BOURSE SECURITIES LIMITED

14th August, 2017

GHL Spurs NCBFG Growth

This week, we at Bourse examine the six-month performance of Guardian Holdings Limited (GHL) and the nine months results of NCB Financial Group Limited (NCBFG). We look at factors contributing to the strong performance of both entities and provide a recommendation

Guardian Holdings Limited

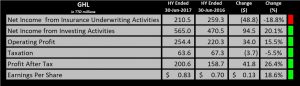

Guardian Holdings Limited (GHL) reported Earnings per Share (EPS) of $0.83 for the six month period ended June 2017, an 18.6% increase over its reported EPS for the comparable six-month period in 2016.

GHL’s Net Income from all activities grew 5.9% to $783.0M, mainly due to a $94.5M increase of Net Income from Investing activities. Operating Expenses rose $10.3M (2.2%) to $464.2M. Finance charges, on the other hand declined to $64.4M, a reduction of 1.47%. As a result, Operating Profit grew to $254.4M, an improvement of $34M (15.4%) from the prior period. Profit after Tax for the period advanced to $200.6M from $158.7M, an improvement of 26.4%.

Outlook

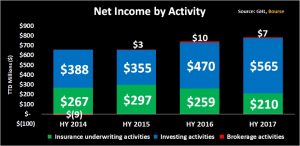

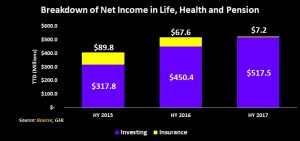

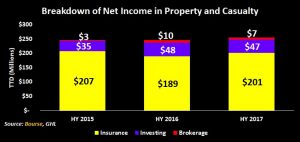

Net Income from Investing activities continues to play an increasingly important role as a proportion of GHL’s total Net Income, climbing from 60.0% of total Net Income in half-year 2014 to 72.2% in half-year 2017. Over the comparable six month period, Net Income from Investing acitivities grew 20.1%, primarily due to fair value gains. Conversely, Net Income from Insurance underwriting activities declined 18.9%, the second consecutive first-half period of declines in this segment since 2015. According to GHL, accounting changes which resulted in one-off gains in the 2016 H1 period did not recur, leading to a reduction in comparable period performance for Net Income from Insurance underwriting.

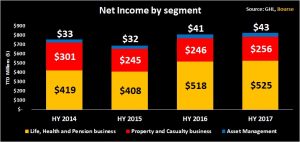

Total Net Income from all segments grew 2.2% (excluding ‘Other consolidating adjustments’) from half-year 2016 to the equivalent period in 2017.

The LHP segment continued to be the main contributor to overall income accounting for 63.8% of total Net Income at half-year 2017. Net Income from Asset Management improved $2.0M year-on-year to $43.0M and accounted for 5.2% of total Net Income. Given the declining contribution of Insurance underwriting to Net Income and the relatively small contribution of brokerage activities, it would appear that GHL’s performance is becoming increasingly reliant on Net Income from Investing activities, which may be subject to vagaries of financial markets.

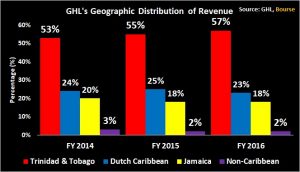

With respect to geographic diversification, over the last three years the Trinidad and Tobago market has accounted for a greater share of GHL’s revenue (57%). Notwithstanding the economic challenges in the territories GHL operates in, the firm’s focus on improvements in investing income has led to resilience in profitability. According to the Central Bank of Trinidad & Tobago, activity is expected to improve in Trinidad and Tobago during the second half of 2017. Jamaica’s economy, meanwhile, is projected to grow at a faster pace in 2017.

The Bourse View

At a current price of $16.50, GHL trades at a trailing P/E of 9.5 times, above its three-year average of 8.9 times. The current dividend yield is 4.06%, above the sector average of 3.49%. On the basis of a relatively attractive valuation, but tempered by continued challenges in its Insurance Underwriting activities, Bourse maintains a NEUTRAL rating on GHL.

NCB Financial Group Limited (NCBFG)

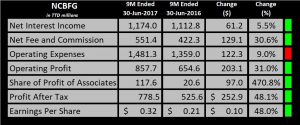

NCB Financial Group Limited (NCBFG) reported an EPS of TT$0.32 for the nine month period ended June 2017, an improvement of 48.0% when compared to the EPS of TT$0.21 reported in the equivalent period in 2016.

NCBFG’s Net Interest Income grew TT$1.17B at the end of the nine-month period, an increase of TT$61.2M (5.5%) over the corresponding period in 2016. Primarily due to higher revenues from Net fees and commission income and Gains on foreign currency and investment activities, Operating Income grew 16.2% to TT$2.3B. Operating Expenses rose TT$122.3M mainly on account of higher staff costs and other operating expenses. As a result, Operating Profit rose 31.0% to TT$857.7M. Share of Profit from associates increased $97M or 470.8%. This contributed to NCBFG’s Profit after Tax of TT$778.5M, a 48% increase compared to Profit after Tax of TT$525.6M reported in the prior period.

Outlook

Non-Interest Income has grown faster than Interest Income and currently accounts for a larger proportion of total Operating Income compared to the nine month period ended June 2014. Over the past four years, Non-Interest Income has grown from 42% of Total Operating Income in nine months 2014 to 50% in nine months in 2017. Net Fees and commissions has grown 31% year-on year and greater than any other income stream in the last four years. From the end of the third quarter 2014 to the equivalent period in 2017, Net Fees and Commissions increased 66% due to growth in NCBFG’s loan and unit trust portfolios. Gains on Investment activities and Other Income increased 22.0% year-on-year, a faster pace than Net Interest Income, which grew 5.5% year-on-year.

While Profit before Tax grew TT$300.0M, Share of Profit of Associates accounted for TT$96.99 or 32.3% of the increase. The growth in Share of Profits from Associates is primarily due to the inclusion of earnings from NCBFG’s acquisition of 29.99% of Guardian Holdings Limited (GHL), which was finalised in May 2016.

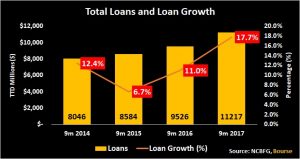

NCBFG has been succesful in expanding its loan portfolio and as a result been able to grow both interest and non interest income. Overall, loan growth has increased annually from the nine month period in 2014 to the same period in 2017. The growth in overall loans (year-on-year) was mainly attributable to 23% loan growth in NCBFG’s Retail Banking portfolio. NCBFG’s has been able to expand credit due to the turnaround in the Jamaican economy which has recorded nine consecutive quarters of economic expansion at the end of the first quarter of 2017. Besides growing its loan portfolio 17.7% year-on-year, NCBFG has also been able to reduce its non-performing loans as a percentage of total loans to 2.6% at the end of the third quarter 2017 from 4.8% in the same period in 2016.

The Bourse View

In Jamaica, NCBFG trades at a trailing P/E of 10.8 times, in line with other financial instituions such as JMMB Group Limited, Scotia Investments Jamaica Limited and Scotia Group Jamaica.

In Trinidad, at the current price of $4.20, the trailing P/E is 9.6 times, above its three year average of 7.5 times. The trailing dividend yield is 3.50%, in line with the market average of 3.62%. On the basis of fair valuations, Bourse maintains a NEUTRAL rating on NCBFG.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”