BOURSE SECURITIES LIMITED

27th April 2020

Oil Crumbles, Growth Stalls

This week, we at Bourse take a closer look at the violent swings in oil prices resulting from COVID-19, culminating in a historical decline to negative territory. We consider the impact of this most recent oil price capitulation on several emerging economies, discuss the various considerations of the global pandemic on the Caribbean economy and provide a brief outlook.

Oil Prices Collapse

Oil prices have faced sustained headwinds since the start of the year, as demand for the commodity dried up with transportation grinding to a near-halt across most of the world. The Organization of Petroleum Exporting Countries (OPEC), in an attempt to offer some support to oil prices, hosted a meeting in March with members and allies aimed at reducing the supply of oil. The meeting proved futile, with Russia ‘walking out’ and Saudi Arabia reactively waging a price war by upping supply and undercutting prices, further complicating an already difficult situation. As the first quarter of 2020 came to an end, WTI and Brent recorded their worst quarter ever declining 69% and 66% respectively.

April brought renewed positive sentiment for investors as President Trump signalled that Russia and Saudi Arabia were close to ending their so-called price war, while market participants anticipated a supply cut by OPEC members. As OPEC members finally concluded an agreement on the 13th of April to cut production by 9.7M barrels per day in May and June, investors were left underwhelmed as demand concerns continued to spark pessimistic reactions.

WTI Prices Hit Historic Low

A number of factors combined on the 20th of April leading to a record breaking low for the price of WTI crude oil, which eventually closed the day at an unprecedented price of US$-37.63. In addition to sharply contracting demand, market ‘technicalities’ led to oil prices turning negative. Specifically, the expiry of WTI May Futures contracts would have left holders of these contracts having to receive physical crude oil. Delivery and storage of oil related to these contracts takes place at a single site, Cushing, Oklahoma. With storage at this location very near capacity, traders decided to hurriedly sell futures contracts as opposed to dealing with a logistical nightmare of receiving physical oil.

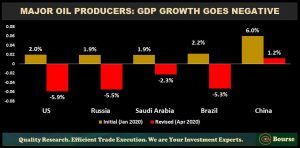

Major Oil Producing Nations Feel the Pinch

As global travel demand all but disappears and industrial hubs face severe alterations to operations, the demand for oil has trended sharply lower. OPEC now forecasts that average global demand for oil will stand at 92.8Mb/d at the end of 2020, a record-breaking projected decline of 6.9Mb/d from 99.7Mb/d demanded in 2019. With benchmark oil prices plunging and demand facing historic lows, oil producing economies are likely to face significant economic consequences.

Major oil producing nations will expectedly confront more difficult economic challenges, as lower oil prices and waning economic activity disrupt budgetary forecasts.

United States’ real GDP is forecasted to experience a severe contraction of 5.9% after recording a 2.3% growth in 2019. The energy sector, while not the primary driver of US economic growth, still plays an important role in employment and output. The Oil and Natural Gas Industry supports 9.8M jobs (5.6% of total US employment), as such, contractions in the industry will impact the US unemployment rate. US crude production forecasts in 2020 have been revised downwards by 0.85Mb/d to average 12.03Mb/d. This could be more pronounced, however, as lower prices force higher-cost shale producers in the US to shut down.

Russia’s crude oil production was roughly 10.60Mb/d throughout the first quarter of 2020. With the fluidity of the contagion and weakening demand throughout the world, the country’s economy is likely to face further oil production cuts. The original price to keep the economy’s budget balanced was $42/barrel. The International Monetary Fund (IMF) forecasts that Russia’s economy will shrink 5.5% in 2020. With oil and gas accounting for 70% of the country’s exports, prolonged low oil prices could mean a more severe economic contraction.

After recording 0.3% growth in 2019, Saudi Arabia’s economy is forecasted to contract by 2.3% in 2020. Oil demand in the Middle East was revised sharply downward due to lower economic activity, and is projected to fall by 0.48Mb/b in 2020. Saudi Arabia ramped up production in March 2020 to 10.06Mb/d (by 0.39Mb/d from February) despite weakening demand, sparking a price war with Russia after disagreements on production cuts. Oil revenue is expected to account for approximately 62% of the country’s total revenue. Like all oil-dependent economies, Saudi Arabia’s budget deficit is likely to widen materially.

The oil superpower of Latin America, Brazil’s economy is forecasted to contract 5.3% in 2020, after staggering out of a low growth pattern in 2019 with 1.1% GDP growth. Declining demand for oil continues to weigh on the country’s fiscal balance. Falling revenue from plummeting oil prices and reduction of taxes arising from quarantine restrictions leaves the Brazilian economy in a precarious position.

Despite China’s economy showing signs of an economic rebound in Q2 2020, its GDP is expected to grow by 1.2%, after lifting lockdown measures in early April. In February 2020, oil demand contracted by 3.2Mb/d. Chinese crude oil output fell by 38Kb/d to average 3.78Mb/d. As a result of the predetermined production target by the Chinese government to ensure the security of the energy supply, low oil prices will not translate into sharp production cuts in the short term. Should prices remain down for a prolonged period of time, major Chinese oil companies will bear the burden of lower revenue and reduce capital expenditure for the remainder of 2020. Domestic output in 2020-2021 could in turn be adversely impacted.

COVID-19 Impacts Caribbean Growth

At home, Trinidad and Tobago has been feeling the impact of COVID-19, particularly resulting from the drastic slashing of oil prices on account of the economy’s high dependence on the Energy Sector. On March 10th, Finance Minister Colm Imbert indicated that the crash in oil prices and lower projected natural gas revenue was expected to lead to a budget shortfall of an additional $3.5B, resulting in a cumulative budget deficit of more than $8.5B. In addition to this, the government announced its revised budgeted oil prices for the year from US$60 per barrel to US$40 per barrel.

One week later, the updated forecasted shortfall in revenue using the revised budgeted oil prices of US$40 per barrel for the remainder of 2020 in addition to a contraction of economic activities as a result of COVID-19, increased the shortfall to an estimated $5B. Currently, the unanticipated expenditure from measures implemented to cushion the adverse impact of the pandemic is $0.5B. Subsequently, the initial deficit of $5.3B combined with the additional shortfall and increased expenditure equates to a new fiscal deficit of roughly $10.8B.

Fast forward to present day, these updated figures have not yet taken into account the subsequent drastic fall in oil prices. This is expected to further widen the projected budget deficit and apply more downward pressure on projected oil revenues for the year.

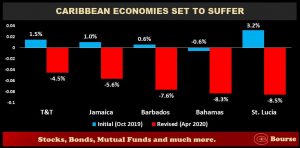

Regionally, the slowdown of the Tourism Industry and reduction in remittance inflows pose a significant threat to Caribbean economies. The World Bank has estimated that remittance flows to the Latin American and Caribbean region will fall by 19.3% in 2020, largely due to the declines in wages and employment of migrant workers abroad. As the effects of COVID-19 continue to rampage through global economies, the IMF has published updated 2020 GDP growth projections as at April 2020, with T&T’s economy forecasted to decline 4.5%, from an initial 1.5% growth projected in October 2019.

In Jamaica, the country has been impacted by the heavy blows to the Tourism industry (33.7% of its GDP) and disruptions to the inflow of remittances. Considering the significant effect of these factors, international credit rating agency S&P Global Ratings (S&P) has confirmed the B+ credit rating of Jamaica, while downgrading its outlook from stable to negative. The IMF has projected a 5.6% decline in GDP for the island for 2020, much lower than its growth of 1.0% forecasted earlier in October 2019.

With an economy also heavily dependent on its Tourism Industry, (41.2% of GDP) Barbados has also been seriously afflicted by the pandemic. The island is no stranger to the IMF, which has provided assistance over the past two years with the Barbados Economic Recovery and Transformation Programme (BERT) in an attempt to reduce its debt. In the IMF’s statement following its visit to Barbados earlier this year in February, it was noted that the country was on track to reach its 6% primary surplus goal for FY 2020. However, with the series of tumultuous COVID-19 events that have unfolded since then, Barbados’ economy will likely take a much longer time to regain its momentum. The IMF has revised Barbados’ GDP growth 2020 projection downward to -7.6%.

The Bahamas is still reeling from the massive negative economic impact of Hurricane Dorian, which affected the country late last year with estimated damages of US$3.4B (equivalent to 25% of its GDP). The already weakened economy now finds itself in another difficult situation at the hands of the temporary stoppage of the Tourism Industry, which accounts for 48.3% of its GDP. Consequently, the country was downgraded by the S&P from ‘BB’+ to ‘BB’ with a stable outlook, while the IMF has further decreased its GDP growth projection for 2020 to -8.30% from -0.56% in October 2019.

Real GDP growth for St. Lucia was boosted in 2019 due to strong growth in tourism activities according to the IMF. However, a significant slowdown in the tourism market (41% of its GDP) and slowed remittances will dampen St. Lucia’s growth prospects. The IMF forecasts a decline of 8.50% in GDP for 2020.

Out of the sixteen countries in the Americas requesting emergency assistance from the IMF, about 50% are from the Caribbean. At a press conference on April 17th, the organization announced that it has already approved loans for Caribbean countries and are examining further potential assistance.

Will local stocks be impacted?

Stunted growth for countries throughout the region will inevitably affect the profitability and operations of companies. On the Trinidad & Tobago Stock Exchange (TTSE), several stocks have regional exposure to some of the vulnerable countries listed above. Companies with the highest exposure include, but are not limited to:

- Republic Financial Holdings Limited (RFHL) in terms of Profit Before Tax holds a 66% weighing in T&T, roughly a 7% weighting in Barbados, Guyana and Cayman Islands and 5% in the Eastern Caribbean.

- Ansa McAl Limited (AMCL), with Third Party Revenue of 76% from T&T, 13% from Barbados and 11% from Eastern Caribbean.

- NCB Financial Group (NCBFG) with Operating Income of 75% from Jamaica.

- FirstCaribbean International Limited (FCI) with Revenue of 30.5% from Barbados, 22.3% from the Bahamas and 9% from the Eastern Caribbean.

- JMMB Group Limited (JMMBGL) which derives Net Profit of 83% from Jamaica and 13% from T&T.

- Agostini’s Limited (AGL) with Revenue exposure of 63% to T&T and 25% to Eastern Caribbean territories.

- Guardian Holdings Limited (GHL) with Revenue exposure of 55% in T&T and 19% in Jamaica.

- Massy Holdings Limited (MASSY) with Profit Before Tax exposure of 55% in T&T, 8% in Jamaica and 29% in Barbados & Eastern Caribbean territories.

For most Caribbean economies, a return to ‘normal’ may be farther into the future than initially expected. Even after travel restrictions are eased and a vaccine is developed, consumer concerns will likely lead to a slower recovery of tourist volumes and associated economic activity. Individuals, having faced reduced or lost income for even a short space of time, will likely adopt a more cautious approach to spending. Government finances and borrowing will also come under strain, which could take years to correct.

Ultimately, investors may have to become accustomed to a new normal, carefully reevaluating their investment portfolio on a more frequent basis as developments unfold.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”