boursBOURSE SECURITIES LIMITED

October 10th, 2016

Making the most of your US dollars

This week, we at Bourse consider some of the options available to investors with access to US dollars. With the announcement of several new initiatives to raise revenue and/or curb expenditure in the FY2017 National Budget, it would seem that the TT dollar investment landscape is set to undergo some adjustment in the near term. Changes to taxation policies, lower government spending and other factors will increase economic uncertainty, which should filter into both local equity and bond markets. Investors with US dollars, then, may want to consider looking outward to generate positive returns and increase diversification away from the local economy.

A more investment-oriented approach (as opposed to a passive, savings approach of storing US dollars at the bank) could be better suited to achieving investors’ wealth objectives, tailored of course to their specific risk and return requirements.

A Broad USD Investment Selection

One of the most attractive features of investing in US dollars is the wide range of investment options, all available through local financial services providers.

For the conservative investor, US dollar money market funds are more rewarding alternatives to leaving cash in a savings account, without incurring any significant increase in risk. USD money market funds provide much of the safety and liquidity usually associated with depositing funds in the bank, while offering a higher return. The average interest rate on US savings accounts has stood around 0.10% for some time, while the returns on local USD money market-type funds are in the order of 1.00% to 1.25% per annum.

Investors willing to tolerate slightly more risk and with a longer time horizon may consider investing in US dollar denominated bonds. US dollar denominated bonds of investment grade or near-investment grade quality, with 5 to 7 years to maturity currently offer investors returns in excess of 4-5% per annum, well above the average returns of USD money market funds (1.05%) and commercial banks deposit accounts (0.10%). Investors who adopt a hold-to-maturity approach benefit from capital preservation, assuming the company’s credit quality is maintained.

Investors with even higher risk appetites may consider adding US dollar equities and/or equity mutual funds as part of a well-diversified investment portfolio. US dollar equity mutual funds, in particular, offer access to international equity markets which have broadly outperformed the local equity index in recent times. These instruments can potentially provide a higher return on your USD investments in the long run, compared to simply keeping USD in the bank. It should be noted however, that there is also the possibility that your investment could decline in value, should equity markets head lower.

International Market Performance

Equity Markets

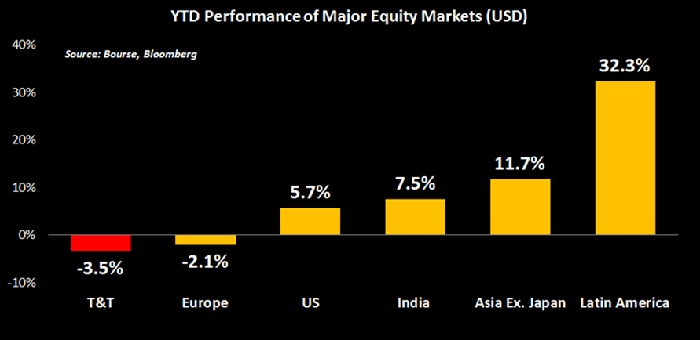

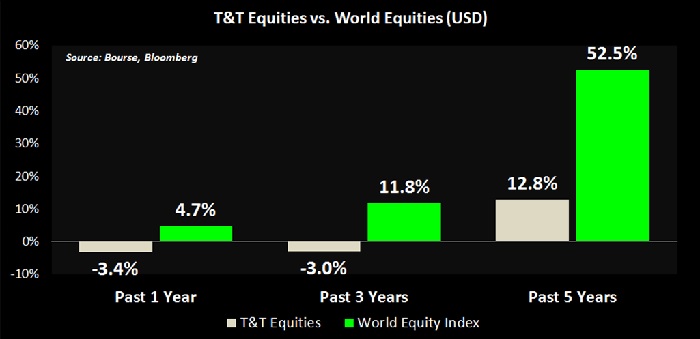

While TTD returns have been flat to negative in recent years, international market returns have been much more positive. Over the past 5 years, TTD equities appreciated 12.8% whereas an index of international equities advanced 52.5%. When looking to global equity markets, diversification remains a key component of investing discipline.

USD Bond Market Performance

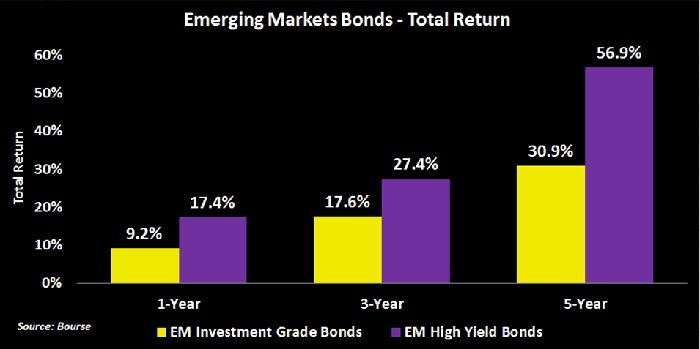

Following rounds of extraordinary stimulus measures by global central banks over the past several years, government bond yields across much of the developed world have fallen to near-record lows, with some negative territory. However, depending on an investor’s particular risk tolerance, opportunities are available to invest in either the investment grade or high-yield bond sub-asset classes. USD denominated bonds have emerged as one of the best-performing asset classes for 2016, with emerging market investment grade and high yield dollar-denominated bonds returning 9.2% and 17.4% respectively on a year-on-year.

Crafting a US dollar portfolio

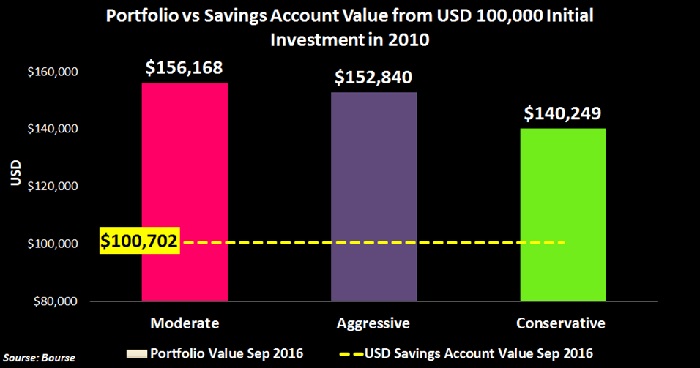

From a portfolio perspective, there is considerable flexibility in building a pool of investments which are best-suited to the individual investor’s risk profile. In almost all instances, a USD dollar portfolio, irrespective of risk tolerance, would have been a better option than leaving funds at the bank over the past 5 years.

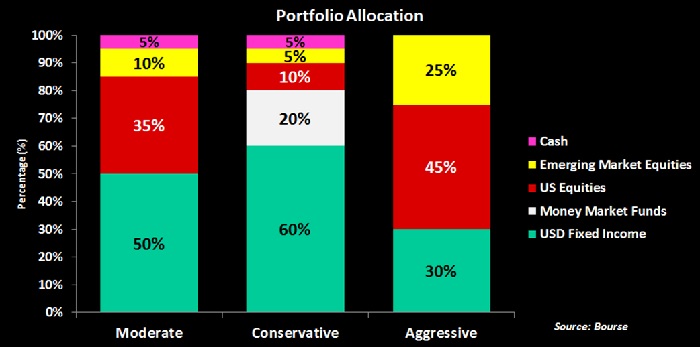

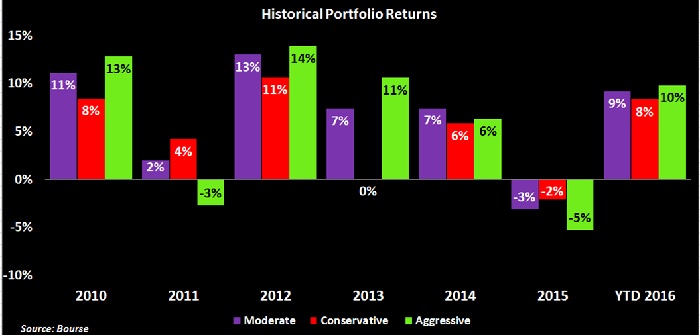

The Conservative Portfolio

Investors adopting a Conservative model portfolio -consisting of 60% USD Fixed Income Securities, 20% Money Market funds, 10% US equities, 5% Emerging Market Equities, and 5% in cash- would have benefited from a portfolio return approximately 8.3% 2016 year-to-date and a total return of 35% from the beginning of 2010 to the end of September 2016. The Conservative portfolio’s weighting to less risky assets such as bonds and money market funds act as an insulator in periods of turbulent global equity market performance. Put differently, an investment of US$100,000 in the conservative portfolio at the start of 2010 would now be worth approximately US$140,249. This compares favourably to the passive savings approach, in which the same US$100,000 would be worth just US$100,701.

Historically, the conservative portfolio outperformed the aggressive and moderate portfolios when equity markets underperformed in 2011 and 2015.

The Moderate Portfolio

The Moderate portfolio has returned 9.2% YTD through its 50% allocation in US Fixed Income Securities, its 35% investment in US Equities, its 10% in Emerging Market Equities and its 5% allocation in cash. Outperforming the Conservative portfolio while modestly underperforming the Aggressive portfolio YTD, the moderate investor has benefited from a healthy weighting to USD-denominated bonds and US equities which performed well over the period. An investment of US$100,000 in a moderate portfolio at the start of 2010 would now be worth approximately US$156,168 or a total return of 56.2%.

The Aggressive Portfolio

Investors taking a bullish stance regarding equity instruments who have adopted a portfolio consisting of 45% US equities, 25% Emerging Market Equities, and 30% US Emerging Market Fixed Income instruments, would have seen portfolio returns to the tune of 9.8% YTD. The Aggressive portfolio’s higher weighting to riskier equity securities would have contributed to higher returns relative to the other two portfolios in periods of equity market outperformance. In times when both bond and equity markets have posted negative returns, as per 2014 and 2011, this portfolio posted the least favourable returns of all risk profiles. An investment of US$100,000 in a moderate portfolio at the start of 2010 would now be worth approximately US$152,840 or a total return of 52.8%

Diversification remains key

Regardless of an investor’s risk profile, the principle of diversification remains a critical component of successful portfolios. There are several routes investors can take in generating higher returns on their USD assets in keeping with Bourse’s investment themes, including

- Targeting positive inflation-adjusted returns

- Lengthening the investment horizon

- Diversifying across currencies

- Diversifying across asset classes

- Diversifying across geographical regions

The benefits of making US dollar holdings earn more for an investor is magnified in the current environment of declining GDP growth, rising inflation and other economic uncertainties in the Trinidad & Tobago markets

As always, investors should consult with an experienced investment advisor, like Bourse, to help make investment decision best-suited to their particular needs and objectives.

For the detailed report and access to our previous articles, please visit our website at: https://bourseinvestment.com

For more information on these and other investment themes, please contact Bourse Securities Limited, at 628-9100 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”