BOURSE SECURITIES LIMITED

1st May 2017

The Impact of the T&T Downgrade

This week, we at Bourse take a closer look at the recent rating downgrades on both Trinidad and Tobago (T&T) and its domestic quasi-sovereign companies. We assess the impact of these downgrades on the sovereign and evaluate possible implications and opportunities presented to investors.

Moody’s, S&P downgrade T&T

Within the space of one week, T&T together with its quasi-sovereign entities had their international credit ratings lowered by rating agencies Standard and Poor’s – S&P (April 21st 2017) and Moody’s Investor services – Moody’s (April 24th 2017). This was also the case for its quasi-sovereign entities – the National Gas Company of Trinidad and Tobago (NGC) and Trinidad Generation Unlimited (TGU)

In the wake of an economic contraction and rising debt levels, S&P downgraded T&T’s rating from ‘A-’ (which represents a “strong capacity to meet financial commitments”) to ‘BBB+’ (defined as an “adequate capacity to meet financial obligations”). Following suit, NGC’s rating was subsequently lowered from ‘BBB+’ to ‘BBB’, TGU was downgraded from ‘BBB’ to ‘BBB-’ and Petrotrin’s rating was affirmed at ‘BB’. A stable outlook was assigned to all issuers.

A more impactful adjustment followed from Moody’s, as the rating agency downgraded T&T from its assigned lowest level of investment grade (Baa3) to the speculative grade rating ‘Ba1’. While investment grade rated issuers are deemed to possess low/moderate credit risks, speculative grade issuers are judged to offer higher credit risks.

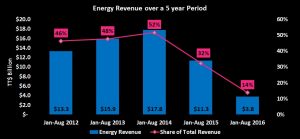

The driving factors behind the downgrades included a contraction in the energy sector and its subsequent impact on the country’s Gross Domestic Product (GDP) and debt burden. The combination of a domestic decline in crude oil and natural gas production was coupled with a precipitous fall in energy prices. This caused T&T’s taxation Energy Revenues to fall by 78% from TT$17.8 billion over the period January-August 2014 to TT$ 3.8 billion over the same period in 2016.

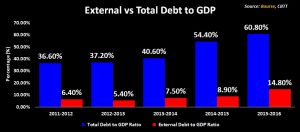

A significant decline in GDP combined with additional borrowings resulted in a rise in the country’s debt ratios. Total Debt to GDP rose from 36.6% in fiscal 2011-2012 to 60.8% in fiscal 2015-2016. External Debt to GDP increased from 6.40% to 14.8% over the same period. Moody’s now expects the country’s debt ratio to climb to nearly 70% of GDP by 2019. The realization of Moody’s forecast would exceed the limit of 65% targeted by the Honourable Minister of Finance as noted in the 2017/2018 budget presentation.

Rising Borrowing Costs for the Country

The direct impact of a rating downgrade on T&T is a likely increase in its international cost of borrowing. As an issuer becomes riskier, investors demand a higher additional yield above risk free bonds (US Treasuries) to hold the issuer’s bonds. This has been observed in the case of T&T, as the extra yield demanded by investors to hold T&T US dollar denominated increased following the downgrades.

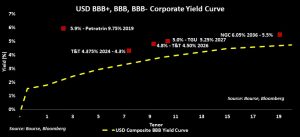

For example, investors now require a spread/extra yield of 300 basis points (3.0%) above US Treasury bonds on the NGC’s 6.05% bonds due in 2036 (BBB). This is contrast to the spread of 160 basis points (1.60%) which was demanded when the bond was first issued with a rating of BBB+.

The sovereign’s last issue – T&T 4.5% bond due 2026 – was oversubscribed by 3.5 times. Should the country’s debt metrics continue to weaken, sovereign issues may have to offer higher yields to attract investors. This translates into a higher cost of borrowing.

Investor Implications

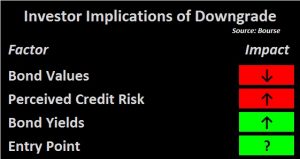

Though the recent downgrades are likely to have a limited impact on the Government’s local bond issues, there are both negative and positive impacts for investors holding T&T US dollar denominated bonds.

Investors holding T&T sovereign bonds are likely to face a downward adjustment in the values of their holdings, given the inverse relationship between bond prices and yields. That is, as bond yields increase, prices decrease, all other things being equal. However, we reiterate the benefits of adopting a hold-to-maturity approach.

Holding other factors constant, investors who adopt a hold-to-maturity approach will not be affected by volatility at a point in time in market prices. In other words, even though bond prices may go up or down, investors will continue to receive a fixed coupon and the face value at maturity. In contrast, investors who exit their positions prior to maturity will be subject to current market prices at the time of the sale. It should be noted, however, that investors holding to maturity should be reasonably confident that the bond issuer – in this case the GORTT – is able to make repayments of principal at maturity.

For investors who have been waiting for an opportunity to purchase T&T USD sovereign bonds, the rating downgrades may have a created an entry point. At this time, the resulting downward movement in bond prices has led to a rise in bond yields.

The graph below shows that T&T bonds are providing better returns when compared to similar rated issues. TGU’s 2027 bond now offers investors a yield to maturity (YTM) of 5% when compared to 3.8% offered by other BBB rated bonds. Similarly, investors can purchase T&T’s 2024 bond at a YTM of 4.3% when compared to the average YTM of 3.3% provided by similar rated bonds.

As with any other investment, investors should contact a trusted independent investment adviser, such as Bourse, before making an investment decision.

As with any other investment, investors should contact a trusted independent investment adviser, such as Bourse, before making an investment decision.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”