Start Investing Early to Get Ahead

| HIGHLIGHTS

Investing Early · Earlier investment leads to stronger long-term growth and reduced need for larger contributions · Benefits: o Smaller monthly contributions o Potential to generate greater investment benefits o Ability to ride out many investment cycles

· Savinvest Individual Retirement Fund generated a 10 year compounded annual growth rate of 5.4%

|

Have you started on your journey to financial security? This week, we at Bourse focus on the importance of building your long-term wealth in preparation for your financial future, considering the investing decisions individuals face when thinking about the often overlooked ‘R’ word, Retirement. While many persons believe retirement planning occurs later in life, the reality is that creating a comfortable financial future gets easier the earlier you start. Let’s take a look at how you can give yourself the best chance to maximize your future wealth.

Time is Your Ally

When building long-term wealth, time is your greatest ally. But how does time benefit your investing goals? Let’s consider the case of two individuals, Renata and Nigel.

Nigel just turned 50 and has finally decided to prepare for retirement. Despite working for almost 30 years, he has very little accumulated savings. Renata is 25 and only started working 3 years ago. Renata got some good advice about starting to invest for her future early.

Both Nigel and Renata would like to retire at the age of 60. They have also both decided that they would like to accumulate a ‘nest-egg’ or lump-sum of $1 million at their retirement age. At that point, they would use their investment lump-sum to purchase an annuity from a company providing the best terms, which would give them monthly income. After speaking to their investment advisers, Renata and Nigel have determined that a long-term annual investment return expectation of 4.5% per annum would be reasonable on the funds they invest over the coming months and years.

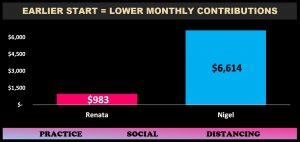

Earlier Start = Lower Monthly ‘Contributions’

With financial objectives and expected returns in hand, investment advisers turn Renata and Nigel’s intentions into numbers. In the case of our ‘early bird’ Renata, achieving her $1 million goal at the age of 60 translates into making a monthly ‘contribution’ or investment of around $983 over the next 35 years until her retirement age. On the other hand, our late starter Nigel – with 10 years to go before reaching his retirement age of 60 – would need to make monthly contributions of around $6,614 to achieve the same goal. In other words, Nigel is required to set aside over 6 times the amount each month compared to Renata, who started making contributions much earlier.

All other factors being equal, the longer the timeline to achieve your financial goal, the smaller will be the monthly contribution or investment required. An earlier start makes it easier to save on a monthly basis.

Earlier Start = Greater Investment Benefits

An equally powerful benefit of an early investing start is the opportunity to have your money work for you over a longer period of time. Investment professionals often refer to this phenomenon as the ‘power of compounding’: generating wealth not just on your principal but also on your investment returns over time.

This investment benefit is illustrated in our example. With a longer time period (35 years) to get to her $1 million goal at the age of 60, Renata would significantly benefit from her investment returns. Assuming she was able to generate 4.5% annual returns as expected, Renata’s contributions over the 35 years would total around $413,000. The remaining $587,000 (or nearly 59%!) of her $1 million goal would have been generated by investment returns.

In contrast, Nigel, with a shorter investment horizon of 10 years, would have a much lower benefit from investment returns. Over the 10-year period, Nigel would have made total contributions of $794,000 to achieve his $1 million goal. Only $206,000 (or around 20%) of his target value would have been achieved from investment returns.

All other factors being equal, the longer the timeline to achieve your financial goal, the greater the benefits of investing. An earlier start increases your potential earning power.

Where Do I Start Investing?

There are many ways to begin or enhance your investing journey. Most importantly, you do not have to be an expert to get started. Many investment vehicles are available, which may help to achieve your investment goals. One such investment vehicle is a Retirement Fund.

For individuals with investing goals like Nigel and Renata, Retirement Funds provide a very convenient and hassle-free investment solution. Among some of the major benefits, Retirement Funds:

- Are professionally managed, removing the stress of managing your own investment portfolio on a daily basis

- Allow investors to gain access to a diversified portfolio of investments, which helps to spread risk and generate returns from multiple sources

- Provide compelling tax benefits to investors on an annual basis. Being an approved investment vehicle by the Board of Inland Revenue, investors receive a tax shield on contributions up to $50,000.00 per year

- Are Convenient. Investing is as simple as setting up a standing order to make a monthly investment.

Do Retirement Funds Perform?

When deciding on which Retirement Fund provider is right for you, consider factors such as (i) the strength of the provider’s reputation, (ii) how easy is it to move my investment to another provider (iii) what are the costs associated with investing and of course (iv) what has been its track record in terms of investment performance? Most persons will naturally place emphasis on investment performance, being critical to achieving your investment objectives.

As an example of actual performance, we consider the Savinvest Individual Retirement Fund (IRF) managed by Bourse. While investment returns would vary from year-to-year, $100,000 placed in the IRF at the beginning of 2010 would now be worth $ $169,290 as at December 23rd 2020. In other words, the IRF would have delivered annualized returns of 5.4% over the period. In our example where Renata and Nigel require an expected return of 4.5%, they would both be quite happy with the IRF’s performance!

The actual performance of the IRF, like other Retirement Funds and general investments, highlights another important principle of investing: All other factors being equal, the longer the timeline for investing, the more likely you are to ride out periods of weaker investment performance.

Earlier Start = Easier Achievement of Investment Goals

For the everyday individual seeking to build wealth in the long run, Retirement Funds present an attractive solution. Importantly, creating the discipline to invest periodically is as easy as setting up a standing order to pay your rent, mortgage or car loan. Retirement Funds (and other investment solutions) can play an important role in achieving your long-term financial objectives, which become much more attainable by getting an early start.