FIRST Declines, Banking Sector Records Tough FY2020

| HIGHLIGHTS FIRST FY2020 · Earnings: EPS contracted 19.5% from $2.98 to $2.40. · Performance Drivers: o Increased credit impairment loss expenses due to COVID-19 · Outlook: o Impairment expenses likely to normalize · Rating: Maintained at NEUTRAL.

Banking Sector · Earnings: Total Earnings* fall to $188, 73% lower than $697 in FY 2019 · Dividends: Total Dividends* decline to $255.00, 28.4% lower than $356.20 in FY 2019 · Share Price: Share Price* depreciates 8.9% relative to year to date · Performance Drivers: o Relatively muted top-line growth o Higher impairment charges · Outlook: o Potential Normalization of Economic Conditions o Reduction in Provisional Impairment Changes *Assumes equal investment in each banking stock

|

This week we at Bourse review the financial performance of First Citizens Bank Limited (FIRST) for its financial year ended 30th September, 2020. With FIRST being the last of the banking sector stocks to report full fiscal 2020 results, we review the overall performance of the publicly listed Banking Sector stocks for 2020 in the context of the Covid-19 pandemic. FIRST’s earnings for the period followed in the direction of other Banking entities, with profits being impacted by higher impairment losses and relatively muted revenue growth. Will this performance filter into FY2021, or is the worst of the COVID-19 financial performance impact now behind us? We discuss below.

First Citizens Bank Limited

First Citizens Bank Limited (FIRST) reported an Earnings Per Share of $2.40 for the financial year ended 30th September, 2020 (FY 2020), 19.5% lower compared to $2.98 in the previous comparable period.

Net Interest Income was relatively flat at $1.627B, 0.4% lower than $1.633B reported in the prior year. Fees and Commissions declined 7.4% to $432.9M, amid concessions made in light of the pandemic. Other Income grew 3.6% despite economic challenges. Cumulatively, Total Net Income declined 1.8%, moving from $2.28B in FY 2019 to $2.23B. Credit Impairment Loss on Loans grew to $216.7M, $194.4M higher than prior year. Administrative Expenses and Other Operating Expenses fell 1.5% and 5.7% respectively in the financial year. Ultimately, Operating Profit decreased 22.1% to $812.3M.

FIRST reported a total share of profit in associates and joint ventures of $19.3M, relatively unchanged from a prior $19.9M. Profit Before Taxation stood at $831.6M, 21.8% lower than $1.06B in FY 2019. Overall, Profit After Taxation declined 19.3% to $606.9M, relative to $751.7M in FY 2019.

Profit Before Tax Declines

Between the period FY 2017 to FY 2019, FIRST grew its Profit Before Tax (not adjusted for Eliminations) at an average annual growth rate of 3%. However, in FY 2020 this trend was reversed amid adverse economic conditions with the Bank’s Profit Before Tax (before Eliminations) slipping 1.3% lower from the prior year.

Corporate Banking is historically the largest contributor to PBT, accounting for 40% of PBT before eliminations. Retail Banking accounted for the second largest proportion of PBT at 28%. However, both segments reported declines of 17.0% and 13.9% respectively in FY 2020, likely owing to reduced business activity amid the pandemic, as well as the Bank’s decision to waive certain fees and lower credit rates. Similarly, Treasury & Investment Banking, which contributed 25% of PBT, fell 5.7% YoY, potentially influenced by the disruptions to the financial markets. Trustee & Asset Management (7% of PBT) followed the same trajectory, reporting a 3.8% decline compared to the previous period.

After incurring significant credit impairment losses in FY2020, FIRST could benefit from improving credit conditions as its operating jurisdictions begin a period of recovery. FIRST’s primary operating jurisdictions of Trinidad & Tobago and Barbados are projected by the International Monetary Fund to grow 2.6% and 7.4% respectively in 2021.

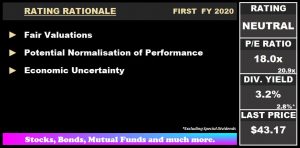

The Bourse View

At a current price of $43.17 and having declined 3.0% year-to-date, FIRST trades at a Trailing P/E ratio of 18.0 times, slightly lower than the Banking sector’s average of 20.9 times. With the Bank’s decision to issue a final dividend payment of $0.45 per share on January 7th, 2021, a total dividend payment of $1.37 will be paid for FY 2020, 19.4% lower, compared to prior year’s $1.70. FIRST currently offers investors a trailing dividend yield of 3.2% relative to a sector average of 2.8%. On the basis of fair valuations and the potential for the normalisation of the Bank’s performance in the upcoming periods, but tempered by continued uncertainty of prevailing market conditions, Bourse maintains a NEUTRAL rating on FIRST.

Banking Sector Stocks Weather Tough 2020

With FIRST being the final member of the Banking Sector to release its full year 2020 financial results, we look at how the overall Banking Sector fared in a challenging 2020 period. Earnings, Dividends and Share Prices were all tested to varying degrees in the adverse economic conditions.

Earnings Decline

Assuming an investor held an equally-weighted portfolio of banking stocks worth $10,000 at the start of 2020, total earnings of the portfolio declined from $697 in FY 2019 to $188 at the end of FY 2020 a 73% decline.

Banking Sector members reported a decline in earnings over the course of FY 2020, impacted by an extraordinary increase in Credit Impairment Losses and muted top line growth. Republic Financial Holdings Limited (RFHL) and NCB Financial Group Limited (NCBFG), the Caribbean’s two largest indigenous banks, reported 43% and 35% lower earnings respectively. Barbados-based FirstCaribbean Bank Limited (FCI) reported a 193% contraction in earnings as its tourism-based operational jurisdictions faced significant economic consequences. Scotiabank Trinidad and Tobago Limited (SBTT) and First Citizens Bank Limited, both of which primarily generate earnings domestically, recorded 22% and 19% declines in earnings per share.

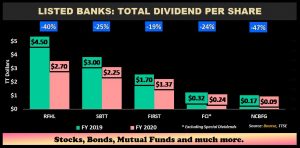

Dividends Decrease

Assuming an investor held an equally-weighted portfolio of banking stocks worth $10,000 at the start of 2020, total dividends from the portfolio declined from $356.20 in FY 2019 to $255.00 at the end of FY 2020, a 28.4% decline.

Like Earnings, dividends paid across all listed banks decreased. NCBFG reported the largest decline in dividends paid, taking it from a total dividend of $0.17 per share in FY 2019 to $0.09 in FY 2020, 47% lower. Being a Jamaica domiciled entity, NCBFG was also subject to the Bank of Jamaica’s mandate whereby only shareholders holding 1% or less of entity interest would be eligible for dividend payments. RFHL recorded the second largest percentage decline in dividends, reporting a 40% decrease. FCI, which provides investors with USD dividends, reported a 24% decline in regular dividends and has taken the decision to not pay a final dividend for FY 2020. Notably, the Group paid a special dividend in the period taking it to a total of $0.46 and trailing dividend yield of 6.6%.

Prices Slip

Assuming an investor of holds an equally weighed portfolio of banking stocks of worth $10,000 at the end of 2019, this value would have fallen to $9,109.78 at current levels, an 8.9% decline year-to-date.

In contrast to the significant decline in earnings and dividend payments, four of the five listed banking stocks recorded lower prices as compared to the prior comparable period. RFHL was the only entity in positive territory relative to the preceding year’s prices.

Investor Considerations

According to the latest data published by the Central Bank of Trinidad and Tobago, as at August 2020 Total Loans by commercial banks amounted to $75.4B, 0.6% lower than that reported in December 2019. Other Assets owned by commercial banks was more buoyant, reporting 6.3% growth. Despite the prevailing economic conditions, the growth in the Banks’ total asset portfolios may allude to the resilience of the sector and well as the potential likelihood for rebound.

In FY 2020, Banks were primarily able to maintain positive growth to its revenue, albeit at a slower rate relative to prior years. The primary driver affecting profits in FY2020 for most listed banks has been Credit Impairment Losses.

With resilient asset growth and the prospect of post-pandemic recovery, is it time to take a more positive position on the Banking Sector? It will all depend on an investor’s outlook. While recovery is widely forecast, the magnitude and timing of improvement remains quite uncertain. Inevitably, COVID-19 will leave lasting effects on businesses and economies.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”