BOURSE SECURITIES LIMITED

14th October, 2019

Budget 2020: Investor Opportunities on the way?

This week, we at Bourse review some of the highlights of the fiscal year 2020 Budget, as presented by the Honourable Minister of Finance on October 7th, 2019. We also take a look at some of the main fiscal stimulus measures mentioned and the investor opportunities which might be on the horizon.

FY2019 Revenues, Expenditure Lower

Revenues for FY 2019 were estimated to be $46.56B, roughly 2.0% ($941M) lower than the mid-year review projection of $47.50B. Expenditure also came in below budget at $50.50B or 3.0% ($1.57B) below the mid-year $52.07B forecast. Based on these estimates, the government’s operations would have resulted in an overall deficit of $3.95B or 2.4% of Gross Domestic Product (GDP) which has been estimated at $164.6B by the Ministry of Finance. Financing of the deficit would have taken the form of $1.52B in Net External Financing and $2.43B in Net Domestic Financing.

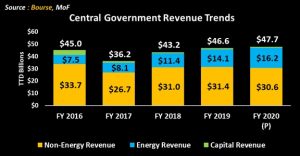

FY2020 Revenue Growth Slows

Projected Revenue for FY2020 is $47.7B, a 2.6% or $1.1B increase over FY2019 based on WTI crude oil prices of US$60.00/bbl and natural gas price of US$3.00/MMBtu. Energy Revenue is expected to amount to $16.23B in FY 2020, accounting for roughly 36.1% of Total Revenue, while Capital Revenue is projected to be $0.95M or 2.1% of Total Revenue.

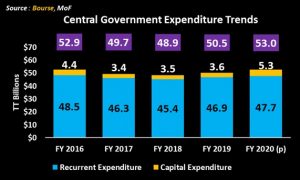

FY2020 Expenditure ramps up

Government expenditure for FY 2020 is projected to grow by 5.0% YoY, amounting to $53.03B. With Capital Expenditure expected to be maintained at FY2019 levels of $3.59B, the increase would be mainly as a result of higher recurrent expenditure. Should the FY 2020 expenditure materialize, the fiscal deficit could widen to $5.287B or 3.1% of GDP.

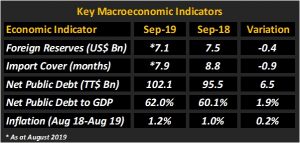

The depletion of Official Foreign Reserves continued into 2019 with the most recent balance amounting to US$7.1B, 0.4B lower than the US$7.5B reported last year. Resultantly, Import Cover lessened from 8.8 months in September 2018 to 7.9 months in August 2019. While Import Cover continues to trend downward, its current level is still above the 3-month international standard.

Net Public Debt climbed to $102.1B in September 2019 from $95.5B in September 2018, a $6.5B rise. This resulted in Net Public Debt to Nominal GDP increasing from 60.1% in 2018 to 62.0% in 2019. The Honourable Minister also highlighted that in the medium-term, Public Debt levels should remain around a soft target 65% of GDP, within international standards.

Headline Inflation as at August 2019 saw a marginal increase at 1.2% when compared to 1.0% in August 2018. One notable fiscal measure for FY2020 was the decision to increase the minimum wage by 16.67% from $15 per hour to $17.50 per hour. This change should directly increase the disposable income of approximately 194,000 persons in the workforce. Furthermore, the 10% increase in wages for OJT workers, 15% increase in wages for CEPEP workers and contractors and 15% increase in URP payments should result in more disposable income in the hands persons with a higher propensity to spend. Whether or not these initiatives lead to direct/indirect increases in the cost of operations for businesses and/or upward pressure on prices remains to be seen.

Environment takes priority

FY 2019/2020 marked the progressive implementation of green initiatives into the domestic economy. The government proposed a 100% tax credit allowance on the cost of Solar Water Heating Equipment, an effort expected to take effect from January 1, 2020. The Minister has also promised to improve energy efficiency by limiting inefficient energy usage across government institutions, providing modern LED bulbs to an estimated 400,000 households which currently use energy intensive incandescent bulbs and the removal of taxes and duties on such LED bulbs over the next five years to support the transition.

In a bolder move to create a ‘greener’ T&T, the Finance Minister also proposed a ban on the importation of Styrofoam and a mandate to food containers manufacturers to make their products biodegradable.

Investor Opportunities in bonds?

The Honorable Finance Minister noted that the ‘preferred’ source of financing the FY2020 deficit of $5.3B would be from ‘non-debt creating’ sources. In the absence of raising debt financing – whether as a direct issue of government bonds or indirectly through bonds issued by an entity holding assets wholly-owned by the state (as in the case of the National Investment Fund) – the state would have to pursue either (i) the sale of assets or (ii) drawdown from savings.

In the case of asset sales, no specific mention was made of any assets which would be made available to the public, for example, through Initial Public Offerings (IPOs) or Additional Public Offerings (APOs) as would have been the case in prior years. In terms of drawdowns from savings, certain conditions would have to be met before any of the US$6.25B in the Heritage and Stabilization Fund (HSF) could be accessed.

Several potential bond opportunities were, however, noted including:

- Having teased investors in FY2019, the issuance of TT$1B in 5-year government Housing Bonds seems set to become a reality in the near future. Offering investors a fixed annual rate of 4.5%, the Minister suggested that these bonds would allow investors to (i) earn a competitive rate of return and (ii) count as a down payment to access government housing.

- As in the FY2019 presentation, mention was made of a second National Investment Fund Bond issue on the cards for FY2020. The Minister noted that certain shares valued at $2.6B would be used in structuring and issuing ‘NIF 2’, along very similar conditions as the existing NIF. Accordingly, the minimum issue size of NIF 2 should be an estimated TT$1.3B, using the prevailing ratio of 2:1 for Collateral to Bonds Outstanding. Whether or not additional assets would be included to increase the size of NIF 2 remains to be seen.

- In an effort to ease the financial burden placed on businesses long awaiting the return of VAT refunds (totaling $4.5B as at September 2015), the Minister announced that ‘VAT bonds’ would be offered to settle arrears. The total issue, in the first instance, is expected to be TT$3B with a coupon of 1.5% and a tenor of 5 years. The Minister noted that the so-called ‘VAT bonds’ would be tradable, transferable and eligible as collateral at financial institutions. In the prevailing interest rate environment, these bonds could trade at a discount of between 10-15% of the stated face value. In other words, bonds holders wishing to sell the VAT bonds (under current conditions) and not wait 5 years to collect their funds would be able to recoup 85-90% of the nominal amount owed.

- The Tobago House of Assembly (THA) has been given the approval the issue up to TT$300M in bonds to fund critical development projects.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”