BOURSE SECURITIES LIMITED

16th December, 2019

Scotia, Agostini’s Advance

This week, we at Bourse review the financial performance of Scotiabank Trinidad and Tobago Limited (SBTT) for its financial year ended 31st October 2019 and Agostini’s Limited (AGL) for its financial year ended 30th September 2019. SBTT would have advanced on account of lower a provision for taxation, while AGL’s profitability improved through effective cost management.

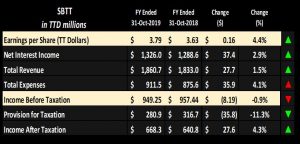

Scotiabank Trinidad and Tobago Limited (SBTT) recorded an Earnings per Share (EPS) of $3.79 over the course of its 2019 financial year, a 4.4% year-on-year (YoY) increase from the EPS of $3.63 reported in the prior comparable period.

SBTT was able to generate a 2.9% YoY increase in Net Interest Income in FY 2019, moving to $1.32B from $1.29B recorded in FY 2018. Other Income declined 1.8% or $9.8M YoY, amounting to $534.7M for the period. Total Revenue improved marginally (up 1.5%) from $1.83B to $1.86B. Net Impairment Loss on Financial Assets would have increased by $5.8M or 4.2% YoY while Non-Interest Expense increased by $30.2M or 4.1% YoY. Both these factors contributed to a 4.1% YoY increase in Total Expenses, which stood at $911.5M. Income before Taxation experienced a marginal decline generating $949.3M, 0.9% lower than the $957.4M recorded in FY 2018. Overall, SBTT generated Income After Taxation of $668.3M a 4.3% YoY improvement from the $640.8M recorded in FY 2018.

Outlook

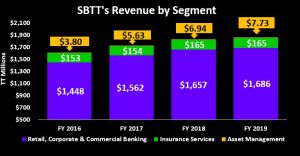

Approximately 90% of Scotiabank’s Total Revenue stream is attributed to Retail, Corporate and Commercial Banking, which grew from $1.45B in FY 2016 to $1.69B in FY 2019 or a Compounded Annual Growth Rate(CAGR) of 5.2%. Insurance Services and Asset Management round up the Group’s operations contributing 8.9% and 0.42% to Total Revenue respectively.

On 27th November 2018, SBTT announced an agreement to sell its insurance operations (ScotiaLife Trinidad and Tobago Limited) to Sagicor Financial Corporation (SFC), subject to regulatory approval and the close of the Alignvest Acquisition II Corporation’s acquisition of SFC. As at November 2019; both remain parties to the share purchase agreement established, in which Sagicor agreed to establish a 20-year distribution agreement for insurance products and solutions in T&T and acquire all outstanding shares of ScotiaLife Trinidad and Tobago Limited. The agreement is expected to be completed in 2020.

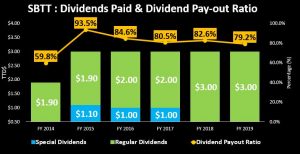

SBTT’s dividend history can be described as one of stability. Dividends have been supported by consistent earnings growth and an above-average Dividend Pay-out ratio, ranging between 79-94% over the past 5 years.

With changes to SBTT’s earnings capacity arising from the eventual sale of its insurance operations, it remains to be seen what (if any) effect this could have on future dividends. Investors might also consider the possibility of a special dividend, which could be paid from proceeds of the sale of ScotiaLife Trinidad & Tobago.

The Bourse View

SBTT currently trades at a price of $60.00 and maintains a Trailing Price to Earnings Ratio of 15.8 times, greater than the Banking sector’s average of 14.8 times. The stock also offers a Trailing Dividend Yield of 5.0%, above the sector’s average of 3.9%. On the basis of a relatively attractive dividend yield, but tempered by above-average valuations and slowing revenue growth, Bourse maintains a NEUTRAL rating on SBTT.

Agostini’s Limited

Agostini’s Limited (AGL) recorded Earnings per Share (EPS) of $1.76 for the year ended 30th September, 2019, a 6.0% improvement from the EPS of $1.66 in the prior comparable period.

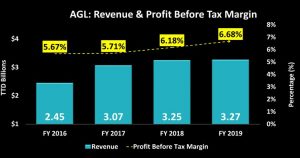

Revenue increased marginally as it moved from a recorded $3.25B in FY 2018 to $3.27B in FY 2019. Operating Profit recorded a fairly significant improvement of 13.0% YoY to stand at $246.6M. Profit Before Tax was up 8.8%, moving from $200.9M in FY 2018 to $218.6M in FY 2019. Overall, AGL generated Profit for the Period of $162.9M, a YoY increase of 12.0%, while its Profit Attributable to Shareholders improved 6.37% YoY moving to $ 122.0M in FY 2019.

Outlook

AGL’s revenue increase was driven by growth in its Fast Moving Consumer Goods segment and Industrial, Construction and Holding segment which improved 0.80% and 4.65% YoY respectively. This was slightly offset by a marginal decline in its Pharmaceutical and Personal Care Distribution segment. Agostini was able to report an 8.82% YoY improvement to its Profit Before Tax, demonstrating the company’s commitment to cost containment and operational efficiency. Over the past 4-years AGL has been able to consistently improve its Profit Before Tax Margin moving from 5.67% in FY 2016 to 6.68% in FY 2019.

The Bourse View

At a current price of $24.00, AGL trades at a trailing Price to Earnings ratio of 13.6 times, below the Trading sector’s average of 15.9 times. The stock also offers a trailing dividend yield of 3.3%, above the sector’s average of 3.0%. On the basis of relatively attractive valuations, but tempered by the ongoing challenging economic environment in relation to its business segments, Bourse maintains a NEUTRAL rating on AGL.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”