BOURSE SECURITIES LIMITED

January 16th, 2017

Finding Opportunities in 2017

After a year of mixed returns for the local indices in 2016, this week we at Bourse consider the fortunes of the local stock market in the year ahead. We do so within the context of several corporate earnings and stock market drivers set out in our recently published article entitled ‘Mixed Returns in 2016’. We examine how these drivers may impact the various sectors which comprise the Composite Index, as well as their local and cross-listed components Finally, we share some insight on how investors could position their stock portfolio to best manoeuvre in the prevailing economic environment.

Market Outlook

The slowdown in local economic activity would have impacted the financial results of most of the local companies in 2016. As mentioned in our previous article, factors including economic contraction, lower consumer spending, higher unemployment rates, challenges to foreign exchange access, the likelihood of further currency depreciation and higher corporate taxation could all potentially further weigh on corporate performance in coming months.

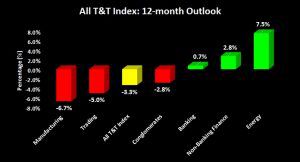

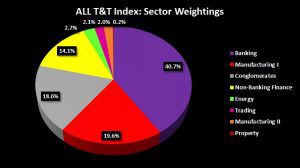

With the above economic and stock market drivers in mind, a closer look was taken at the individual constituents of the Trinidad and Tobago Composite Index (TTCI). Incorporating the over-arching macro-economic drivers, as well as certain stock-specific factors, projections for each major market constituent were developed. We present our forecast for the overall direction of the market, notwithstanding its dynamic nature. Our view for 2017 is for a decline in the Composite Index (TTCI) by 2-5%.

Cross Listed Stocks projected to advance

The cross-listed delivered a stellar performance in 2016, advancing almost 60%. In 2017, positive performance is expected to persists, though not necessarily to the extent experienced last year. Major drivers for projected cross-listed stock performance include (i) lower exposure to the subdued economic activity forecast for the Trinidad & Tobago economy, (ii) reasonably attractive dividend yields, generally above the market average (iii) reporting of earnings in a major currency such as the US dollar, which provides an implicit/explicit hedge against TT dollar depreciation and (iv) relatively attractive valuations when compared to T&T counterparts, despite the recent run-up in prices. Overall, the CLX is projected to advance in the range of 4% to 6% in 2017.

Stock Selection Key for the All T&T Index

The All T&T Index is projected to retreat in the order of 3-6%, as companies with higher exposure to the T&T market grapple with lower demand, foreign exchange issues, weaker purchasing power and higher taxes. For the local market investor, sector and stock selection will become increasingly important in generating value for a portfolio.

Sector Outlook

Banking

Tepid demand across the market has result in a slowdown in loan growth throughout the banking sector. New vehicle sales in the automotive sector, for instance, has fallen by 13.7% within the last 12 months. With unemployment trends on the rise, banks may face higher loan loss impairment. On a positive note, with the prime lending rate on the rise (8.3% in 2015 compared to 9.1% in 2016), banks should continue to enjoy higher net interest margins, particularly if interest rates continue to trend upwards. Certain banks within the sector – the cross-listed stocks, for example – are lower exposed to the local economy. Overall, however, the banking sector is likely to be one of the more stable performers, with the ability to maintain dividend payments, should earnings decline.

Conglomerates

The slowdown in demand will continue to negatively impact the two local companies within the conglomerates sector. Foreign exchange shortage and higher taxation are other impediments to sustainable recovery in the immediate future. A focus on growth in the regional territories could reduce the impact of potential slowdowns in the local operations.

Non-Banking Finance

Companies within the non-banking sector benefitted improvements in investment portfolios. In the current environment, this is expected to continue. Cross-listed stocks in the sector are projected to drive performance. Investors may be particularly attracted to this sector, given its relatively higher dividend yield. In addition, dividend payments are available in US dollars for certain securities, providing a hedge against further depreciations in the TTD.

Energy

The energy sector is comprised of one stock, TTNGL. The company is expected to benefit from improved stability in energy prices in the upcoming year. Additionally, energy production may improve, with the Angostura Phase 3, Sercan, Juniper and Angelin gas fields all expected to contribute to improved gas supply in the near term. TTNGL’s sole investment – Phoenix Park Natural Gas Processors Limited (PPGPL) generates earnings in US dollars, subsequently providing an implicit hedge against TT dollar depreciation. TTNGL’s dividend yield also offers value to investors, even in the current energy environment.

Manufacturing

Lower consumer spending is expected to negatively impact the manufacturing sector in the year ahead. Continued difficulty in accessing USD could also present challenges for companies operating within this sector, placing pressure on supply chains and operating margins. Continued TTD depreciation could lead to inflationary pressures and further weigh on consumer demand. Most companies within the sector have relatively low dividend yields and high dividend pay-out ratios, which could act as a disincentive to investors in the near term. Notably in the Manufacturing 1 sector are AHL and WCO, who are expected to face higher direct taxes for its products. Consequently, these companies could face headwinds to revenue growth in the year ahead.

Trading

The trading sector could face similar challenges as the manufacturing sector may likely decline, as consumers adjust spending away from discretionary items toward necessities and/or shift to non-premium products. Limited access to USD could also lead to challenges within the sector. With dividend pay-out ratios and yields on par with the market, the sector is projected to decline.

Positioning Your Portfolio

With the equity market set to decline for another year, investors may be wondering how they can position their portfolio to avoid such declines.

Firstly, risk-averse investors may choose to avoid the equity market on a whole, and perhaps switch to a different asset class like money market mutual funds. It should be noted though, that these instruments provide a more attractive return than traditional bank accounts, while also providing investors with a relative degree of safety.

Secondly, investors who are more risk-tolerant may be inclined to gravitate toward sectors which may outperform the market. Investors may want to choose stocks with (i) relatively low valuations (low P/E multiples), (ii) above-market dividend yields, (iii) low dividend pay-out ratios, (iv) lower/diversified exposure to the Trinidad and Tobago economy and (v) stocks which provide implicit/explicit hedges against TTD depreciation.

As always, investors should consult a trusted and experienced advisor, like Bourse, to help make better-informed investment decisions.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

For more information on these and other investment themes, please contact Bourse Securities Limited, at 628-9100 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”