BOURSE SECURITIES LIMITED

29th July, 2019

NCBFG Flat, WCO Advances

This week, we at Bourse review the financial performance of National Commercial Bank Financial Group Limited (NCBFG) for the nine months ended June 30th 2019, and West Indian Tobacco Company Limited (WCO) for the half-year ended June 30th, 2019. NCBFG reported relatively muted performance as rising operational costs were tempered by one-off gains resulting from acquisition activity. On the other hand, improved manufacturing efficiency and product innovation would have driven WCO’s performance higher.

NCB Financial Group Limited (NCBFG)

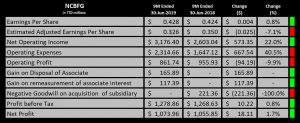

National Commercial Bank Financial Group Limited (NCBFG) reported Earnings per Share (EPS) of TT$0.43 for the nine-month period (9M) ended June 30th 2019, a marginal increase of 0.8% from the EPS of TT$0.42 recorded in the prior comparable period of 2018. Adjusting for several one-off items related to acquisitions and disposals of assets during the comparable reporting period, it is estimated that the Group’s adjusted EPS would have declined 7.1% year-on-year (YoY), from TT$0.35 to TT$0.33.

NCBFG’s Net Operating Income amounted to TT$3.18B, a 22.0% improvement YoY, driven by a TT$323.0M or 13.0% increase in Income from Banking and Investment Activities and a TT$250.3M or 218.2% increase in Income from Insurance Activities. The growth in Operating Income was offset, however, by a 40.5% uptick in Operating Expenses. Operating Profit ultimately declined 9.9% YoY, from TT$955.9M to TT$861.7M. During the period, the Group benefitted from a one-off gain of TT$117.4M on the re-measurement of its prior 29.9% non-controlling interest Guardian Holdings Limited. It would have also accounted for a gain of TT$165.9M related to the disposal of its 20% holdings in JMMB Group Limited, as well as Negative Goodwill of TT$221.36M (in 9M 2018) on the acquisition of its 50.1% interest in Clarien Group Limited. Profit before Tax (PBT) remained relatively flat (+0.8%) YoY at TT$1.28B. Taxation expense declined 3.7%, from TT$212.8M to TT$204.9M, with the Group’s Effective Tax rate falling from 16.8% to 16.0% YoY. Overall, the Group’s Net Profits experienced softer growth of 1.7% YoY, amounting to TT$1.07B as compared to TT$1.06B in the prior comparable period.

Outlook

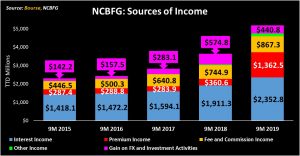

NCBFG has experienced consistent growth in Operating Income over the past five comparable periods. The Group’s focus in recent years has been inorganic expansion, through strategic acquisitions. The consolidation of Clarien Group Limited would have served to improve Interest Income from TT$1.59B in 9M 2017 to TT$2.35B in 9M 2019. This, along with Fee and Commission (up 16.4% YoY) would have experienced growth on account of the 14.0% expansion in Loans and Advances (Net of Credit Impairment Losses). Premium Income grew significantly, from TT$360.6M in 9M 2018 to TT$1.36B in 9M 2019 due to the consolidation of Guardian Holdings Limited during this reporting period. According to the Chairman, the Group would have also benefitted from improved spread performance from a Jamaican Life Insurance subsidiary which effected a change to its mortality assumption.

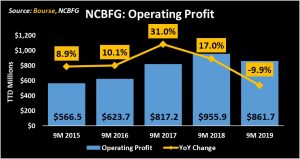

Operating Profit took a hit during the 9M 2019 period, falling 9.9% to a closing value of TT$861.7M, after recording steady improvements over the prior four comparable periods. The decline was attributable to a significant increase of 40.5% in Operating Expenses. Staff Costs and Other Operating Expenses climbed TT$255.8M (+30.7%) and TT$201.5M (+32.5%) respectively, while Impairment Losses on Loans and Securities more than doubled YoY, from TT$69.2M to TT$184.0M. The Group’s Operating Profit Margin declined from 36.7% in 9M 2018 to 27.1% in 9M 2019. Given NCBFG’s aggressive acquisition drive, future performance will be contingent the ability to manage operational costs while improving efficiency and promoting sustainable growth.

The Bourse View

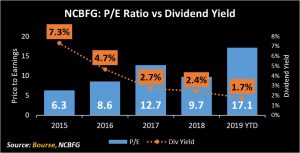

At a current price of TT$10.12, NCBFG trades at a trailing P/E of 17.1 times, above the Banking sector average of 16.7 times and its 3-year average P/E of 9.2 times. NCBFG offers investors a trailing dividend yield of 1.7%, below the Banking sector trailing dividend yield of 3.7%. On the basis of expansion and revenue growth through the acquisition of GHL, but tempered by margin compression, higher valuations and a relatively low dividend yield, Bourse maintains a NEUTRAL rating on NCBFG.

West Indian Tobacco Company Limited (WCO)

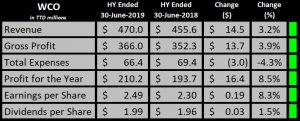

West Indian Tobacco Company Limited (WCO) reported Earnings per Share of $2.49 for the half year period ended 30th June 2019, an 8.26% increase from the prior comparable period. Revenue appreciated 3.2% to $470.01M while Cost of Sales experienced a marginal increase of 0.8% to $104.01M. Gross profit climbed 3.9% as a result, amounting to $365.99M, $13.86M higher than that of HY 2018. Total Expenses declined 4.3% or $3.0M for the period. Operating Profits advanced 5.9% to $299.56M. Profit before Taxation rose 6.1% to $300.93M, an increase of $17.20M YoY. Taxation expense remained relatively stable at $90.77M, while the Effective Tax Rate fell marginally from 31.7% to 30.2%. Overall, Profit after Tax stood at $210.16M, 8.5% ($16.44M) higher than the last comparable period.

Outlook

WCO reported revenue of $470M for HY 2019, representing a 3.2% top line growth over the prior comparable period. This comes despite the growing health concerns surrounding tobacco products lowering demand combined with the growth of the smoke-less tobacco industry distressing global sales for cigarettes. The group also continues to face competitive pressures in the domestic market from illicit cigarette trade activities. Nevertheless, the company credited the experienced growth to revised methods for improving manufacturing operation efficiency as well as continued efforts to maintain brand relevance through product innovations and marketing strategies.

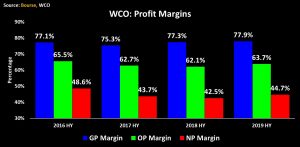

WCO has maintained its operating efficiency throughout the years, however, the previous two years have seen net profit margins diminishing due to increased taxation. Gross profit margin for the 2019 HY period improved marginally to 77.9%, regardless of a $0.78M increase in Cost of Sales. Net Profit margin rebounded after declining two consecutive years, standing at 44.7% for 2019 as compared to 42.5% in 2018. Operating Profit also saw advancements in 2019 rising to 63.7% from 62.1% in 2018.

The Bourse View

WCO trades at a current price of $110.25 and a trailing P/E of 22.05 times, lower than the Manufacturing 1 Sector average of 25.67 times (excluding GML) but higher than its five-year average P/E of 20.85 times. The dividend yield is 4.2%, above the sector average of 3.94%. Based on an attractive dividend yield and moderate improvements in profit margins, but tempered by relatively high valuations, Bourse maintains a NEUTRAL rating on WCO.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”