BOURSE SECURITIES LIMITED

11th May 2020

Mixed Fortunes for Bond Investors in 2020

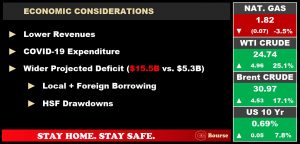

This week, we at Bourse review some significant developments in the Fixed Income environment year-to-date (YTD), with COVID-19 being a considerable influence on the market. Locally, conditions seem set to bring about increased borrowings as the T&T Government actively addresses the impact of the global pandemic. Internationally, deteriorating economic activity has resulted in a tectonic shift in investor risk perception, repricing most segments of US dollar bond markets. We discuss in more detail below.

Central Bank reacts to COVID-19

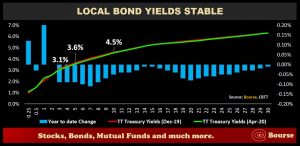

Similar to its international peers, the Monetary Policy Committee (MPC) of the Central Bank of Trinidad and Tobago (CBTT) held a special sitting on 17th March 2020, following the sovereign’s first COVID-19 case. For the first time since September 2018, the MPC lowered the repo rate by 1.5% to 3.5% (previously 5.0%). Subsequently, Commercial Banks’ prime lending rates fell from an average of 9.5% to 7.5%. The CBTT also moved to lower its Primary Reserve Requirement (PRR) for Commercial Banks from 17% to 14%, providing additional liquidity into the banking system. As at March 2020, Commercial Banks Average Excess Reserves stood at TT$4.6 billion, compared to February 2020 levels of $3.3 billion. Year to Date, the T&T TT Dollar Government Yield curve has remained fairly constant.

Local opportunities

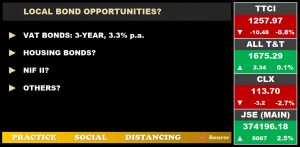

An estimated TT$15 billion government fiscal deficit significantly heightens the likelihood of increased bond issuance, in the absence of asset sales and even when considering an up to US$1.5bn drawdown from the Heritage and Stabilization Fund (HSF). Fixed Income investors would be hoping that such issuances would be made available for public participation.

Otherwise, the long-awaited Value Added Tax (VAT) Bonds as payment for VAT refunds are expected to be issued ‘imminently’. The Minister of Finance stated at a parliamentary meeting on February 28th 2020 that the bonds will be issued in three (3) tranches of $1B each. The bonds will mature three (3) years from the date of issue with a coupon of 3.3%. These bonds are transferable and can be bought and sold on the secondary market. The VAT Bonds would be issued to firms with more than TT$500,000.00 outstanding in VAT refunds.

The Federal Reserve flexes its muscle

In an unprecedented series of aggressive moves, the Federal Open Market Committee (FOMC) cut US interest rates twice in the month of March, its first emergency cut since the 2008 Financial Crisis. This about-turn of the Fed’s sentiment for 2020, which was to hold rates steady and achieve an inflation of 2%, was brought on by the “evolving risks” posed to the US economy by the coronavirus. The FOMC first cut rates by 50 basis points (0.5%), following an increase in the number of COVID-19 cases outside of mainland China. The second cut was a whopping 100 basis points (1%), on the heels of the declaration of COVID-19 as a global pandemic. The Fed rate currently stands at a range of 0-0.25%.

Closed borders and nationwide lockdowns have left millions unemployed as businesses close their doors to stem the spread of the highly contagious COVID-19. Following almost 11 years of growth, the US economy is near-certain to enter a recession, as the country grapples with the rapidly rising number of cases. In addition to interest rate cuts, the Fed announced various measures including (i) increasing liquidity to support smooth market function and (ii) the establishment of facilities to sustain the flow of credit to consumers and businesses, to combat the impact of the virus on the US economy.

US Treasury yields plunge

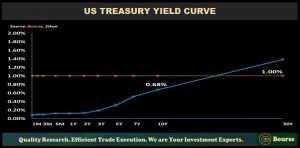

Investors have flocked to safe haven assets as the spread of COVID-19 grips the world. US Treasury yields plummeted to new lows, resulting in an inversion in US Treasury Yield Curve in March. US Treasury yields were further pressured by the emergency cuts by the Fed, driving the entire US Treasury Yield Curve below 1% for this first time ever.

As the coronavirus crisis heightened in the US, US financial markets experienced another first- negative yields. Short-term treasury yields fell into negative territory in March, with the 1-month Treasury yield and 3-month Treasury yield trading as low as -0.193% and -0.112% respectively. A bond with a negative yield means that investors would receive less funds on maturity. Essentially, investors lose money when investing in a negative yielding bond. While US Treasury yields have rebounded, most yields still remain below 1% and may stay at this level for some time.

Local and Regional Credit Ratings Impacted

The Covid-19 pandemic has contributed to an alteration of the credit rating and outlook for many sovereign and corporate debt issuers globally, with the Caribbean region being no exception. International credit rating agency S&P Global Ratings downgraded and changed the outlook of over 600 debt issuers as at 1st May 2020, with 42 of these changes being related to sovereign issuers.

Trinidad and Tobago’s (T&T) sovereign credit rating was downgraded from BBB to BBB- in March 2020, based on Covid- 19 pandemic and the impact of lower oil and gas revenue on the country’s debt levels. The outlook for the twin island state remained stable, reflecting the government’s access to liquid external assets that could be utilized to offset the shock on the economy from lower energy prices. Subsequent to the downgrade of the sovereign, firms with high exposure to T&T were not spared. The credit rating of the National Gas Company of Trinidad and Tobago (NGC), First Citizens Bank Limited, and Republic Financial Holdings Limited were downgraded from BBB to BBB-, while Trinidad Generation Unlimited (TRNGEN) fell out of the investment grade category being downgraded from BBB- to BB+.

Regionally, the credit rating of Jamaica was affirmed at B+, while the sovereign’s outlook by S&P was revised from stable to negative in April 2020. The change in outlook reflected the negative impact of the pandemic on the island’s tourism sector and tax revenue. The outlook of the National Commercial Bank Jamaica was also changed to negative.

Local and Regional USD Bond Yields Higher

Notwithstanding the cut in US interest rates, which (all else constant) supports higher bond prices, USD bond markets have fallen year-to-date (YTD). The increase in credit risk would have affected investor confidence, more than offsetting any potential benefit from lower benchmark rates. Investors are understandably demanding higher yields (returns) in the current environment of weaker economic activity and greater uncertainty.

For example, the yield on Trinidad & Tobago (TRITOB) 4.50% bonds due 2026 increased from 3.1% to 5.1% YTD. Trinidad Petroleum Holding Company Limited’s (TPHL) 9.75% bond due 2026 yield jumped to 11.5%, as compared to 6.9% at the start of the year. Trinidad Generation Unlimited (TRNGEN) 5.25% bond due 2027 yield increased to 8.1% from 4.1%, while the Telecommunication Service Company of Trinidad and Tobago’s (TSTT) US dollar bond due 2029, currently yield 10.8%, as compared to 8.5% at the beginning of the year. Sagicor Financial Corporation (SAGICOR) US dollar bond due 2022 offers investors a yield of 8.1%, as compared to a yield of 5.9% at the start of the year. The Jamaican sovereign bond due 2028 now offers investors a yield of 6.3% from 3.8%.

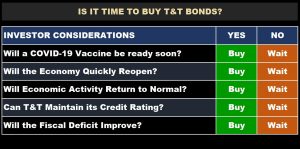

Is it time to buy bonds?

On the TT-Dollar front, investors remain relatively starved of attractive fixed income alternatives. With uncertainty abounding in T&T, there will be a natural preference for safer investments, including short-term solutions such as (i) Fixed NAV Mutual Funds and (ii) Repurchase Agreements, as well as longer-term investments like Government or Government-Guaranteed bonds.

When looking at USD bond markets, the outlook is less clear. With the exception of the United States, no country can ‘print’ US dollars to service foreign currency obligations. Investors considering participating in sovereign (country) USD bonds should consider factors such as international reserves and USD earning capacity among other factors. Similarly, investors looking at company or corporate bonds should consider the company’s financial strength, USD generating ability and current debt levels, among others. For state-owned companies (quasi-sovereign), it is always useful to consider the financial strength of the country standing behind the quasi-sovereign’s obligations.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”