BOURSE SECURITIES LIMITED

13th February, 2017

FIRST, MASSY Performance Stable

This week, we at Bourse review the first quarter results for the period ending December 2016 of Massy Holdings Limited (MASSY) and First Citizens Bank Limited (FIRST). We take a closer look at the drivers of each company’s performance and provide an outlook on various factors which are likely to contribute to performance in the near term.

Massy Holdings Limited (MASSY)

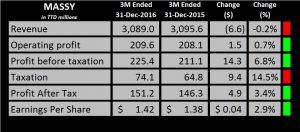

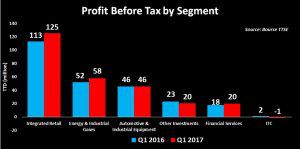

MASSY reported Earnings per Share (EPS) of $1.42, an improvement of 2.9% when compared to the EPS of $1.38 earned in the prior year. MASSY’s revenue remained relatively flat, moving from $3,095.5M to $3,089M. Despite the falloff in revenue, operating profit marginally improved by $1.5M (0.7%). After experiencing losses from the impairment of its ownership in a Costa Rican I.T. company, Share of results of associates increased by $12.8M (429%). As a result, Profit before Tax moved up by 6.8% ($14.3M). MASSY’s main segment, Integrated Retail, delivered a 10.9% increase in Profit before Tax over the comparable periods. Additionally, its Financial Services and Energy segments also improved by 12.8% and 10.9% respectively. The Automotive segment stabilized, whilst the ITC segment negatively impacted earnings. This was due to its IPTV business, which is still in its start-up stage. Overall, profit for the period improved from $146.3M to $151.2M, up $4.9M (3.4%).

Outlook

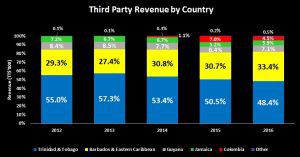

While the Trinidad and Tobago market accounts for the majority of the MASSY’s revenue by geography, exposure to the domestic market has been on a downward trend (55% in 2012 compared to 48.4% in 2016). This is consistent with MASSY’s objective to continue diversification by expanding throughout the region. MASSY’s announcement of its acquisition of another car dealership in Colombia, taking its total exposure to the Latin American country to 5% (compared to 0% in 2012), is another step in direction of currency and geographic diversification. The exposure to the Trinidad and Tobago economy could pose some challenges to corporate performance particularly with respect to higher corporate taxation of 30% (previously 25%), which will likely impact earnings from Q2 2017 going forward .

The Bourse View

At a current price of $52.00, MASSY trades at a reported trailing P/E of 10.1 times, which is lower than the only other locally competing conglomerate, AMCL, which trades at 14.8 times. Adjusting for one-off costs in the last fiscal year, MASSY’s P/E would be in the range of 8.9 times. The firm pays a trailing dividend yield of 4%, above the Conglomerate sector average of 2.7%. On the basis of performance stabilisation and relatively attractive valuations, but tempered by ongoing challenging economic conditions on its main market, Bourse maintains a NEUTRAL rating on MASSY.

First Citizens Bank Limited (FIRST)

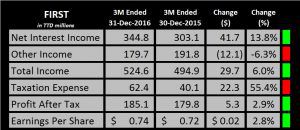

FIRST generated Earnings per Share of $0.74 for the first fiscal quarter of 2017, up 2.7% when compared to the prior period of $0.72.

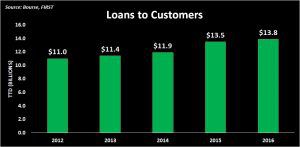

Net interest income improved by 13.7% ($41.7M) year-on-year, from $303.1M to $344.8M, benefitting from an increase in investments and loans to customers by 21% ($15.3B) and 2.67% ($13.8B) respectively, when compared to the period ending December 31st 2015. Other income declined by 6.29%, resulting in an increase in total net income to $524.6M.

Impairment expenses increased by 5.27%, while non-interest expenses remained relatively unchanged at $251M when compared to the previous period. As a result, operating profit increased by 13.1% ($28.2M). This was offset by a decline in share of profits of associates $0.6M or 11%, as well as a higher taxation expense of $62M. This tax expense represents an increase of 55% when compared to the previous year, with the effective rate jumping from 18.1% to 25.2%. Consequently, profit after taxation improved after taxation improved by 3%, moving from $179.8M to $185.1M.

Outlook

FIRST will continue to experience some headwinds, given the slowdown in economic activity in its main market, Trinidad and Tobago. Loan growth remains tepid at 2.67% year-on-year. Over the past 5 years, FIRST has encountered mixed performances in growing its loans to customers, which may be a continuing trend in a muted economic environment. The upward trend in loan impairment is expected to continue, should loan quality decline as recessionary conditions persist. Corporate taxation increases, as with most other companies, will likely impact after-tax profits.

The Bourse View

At a current price of $32.50, FIRST trades at a trailing P/E of 12.8 times and pays a trailing dividend yield of 4.1%.

Since listing on the TTSE, FIRST has traded at an average price of $35.50, reflecting its earnings stability and measured growth. Year-to-date, however, the share price has declined 7.1%. This could be attributable to investors’ expectations of the second public offering of FIRST shares within the next few months. Based on the announcement by the Minister of Finance in the 2016/2017 budget, it is estimated that the secondary issue will be at a price of around $30.00. The estimated offer price, if realized, would represent a trailing P/E of 11.8 times, significantly lower than the banking sector average of 14.3 times and more compelling value than purchasing at the current market level. Bourse maintains a NEUTRAL rating on FIRST.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

For more information on these and other investment themes, please contact Bourse Securities Limited, at 628-9100 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”