| HIGHLIGHTS NCBFG Q1 2021

|

NCBFG Profits Lower, Regulators Halt FCI Sale

This week, we review the performance of the Caribbean’s second largest indigenous banking group, NCB Financial Group Limited for its first quarter ended 31st December, 2020. Despite recording marginal growth in its operational income, increases across the Group’s non-interest expenses led to broadly lower profits for Q1 2021. We also examine the recent announcement of the dissolution of acquisition of FirstCaribbean International Limited (FCI) by GNB Financial Group Limited (GNB) and what it could mean for investors.

NCB Financial Group (NCBFG)

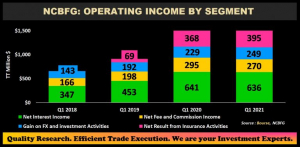

For the first quarter ended December 31st 2020 (Q1 2021), NCBFG reported an Earnings per Share (EPS) of TT$0.08, 32.5% lower than TT$0.11 in the previous period. Net Interest Income fell by 0.8%, from TT$640.6M to TT$635.5M, primarily driven by a 19.5% increase in Interest Expense relative to a 5.2% increase in Interest Income. Net Fee and Commission Income contracted 8.5%, from TT$295.0M to TT$270.0M in the current period. Gain on Foreign Exchange (FX) and Investment Activities improved 8.6% from TT$229.3M to a current TT$249.0M. Meanwhile, the Group recorded a 25.6% decline in Credit Impairment Losses, which amounted to TT$53.7M. Cumulatively, Net Result from Banking and Investment Activities inched 0.4% lower, to TT$1.159B in the current period. Net Result from Insurance Activities rose 7.3% from TT$368.2M to TT$395.2M. Overall, Net Operating Income marginally increased by 1.5% from TT$1.53B to TT$1.55B in the current period. Operating Expenses stood at TT$1.18B (9.5% higher) in Q1 2021 influenced by a 16% increase in staff expenses. Operating Profit contracted 17.3% to TT$378.2M relative to TT$457.5M in the previous period. Profit Before Tax amounted to TT$375.1M, down 16.3% from a previous TT$448.2M. Net Profit Attributable to Equity holders stood at TT$180.2M, 33.6% lower relative to a prior TT$271.5M.

Operating Income Marginally Higher

NCBFG reported a modest 1.5% YoY expansion in Net Operating Income for the period under review. Net Interest Income, 40.9% of Net Operating Income, marginally declined by 0.8%, influenced by an increase in Interest Expense, which more than offsets the growth in Interest Income. Notably, the Group’s loan portfolio grew 5.2% in the period relative to a 16.5% expansion in its Customer Deposits portfolio. Net Interest Income in NCBFG’s Treasury and Correspondent Banking operations declined by 32.0%.

Net Fee and Commission Income, 17.4% of Net Operating Income, contracted 8.5%, a consequence of lower transaction volumes in its Payment Services operations.

Gain on FX and Investment Activities, amounting to 16% of Net Operating Income, experienced the largest increase of 8.6%, owing to improving capital market conditions. Resultantly, NCBFG’s Wealth, Asset Management and Investment Banking operations recorded a 25.7% increase in Operating Profit.

Net Result from Insurance Activities, which accounted for 25.4% of Net Operating Income (TT$395.0M), expanded by 7.3% YoY, benefiting from an expansion of GHL’s operations primarily across its life, health and pension segment in addition to growth in its Dutch Caribbean operations. Resultantly, NCBFG was able to improve its Operating Profit generated by the Life and Health Insurance & Pension Fund Management and General Insurance segments, up 5.6% and 45.1% respectively.

The Bourse View

NCBFG is currently priced at $8.40 and trades at a Price to Earnings ratio of 25.1 times, above the Banking sector’s average of 21.9 times (excluding FCI). The Group made the decision to not declare an interim dividend payment in its latest earnings release. With its primary operating jurisdictions Jamaica (FY 2020: 39% of Revenue) and Trinidad and Tobago (FY 2020: 26% of Revenue) expected to at least partially recover in 2021, NCBFG could benefit from improving economic conditions. On the basis of recovering financial markets and growth stemming from the consolidation of GHL, but tempered by relatively high valuations and prevailing economic uncertainty, Bourse maintains a NEUTRAL rating on NCBFG.

FirstCaribbean International Limited (FCI)

Regulators Red-light CIBC/GNB Transaction

The proposed sale of CIBC’s stake in FCI to GNB, initially announced in November 2019, was rejected by regulators in February 2021, perhaps coming as a surprise to investors who were anticipating the approval of the transaction.

Canadian-based CIBC, which owns approximately 92% of FCI, announced that they would sell a 66.7% stake in FCI to GNB, a company domiciled in the Cayman Islands and ultimately part of the Gilinski Group of Companies, based in Colombia. The acquisition of the 66.7% stake was announced for a total consideration of US$797M, valuing FCI at approximately US$1.195B (TT$8.01B) or roughly TT$5.08 per share. The sale, if approved, would have triggered a take-over bid in Trinidad and Tobago and Barbados, from which GNB would have had to make an offer to also acquire shares from stockholders of the remaining 8.3% of FCI shares outside the control of CIBC. On a per share basis, FCI’s book value translates to approximately $4.20, roughly 21% lower than the per share consideration previously slated to be offered by GNB. FCI currently trades at a price of $7.00 and has a 12-month average price of $7.27.

Investors Impacted?

Prior the announcement of the sale, FCI traded at an average price of $9.15 in October 2019. Upon announcement, the price fell to $8.99 on November 8th 2019. Since then, FCI’s price has gradually declined to its current level of $7.00. The rejection of the sale of FCI to GNB is not anticipated to impact shareholders in the near-term, as operations of the regional banking giant remain largely unaffected. It remains to be seen whether parent company CIBC will go back to the market to attract potential alternative buyers and, if so, at what price under current conditions.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”