual, who has National Insurance contributions, may be eligible to claim the $3,000.00 benefit and a portion of the Senior Citizens Grant.

Government Pensions

Government pensions are the most common retirement benefit among government institutions. Permanent employees of government ministries benefit from a non-contributory (the government is the sole contributor) pension benefit, which offers a cash lump sum and monthly payments based on a percentage of the consolidated gross salary. However, the monthly benefit allotted would be a fraction of your premium monthly salary.

Pension Plans (Defined Contribution & Benefits Plans)

With Pension plans, contributions are automatically deducted from your salary and matched by the employer (in many cases dollar-for-dollar). The Defined Contribution Plan pays from a trust fund upon retirement and is dependent on the value at that point. As a result, while the employer and employee’s contributions are known in advance the benefit to be paid upon retirement is unknown, so there is no guarantee that a given level of contributions will meet future obligations. In contrast, the Defined Benefits Plan offers the holder a specified pension benefit upon retirement.

Guaranteed Income Annuities

An annuity is an insurance product that allows you to invest today and get a guaranteed income stream when you retire. The deferred-income annuity (DIA) is one of the more popular plans. This investment vehicle offers the policyholder the choice of maturity between 50 to 70 years with the option to extend the initial life of the plan. If longevity is not in the cards, payments are made to a designated beneficiary until the end of a specified period.

Individual Retirement Plan (IRPs)

IRP contributions are tax deductible and you enjoy tax-deferred growth, meaning you do not pay capital gains tax. However, if the plan is surrendered before maturity a 25% tax expenses is applied to the current cash surrender value of the plan. The IRP is often the best option to provide a secondary source of income to retirees. Upon maturity, an investor has the option to receive their investment in two ways, 25% lump sum and 75% purchase of an annuity or 100% purchase of an annuity.

Are you saving enough?

By the time you are ready to retire, you should be in a financially healthy position. Depending on one source of income upon retirement may not be the best strategy. Most retirement plans, whether state or corporate, are meant to provide supplemental income. In fact, an individual earning $5, 000.00 per month or more, can expect to receive $3,000.00 per month from NIB upon retirement at 60 or a maximum of $3,500.00 per month as Senior Citizens benefit at 65. Independent retirement savings are becoming increasingly important as the cost of living has increased over the years and the shortfall in retirement income has also been increasing.

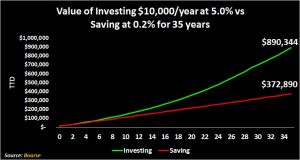

Investing in a retirement plan early provides the investor with the opportunity to make smaller monthly contributions over a longer period. Depending on your lifestyle after retirement, you may need a greater portion of your pre-retirement income to cover living expenses. If you start contributing to your IRP at 25, an annual investment of $10,000 would result in a value of $890,344 (assuming a 5.0% return p.a.) at age 60. This compares favourably to the $372,890 from saving at 0.2% p.a. Persons with a shorter time frame to retirement, such as those retiring in five or ten years can make larger monthly or lump sum injections (from a bonus or gratuity) into a plan to build up their retirement nest egg.

With the average person living longer, there are more years to plan for. If you are one of the many people who underestimate your financial requirements to retire comfortably, you may find yourself running out of money. With traditional sources of income (NIS, Senior Citizens Grant, and Government Pension) becoming increasingly insufficient to cover expenses at retirement, it is important to take control of your financial future to ensure that you are prepared.

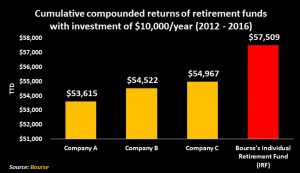

In order to build the best retirement plan for your specific needs, it is important to put money into a tax advantage plan that maximizes your savings, such as the Savinvest Individual Retirement Fund (IRF), managed by Bourse. An investment of $10,000 per year in the IRF for the past five years would have been worth $57,509 today. When compared to other retirement funds the Bourse IRF provides the superior return.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”