BOURSE SECURITIES LIMITED

26th August, 2019

MASSY Improves, AMCL Stumbles

This week, we at Bourse take a look at the financial performance of two major conglomerates listed on the Trinidad and Tobago Stock Exchange, Massy Holdings Limited (MASSY) and Ansa McAl Limited (AMCL). Despite a decline in Revenue, MASSY’s overall performance improved due to cost containment and one-off gains from the divestment of its security business operations. Conversely, costs associated with AMCL’s acquisition and restructuring efforts would have offset the impact of its top line growth.

Massy Holdings Limited (MASSY)

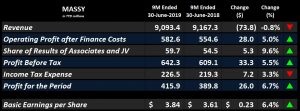

Massy Holdings Limited (MASSY) reported Basic Earnings per Share (EPS) of $3.84 for the nine-month period (9M) ended 30th June, 2019, a 6.4% improvement from the EPS of $3.61 reported in the prior comparable period.

Revenue generated for the 9M 2019 period fell marginally (-0.8%) year-on-year (YoY) to $9.09B, from $9.17B in 9M 2018. Nonetheless, Operating Profit after Finance Costs rose 5.0% or $28.0M YoY, from $554.6M to $582.6M. Additionally, Share of Results of Associates and Joint Ventures stood at $59.7M for the period, an increase of 9.6% or $5.3M YoY. Profit before Tax experienced a 5.5% improvement YoY, amounting to $642.3M, compared to $609.1M in 9M 2019. The Group’s Effective Tax Rate declined marginally from 36.0% in 9M 2018 to 35.3% in 9M 2019. Overall, Profit for the Period closed at $415.9M, up 6.7% from the $389.8M recorded in the prior 9M period of 2018.

Outlook

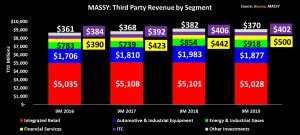

MASSY’s Third Party Revenue experienced a minimal 0.8% decline compared to the 9M 2018 comparable figure after recording moderate growth in the three previous 9M periods. The Automotive & Industrial Equipment business unit (BU) contributed the most to the YoY decline, falling 5.4% or $106.2M as slowing new vehicle sales in Trinidad and Tobago would have inhibited growth. This was closely followed by the Integrated Retail BU, which generated $73.7M less in Third-party Revenue YoY. On the other hand, despite lost revenue from the closure of the Petrotrin Refinery, the Energy and Industrial Gases BU has shown healthy growth of 7.5% YoY. The Financial Services BU has been the only unit to show consistent revenue improvement over the last four comparable periods, having grown 28.0% cumulatively but has, on average, accounted for less than 5% of total Third Party Revenue during the same period.

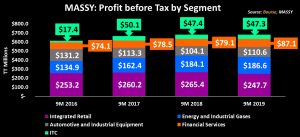

The Group would have seen a 6.7% decline in PBT from the Integrated Retail BU – from $265.4M to $247.7M – on account of the constrained economic conditions which persist, particularly in the Trinidad & Tobago and Barbados operations. Conversely, despite lower revenue generated, the Automotive & Industrial Equipment segment’s PBT climbed 6.3% YoY. According to the Chairman, the Energy and Industrial Gases BU would have incurred one-time severance charges related to Massy Energy Fabric Maintenance, limiting PBT growth to 1.4% YoY. This segment is likely to experience further improvements in growth upon the operationalization of the methanol and dimethyl ether plant in which MASSY has a 10% stake.

During the period, the Group would have divested its interest in G4S Holdings (Trinidad) Ltd., G4S Barbados and Massy Security Guyana, thereby exiting the security and guarding business altogether. The one-off gains resulting from these transactions would have been filtered into this period’s results.

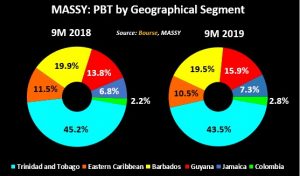

While subdued growth in the domestic and Barbados markets continue to impede profitability, the Group has begun to reap the benefits of its exposure to the Guyanese, Colombian and Jamaican markets. PBT generated from Colombia grew from $16.0M to $20.9M (+29.9% YoY). PBT from Guyana improved 15.8%, from $102.2M in 9M 2018 to $118.3M in 9M 2019 and now accounts for 15.9% of total PBT compared to 13.8% in the prior period. This exposure may bode well for MASSY’s future performance considering Guyana’s GDP growth projections of well over 20% between 2019 to 2021.

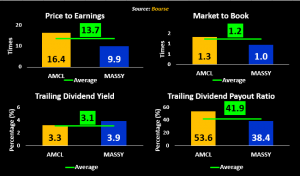

The Bourse View

At a current price of $54.95, MASSY’s share price has appreciated 16.9% YTD and trades at a trailing price to earnings ratio of 9.9 times, well below the Conglomerate sector average of 13.7 times. The stock offers investors a trailing dividend yield of 3.9%, also above the sector average of 3.1%. Given MASSY’s strategic expansion into growing markets, improvements in profitability and attractive valuations, Bourse maintains a BUY rating on MASSY.

Ansa McAl Limited (AMCL)

Ansa McAl Limited (AMCL) reported Earnings per Share (EPS) of $1.43 per share for the six-month period ended 30th June 2019, 11.2% lower than last period’s reported $1.61 per share.

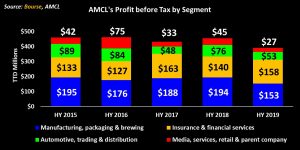

Revenue for the period edged marginally higher to $3.10B in HY 2019 as compared to $3.06B in HY 2018, representing a 1.3% or $40.9M YoY increase. Operating Profit decreased 14.5% or $67.6M YoY, amounting to $397.4M. Resultantly, Operating Profit Margin declined from 15.2% to 12.8% YoY. Profit before Tax for the Period therefore declined 13.9% or $63.2M to stand at $391.1M for the HY 2019 period. Taxation Expense fell 33.2% to $87.8M in HY 2019, $43.6M less than last period’s $131.4M. The Group’s Effective Tax rate also lowered from 22.4% as compared to 28.9% for HY 2018. Overall, Profit for the period stood at $303.4M, a 6.07% or $19.6M fall YoY from the $323.0M recorded in the prior comparable period.

Outlook

The Group’s main contributor to PBT for the HY period 2019, Insurance & Financial Services (40.5%), reported growth of 12.8% or $18.0M amounting to $158.3M. The Manufacturing, Packaging and Brewing Segment (39.1% of total PBT), historically the Group’s largest PBT contributor, reported PBT for the period of $152.9M, a significant 21.1% or $40.8M decline YoY. Likewise, PBT from the Automotive, Trading & Distribution segment fell a significant 30.0% or $22.7M to stand at $52.9M in HY 2019. PBT from this segment accounted for 13.5% of total. Finally, the Group’s Media, Services, Retail & Parent Company segment reported PBT of $27.0M for the HY 2019. This amount represents a sharp 39.7% or $17.8M fall YoY, accounting for 6.9% of Total PBT for the period.

During the period, AMCL would have completed two strategic acquisitions, the costs of which would have been included in the results, dampening profitability. The Group acquired a 94.17% stake in clay block manufacturer, Trinidad Aggregate Products for $53M, assuming operating control in Q1 2019. AMCL acquired a 50% interest in Tilawind S.A., a 21 megawatt wind farm in Costa Rica at a cost of $44M, which represents the Group’s entry into the alternative/renewable energy business. Performance for the period was also affected by the commissioning of a new furnace at Carib Glass ($150M) and program of restructuring which resulted in $25.0M of non-recurring costs. These initiatives are expected to better the position the Group for improved profitability and growth going forward.

The Bourse View

At a current price of $55.20, AMCL trades at a trailing P/E of 16.4 times, above the Conglomerate sector average of 13.7 times but below its three-year average of 17.2 times. The stock offers investors a trailing dividend yield of 3.3%, above the sector average of 3.1%. On the basis of muted profitability and relatively high valuations, but tempered by the possibility for improvements resulting from ongoing restructuring and acquisition activity, Bourse maintains a NEUTRAL rating on AMCL.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”