| HIGHLIGHTS SBTT HY 2021 Earnings: Earnings Per Share 16.2% higher from $1.49 to $1.73 Performance Drivers: Lower Revenue Lower Non-Interest Expense Reduced Net Impairment Loss Outlook: Ongoing Vaccination Campaign Economic Pressures associated with Pandemic Rating: Maintained at NEUTRAL JMMBGL FY 2021 Earnings: Earnings Per Share 3.8% lower from TT$0.18 to $0.173 Performance Drivers: Higher Operating Revenue Higher Impairment Losses Increased Share of Profit of Associate Outlook: Stabilization of Financial Markets Improved Performance of Associate Company Lingering Economic Challenges Rating: Maintained at NEUTRAL |

SBTT Improves, JMMBGL Slips

This week we at Bourse review the performance of Scotiabank Trinidad and Tobago (SBTT) for its half-year period ended 30th April 2021 and JMMB Group Limited (JMMBGL) for its financial year ended 31st March, 2021. SBTT advanced on account of lower Impairment Losses and Non-Interest Expenses. Despite higher revenues, JMMBGL profits fell with increased Impairment Losses among other factors.

Scotiabank Trinidad and Tobago Limited (SBTT)

Scotiabank Trinidad and Tobago Limited (SBTT) recorded Earnings per Share (EPS) of $1.73 for the six-month period ended 30th April, 2021 (HY 2021), 16.2% higher than a prior $1.49. Net Interest Income declined 6.5%, moving from $620.5M to $663.6M. Other Income was relatively more resilient, declining 1.2% to $248.2M (HY 2020: $251.3M). Cumulatively, SBTT recorded $868.7M in Total Revenue for HY 2021, 5.1% lower compared to a prior $914.9M. Non-Interest Expenses moved 7.3% lower to $373.8M in HY 2021, as the Group continued the implementation of cost management strategies. SBTT recorded a 71.0% contraction in Net Impairment Losses on Financial Assets, which amounted to $34.5M relative to a prior $119.1M. Income before Taxation (PBT) stood at $460.4M in the period under review, 19.2% higher than a preceding $392.8M. Income Tax Expense amounted to $155.9M in HY 2021 for an effective tax rate of 33.9% relatively consistent with a previous 33.2%. Overall, SBTT reported an Income After Taxation of $304.6M, up 16.2% compared to $262.1M in HY 2020.

Revenue Headwinds Persist

In HY 2021, with economic pressures continuing to linger, SBTT recorded a 5.1% contraction in revenue growth. Net Interest Income, which contributed 71.4% of Total Revenue, declined 6.5% YoY. Other Income (28.6% of Total Revenue), fell 1.2% in the period under review. SBTT’s largest operational segment by revenue, Retail Corporate & Commercial Banking (90.4% of Total Revenue) declined 5.1% YoY while its Asset Management and Insurance Services segment recorded declines of 4.2% and 5.1%, respectively, in terms of revenue.

Dividend Heads Higher

Despite the volatility associated with SBTT’s earning per share (EPS) in prior comparable periods, it has consistently maintained its cumulative dividends per share (DPS) of $1.00 for the six-month period. Resultantly, in HY 2020 while the Group reported a 24.4% decline in EPS it maintained a cumulative DPS of $1.00, pushing its pay-out ratio to 67% (greater its historical average of 54%). For HY 2021, the Group made the decision to improve its cumulative DPS for FY 2021 to $1.20 with a dividend pay-out ratio of 69%.

The Bourse View

At a current price of $57.00, SBTT trades at a price to earnings ratio of 17.9 times compared to a sector average of 22.6 times. The stock currently generates a trailing dividend yield of 4.3% relative to the Banking sector average of 2.2%. SBTT solely operates in Trinidad and Tobago through the provision of banking services and insurance solutions. Given the recent re-implementation of covid-19 mitigation measures amid a third domestic wave of the virus, a number of industrial sectors are likely to be adversely impacted. Resultantly, SBTT – like other domestic banking entities – could face short term pressures related to muted demand for loans and other financial services. However, the Government of Trinidad and Tobago’s new initiative of “vaccinate to operate” and the ongoing push to vaccinate citizens is expected to result in gradual economic normalization and supportive demand for banking solutions, if implemented in a timely manner. On the basis of consistent dividend payments, but tempered by lingering economic challenges Bourse maintains a NEUTRAL rating on SBTT.

JMMB Group Limited

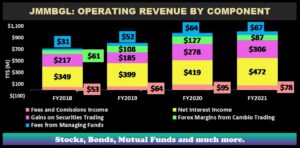

For the financial year ended 31st March, 2021 JMMBGL reported an Earnings per Share of TT$0.173, a decline of 3.8% relative to TT$0.180 in the prior financial year, attributable an increase in the average weighted number of share outstanding. The Group reported a 12.7% increase in Net Interest Income to TT$491.8M compared to a previous TT$418.5M. Fee and Commission Income fell 18.2% to TT$77.8M, while Gains on Securities Trading rebounded 10.0% to TT$306.0M. Net Income from Financial Assets at FVTPL jumped to a gain of TT$2.1M from a loss TT$12.1M. Foreign Exchange Margins from Cambio Trading fell to TT$67.2M, 47.1% lower. Fees Earned from Managing Funds improved 36.8% to TT$87.1M. Cumulatively, Operating Revenue was up 4.3% at TT$1.01B compared to TT$970.4M in FY 2020. Other Income totalled TT$8.1M from TT$2.5M. Operating Expenses stood at TT$655.2M down 8.8% from $718.4M in FY 2020. Operating Profit improved 43.4% moving to TT$364.9M from $254.5M. Impairment Loss on Financial Assets rose 42.8% in FY 2021 amounting to TT$90.5M (FY 2020: TT$63.4M). Share of Profit of Associates increased by TT$75.8M to TT$85.0M, amid a recovery in the performance of Sagicor Financial Company Limited. The Group recorded a Profit before Tax (PBT) of TT$359.0M, moving 8.3% higher than TT$331.5M in the prior year. Notably, in FY 2020 a Gain on Acquisition of Associate contributed TT$131.8M to JMMBGL’s earnings, which did not recur in FY 2021. Taxation Expense in FY 2021 was TT$10.9M relative to TT$6.8M. Profit for the Year was $348.1M, 4.6% higher. Profit attributable to Equity holders of the Parent amounted TT$338.5M, a 7.3% increase from $315.4M.

Operating Revenue Trend Higher

Net Interest Income increased by TT$53.2M (12.7%) in FY 2021, with the growth being propelled by Interest Income which grew TT$109.4M in the year offset by a TT$56.2M increase in Interest Expense. Underpinning the growth in Interest Income has been its Loans and Notes Receivable portfolio which expanded by 21% in FY 2021 while the Customer Deposits improved by 23% driving the increase in Interest Expense. Gains on Securities Trading added TT$27.8M, or 10% in FY 2021, with JMMBGL’s Investment Securities portfolio growing by TT$3.2B. Fees Earned from Managing Funds climbed by TT$23.4M (36.8% YoY) with Funds under Management totalling TT$7.0B at the end of FY 2021 relative to a $6.09B in FY 2020. Foreign Exchange Margins from Cambio Trading and Fees and Commission Income both fell a total $77.0M in FY 2021 partially offsetting improvements in the aforementioned components of Operating Revenue.

Investors eye Sagicor position

JMMBGL accounts for its associate company Sagicor Financial Company Limited (SFC) under the equity method of accounting. Accordingly, the rebound in SFC’s performance between the period April 2020 to March 2021 resulted in an increase in the accounting valuation of JMMBGL’s Interest in SFC. At the close of FY2021 JMMBGL’s Interest in Associate stood at TT$1.76B relative to a prior TT$1.58B. Notably, the Group’s ownership stake in SFC rose to 22.73% in FY 2021 from 22.52%, due to share repurchases undertaken by SFC. In terms of market valuation, as at March 31st SFC was quoted on the Toronto Stock Exchange at a price of CAD$5.75 equating to an indicative value of TT$1.02B. This represents an approximate 42% discount to the carrying value on JMMBGL’s financial statements. Put differently, were JMMBGL to value SFC’s shares at its publicly-traded market value (as opposed SFC’s carrying value on JMMBGL’s financial statements), it would result in a decline of approximately TT$0.74B or 27% of JMMBGL’s shareholder equity.

Listing of Preference Shares

On the 19th of March, 2021 the Group issued 3,206,485,000 7.35% JMD fixed rate cumulative redeemable preference shares at a price of J$3.00 by public offering to JMMB clients. A second tranche was also issued to the general public with 115,493,000 7.15% JMD fixed rate cumulative redeemable preference shares at a price of J$3.00. The preference shares carry a maturity date of 19th March, 2028. Notably, JMMBGL’s preference share offering undertaken in Jamaica was oversubscribed, with subscriptions totalling J$9.97B (TT$449.6M) relative to a minimum of J$6B (TT$271M) initially sought.

The Bourse View

At a current price of $1.76, JMMBGL trades at a price to earnings ratio of 10.2 times relative to a sector average of 10.8 times. The stock currently has a trailing dividend yield of 0.6% relative to the Non-Banking Finance sector average of 1.0%. The continued stabilization of financial markets and the ongoing vaccination rollouts in the Caribbean are anticipated to benefit JMMBGL and associate company SFC over the medium-term. However, the lingering economic effects of the pandemic may affect the Group’s near-term growth momentum. In light of these factors, Bourse maintains a NEUTRAL rating on JMMBGL.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”