BOURSE SECURITIES LIMITED

11th December, 2017

NCBFG in pursuit of GHL

This week, we at Bourse take a closer look at the offer and take-over bid by National Commercial Bank Financial Group Limited (NCBFG) to acquire a majority stake in Guardian Holdings Limited (GHL). We provide an update on details of the offer.

About the Offer

On December 8th 2017, NCBFG, through its wholly-owned subsidiary NCB Global Holdings Limited, announced an offer and take-over bid to all shareholders of GHL to acquire up to an additional 74,230,750 ordinary shares at an offer price of US$ 2.35 per share (TT$ 15.98). This represents approximately 32% of GHL’s total shares outstanding. The offer period commenced on December 8th 2017 and (unless extended) will close on January 12th 2018. The Offer is conditional on NCBFG acquiring control (50.01%) of GHL.

For the full Offer and Takeover Bid Circular, visit the www.remotestores.com

NCBFG’s pursuit of GHL

In November 2015, NCBFG (then NCBJ) entered into an agreement to purchase a 29.99% shareholding in GHL (69,547,241 shares). According to the take-over bid circular, NCBFG acquired entities which held shares from affiliates of Arthur Lok Jack, Imtiaz Ahamad and International Finance Corporation. According to a release by NCBFG in August 2016, the acquisition was completed at “a total price equivalent to JMD $28 billion”. This would imply a price of roughly TTD 20.81 per share (assuming separate transaction costs), a 30.2% premium to the current offered price of $15.98.

NCBFG is now seeking to take a majority stake in GHL, to create a diversified financial services conglomerate in the Caribbean. The collaboration between the two Groups is intended to allow customers to benefit from a broader range of services provided with increased efficiency. Additionally, NCBFG intends to identify further synergies between the two Groups.

Will the takeover bid succeed?

According to the circular, “Arthur Lok Jack, Imtiaz Ahamad and their respective holding companies agreed that they would tender their respective GHL Shares to NCBFG upon NCBFG making a tender to offer to all the GHL Shareholders.” Based on GHL’s 2016 annual report, the total estimated shareholding for parties subject to this agreement was approximately 21.8% or 50,618,643 Shares as at February 9th 2017. With NCBFG needing just 20.02% of the total outstanding shares of GHL, the takeover bid should be successful even without any shares from other shareholders.

Does the Offer represent value for all GHL shareholders?

According to the Offer and Take-Over Bid Circular, Ernst and Young Services Limited (EY) determined a fair market value of GHL between using several approaches. The ‘Income Approach’ was, in EY’s opinion, the most appropriate method to determine the fair value of GHL. This approach placed the value of GHL in the range of $16.99 to $19.51 per share. The closing price of GHL on Friday 8th December was $17.22.

Accordingly, the offer price of US$2.35 (TT$15.98 at prevailing exchange rates using TT$6.7993/US$1) is below the traded market price and EY’s suggested valuation of GHL.

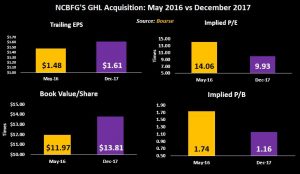

Taking another perspective, the initial $20.80 implied purchase price paid by NCBFG to acquire a 29.99% stake in GHL in May 2016, when compared to the trailing Earning Per Share (EPS) of GHL at that time, equated to an implied Price to Earnings (P/E) multiple of GHL of just over 14 times. The current offer price, however, using GHL’s most recent trailing EPS figure implies a lower P/E multiple of 9.9 times for this phase of share acquisition by NCBFG. From a price to book value (P/B) perspective, the P/B ratio based on the May 2016 implied purchase price was in the order of 1.74 times (based on GHL’s then per share book value of $11.97) . In contrast, the P/B ratio under the current offer terms is lower at 1.16 times.

A win-win outcome?

The maximum shareholding position taken by NCBFG, should the offer be fully/oversubscribed, would be 62% of all shares outstanding (inclusive of their previous acquisition of 29.99%). For illustration purpose, we look at two scenarios to get some perspective of the Offer, its pricing and implications for the range of GHL shareholders.

Scenario I: Shareholders accepting the Offer amount to 32.01%, giving NCBFG exactly 62% of the outstanding GHL shares. Recall our estimate that the selling parties involved in NCBFG’s May 2016 acquisition of 29.99% of GHL (the Tendering Shareholders) would have agreed to sell their remaining 21.8% stake in the subsequent (December 2017) offer to all shareholders. In this scenario, effectively 10.2% of other shareholders (Remaining Shareholders) would have to accept the Offer for it to be fully subscribed. In this scenario, the estimated average price received by the Tendering Shareholders for their entire stake would be in the order of TT$18.78. The Remaining Shareholders, on the other hand, would have to accept the equivalent of TT$15.98.

Scenario II: At the other extreme, Scenario II illustrates a situation in which all shareholders (Tendering Shareholders and Remaining Shareholders) tendered all of their shares for the Offer (constituting approximately 70.01% of the outstanding shares of GHL). In this instance, the Offeror – which is only seeking an additional 32.01% of the outstanding shares of GHL – would accept shareholders holdings on a pro-rata basis at a ratio of approximately 45.7%. Put differently, shareholders accepting the Offer under these conditions would successfully receive US$2.35 for approximately 45 of every 100 shares tendered.

With the Offer made public and a very high likelihood of a successful takeover bid, do all parties stand to benefit?

In the case of NCBFG, its current 29.99% stake, combined with its pre-arranged agreement for the tendering of shares with the Tendering Shareholders under an Offer of this nature, make the acquisition of a controlling interest (50.01% or more) reasonably assured.

In the case of the sellers of the initial 29.99% stake to NCBFG (the Tendering Shareholders), the implied purchase price of TT$20.80 (based on available information) in May 2016 would provide some comfort, having committed to tender their remaining stake at the current offer price of TT$15.98 equivalent. As mentioned above, the lowest weighted average price received by the Tendering Shareholders (based on the available information) would be in the order of TT$18.78 even though all of their shares tendered may NOT be accepted with a level of acceptances submitted by all shareholders exceeding the aggregate 62% cap as set out in the Offer.

For all other shareholders (the Remaining Shareholders), their choices include but are not necessarily limited to:

- Tender at the offer price of US$2.35 and receive US dollars,

- Sell into the open market should the GHL price on the stock exchange be better than the TT equivalent offer price. This will depend on demand/supply considerations.\

- Hold on to GHL shares with the expectation of improved performance and price

- Await the Director’s Circular from GHL’s Board of Directors, which should provide further guidance on the acceptability of the Offer. This should be provided not later than 21 days from the Offer date.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”