| HIGHLIGHTS FCI HY 2021 Earnings: Earnings Per Share improved $0.22 from a Loss Per Share of $0.25. Performance Drivers: Lower Revenue Reduced Credit Loss Expenses Absence of Impairment of Intangible Assets Outlook: Ongoing Vaccine Campaign Gradual Economic Normalization Rating: Maintained at NEUTRAL AGL HY 2021 Earnings: Earnings Per Share 8.5% higher from $0.94 to $1.02 Performance Drivers: Cost Containment Initiatives Outlook: Pandemic Induced Demand Growth from Acquisition Lingering Economic Challenges Rating: Maintained at NEUTRAL |

FirstCaribbean, Agostini’s Earnings Up

This week we at Bourse review the performance of FirstCaribbean International Limited (FCI) for the half year period ended, 30th April 2021 and Agostini’s Limited (AGL) for the half year ended 31st March, 2021. FCI reported an improvement in its performance on account of lower Credit Loss Expenses and the absence of Impairment Costs, despite revenue challenges. AGL recorded lower Revenue on account of normalized demand for its product offerings relative to HY 2020, while the continuation of cost management initiatives spurred improved performance. Can the improvement continue for both entities? We discuss below.

FirstCaribbean International Bank Limited (FCI)

FirstCaribbean International Bank Limited (FCI) reported Earnings per Share (EPS) of TT$0.22 for the six-month period ended April 30th 2021 (HY 2021), 189.2% higher than a Loss per Share of TT$0.25 in HY 2020. Total Revenue for the period contracted by 9.7% to $1.82B from a prior $2.02B. Similarly, FCI’s Operating Expenses declined by 1.8% from $1.38B to $1.35B in HY 2021. Credit Loss Expenses on Financial Assets amounted to $84.4M, 88.2% lower than $711.2M in the previous comparable period. Income before Tax (HY 2021: $386.3M) swung from a Loss Before Tax of $409.3M in HY 2020. An Income Tax Expense of $27.7M was recorded relative to a prior Credit of $18.9M. Net Income for the Period stood at $358.6M relative to a Net Loss of $390.4M in HY 2020. Similarly, Net Income attributable to Equity Holders of the parent improved 188.5% to $346.4M.

Segment Performance Mixed

Notwithstanding a 9.7% decline in Total Revenue, FCI’s PBT expanded by 194.4% during the period primarily owing to the absence of Impairment Costs and reduced Credit Loss Expense on Financial Assets. FCI’s Corporate and Investment Banking (CIB) segment reported for a Profit Before Tax of $371.2M, 80% higher YoY. Retail, Business and International Banking (RBB) recorded a Loss Before Tax of $26.3M in HY 2021, a recovery from a Loss of $$183.4M in the prior comparable period. Notably, both segments continued to be affected by the economic impact of the pandemic. Resultantly, Total Revenue generated by both segments fell to a cumulative $230.7M in HY 2021, 13% lower than HY 2020. However, with Credit Loss Expense on Financial Assets reported by both segments declining to $13.5M from a previous $90.5M, the Group recorded a relative improvement to its pre-tax profits. Wealth Management (WM) was the only segment to record a decline in performance with a Loss Before Tax of $5.1M in HY 2021 relative to an Income Before Tax of $82.9M in the previous period. The decline in this segment was primarily attributable to a decrease in its Total Revenue which was down 31% YoY, relative to attributable costs which remained relatively flat 4% lower YoY.

COVID-19 Impact Persists

FCI’s operations remain primarily based in tourist dependent islands, with Barbados being its largest jurisdiction accounting for 28% of revenue, while Bahamas comprises 25%, the Cayman Islands, Eastern Caribbean and Jamaica contribute a collective 32%. Thus far, Barbados has administered at least 145,964 does of the COVID vaccine so far, assuming 2 doses this equates to approximately 25.4% of the country’s population (287,025). The vaccine rollout in Bahamas has been relatively slower with at least 62,183 doses thus far equating to about 8% of the country’s population (389,482) assuming two doses. As the vaccine rollout continues globally and regionally the prospects for economic recovery particularly in that of tourist dependent Caribbean countries should continue to improve.

The Bourse View

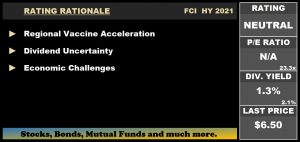

FCI is currently priced at $6.50 and trades at a market to book ratio of 1.5 times relative to a sector average of 2.1 times. The Group has not declared an interim dividend for three consecutive quarters. The stock currently has a trailing dividend yield of 1.3% (compared to a 5-year average dividend yield of 3.6%, excluding special dividends), below the sector average of 2.1%. With ongoing COVID-19 vaccine rollouts and the continued gravitation towards the new normal, improving economic conditions in the Group’s operating jurisdictions could provide continued recovery to FCI’s financial performance. On the basis of, ongoing vaccine campaigns, but tempered by dividend and economic uncertainty, Bourse maintains a NEUTRAL rating on FCI.

Agostini’s Limited

Agostini’s Limited (AGL) generated an Earnings Per Share of $1.02 for the six-month period ended the March 31st 2021 (HY 2021), 8.5% higher to $0.94 in the previous period. Revenue contracted by 5.1% to $1.76B from a previous $1.85B. Operating Profit improved 6.4% to $160.1M, compared to $150.5M in HY 2020. Finance Costs were $2.1M (11.8%) lower, at $15.7M in the current period. Profit Before Taxation rose 8.8% from $132.7M to $144.4M in HY 2021. Taxation Expense was $42.9M relative to the prior $39.3M. Profit Attributable to Owners of the Parent was at $70.6M, 8.8% higher than $64.9M reported in the prior period.

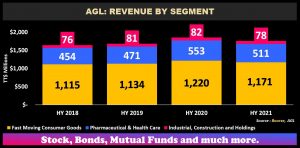

Revenues Lower

Revenue from Fast Moving Consumer Goods (FMCG), which accounted for 66.5% of AGL’s revenue in HY 2021, dipped 4.0%. Similarly, Pharmaceuticals and Health Care, 29.0% of the Group’s revenue contracted by 7.6%. Declines in both segment were attributable to receding pandemic-induced demand in HY2020, which did not reoccur in HY2021. Although the FMCG segments in Trinidad, Guyana and St. Vincent have shown improvements, markets in Barbados, St Lucia and Grenada continue to face challenges due to lower tourist arrivals. Additionally, lower demand for personal care and cosmetic products as a result of social distancing measures weighed on AGL’s pharmaceutical segment. Industrial, Construction and Holdings (HY 2021: 4.5% of Revenue) declined 4.2% as pandemic conditions continue to stifle industrial activities.

Margins Improve

Despite reporting a decline in Revenue, Operating Profit and Profit Before Tax have trended continuously upward a consequence of AGL’s commitment to improving operational efficiency and maintaining cost containment initiatives. Operating Profit Margin improved to 9.1% in HY 2021 from 8.1% in HY 2020, reflecting the Group’s continued efforts to improve its operations, with cost management initiatives. Profit Before Tax Margin also moved to 8.2%, in comparison to a prior 7.2%.

Acquisitions

Following its announced acquisition of T&T pharmaceutical rivals Oscar Francois Ltd and Intersol Ltd, on June 1st 2021, AGL announced its intention to acquire 100% of energy equipment supplier, Process Components Limited through its subsidiary Rosco Petroavance. The move is likely aimed at serving the growing regional demands for energy equipment supplies driven by oil discoveries in Guyana and Suriname. The construction of 12 warehouse/retail units and development of adjoining “lay down yards” in Guyana, set to be completed by April and September 2021, respectively, could potentially generate rental revenue and further improve the Group’s margins.

The Bourse View

AGL is priced at $24.50 and currently trades at a Price to Earnings Ratio of 12.8 times, in comparison to the Trading sector average of 8.7 times. AGL currently offers shareholders a trailing dividend yield of 3.3%, relative to a sector average of 3.2%. AGL declared an interim dividend of $0.25 per share, in line with its 2020 amount, payable on June 21st 2021. With the pandemic impacting AGL’s core operating jurisdiction of Trinidad and Tobago, demand for cleaning products and pharmaceuticals is likely to persist. The Group’s ongoing acquisition initiatives are anticipated to capture both existing markets (in the Pharmaceuticals segment) and regional energy market growth. On the basis of, acquisition activities and improving margins but tempered by prevailing economic challenges, Bourse maintains a NEUTRAL rating on AGL.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”