BOURSE SECURITIES LIMITED

18th December 2017

Bridging the Retirement Income Gap

This week, we at Bourse conclude our two part series on securing your financial future by making a conscious effort to accumulating long-term wealth. As readers may recall, the first part of our series considered different sources of income which were available after retiring. The question of ‘how much is enough savings’ was also posed. The successful transition into the retirement stage of life is often made easier with a longer-term perspective. We provide some insight on how this can be achieved with appropriate effort and focus.

What is a retirement income gap?

Your retirement income gap is simply the difference between how much you expect to spend versus how much you income expect to generate after retirement during a particular period (say monthly). Expected monthly spending is largely driven by your lifestyle choices, as well as cost of living changes (inflation). In reality, the lifestyle we may be able to afford after retiring may need to be moderated as compared to the lifestyle we can maintain when employed.

How big is my retirement income gap?

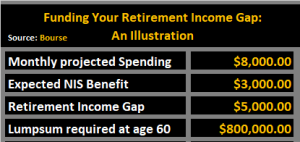

Determining just how large your retirement income gap could be is a major step toward securing your financial future. Everyone’s retirement income gap is different, depending on lifestyle choices, savings and spending habits as well as other factors such as health. For the purposes of this article, let’s assume that a person expects to spend $8,000 monthly after retirement at age 60. Let’s also assume that State Retirement Income (NIS) is $3,000 monthly. Having contributed and being qualified for NIS in this example, the retirement income gap is $5,000.

How do I bridge the gap?

In the simplest terms, bridging the retirement income gap is achieved by exercising discipline in spending and saving. With respect to saving/ investing, bridging the retirement income gap is made easier or more challenging depending on (i) how much you save/invest, (ii) when you start saving/investing and (iii) how much you earn on your savings (investment returns).

How much should I save?

In our example, the retiree would need to supplement his/her income by $5,000 a month. To achieve this, an individual could purchase an immediate annuity from one of many providers. The natural question arises, ‘how much will this cost?’ In this particular case, the cost of purchasing an annuity for life of $5,000 monthly could be in the order of $800,000. It should be noted that rates and costs tend to vary on an individual basis.

Is it worth purchasing this annuity? From one perspective, an $800,000 savings ‘nest-egg’ at age 60 – assuming you spend $5,000 monthly and earn no interest – could comfortably supplement your income to just over the age of 73. At this point, you would have depleted your savings. Purchasing an annuity, on the other hand, would guarantee this monthly income for as you long as you live.

When should I start investing?

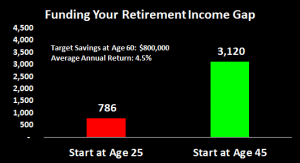

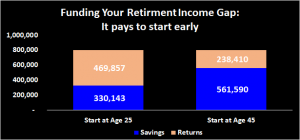

While it is never too late to start, saving is very much a case of the earlier the better. To illustrate, if you started saving/investing at the age of 25 years (assuming a conservative average annual return on your savings and re-investment of 4.5%) to accumulate $800,000 by age 60, you would have to set aside just $786 a month. On the other hand, if you started saving at age 45 under the same conditions, you would have to set aside about $3,120 monthly, almost four times the amount had you started earlier. Starting earlier gives you the double benefit of (i) spreading the savings amount over a longer period and (ii) having your money work harder for you by compounding investment returns. In the case of the early start at age 25, the cumulative funds saved (excluding investment returns) would be around $330,000. The rest of the $800,000 would have been earned through investment returns. The late start would mean saving a total of almost $562,000, with a much smaller amount of the $800,000 target earned from investment returns.

Do returns matter?

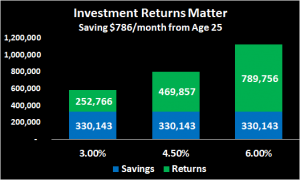

Bridging the retirement income gap is made easier with better investment returns. The power of compounding – the benefit of earning interest on interest for longer periods of time – cannot be emphasized enough. Extending our example, let’s say you did in fact start saving $786 a month at age 25. We already saw that an average annual return of 4.5% would help you to achieve your age 60 savings target of $800,000. Earning instead an average annual return of 3.00%, you would fall short of your target, accumulating just over $580,000. On the other hand, earning an average annual return of 6.00% would result in an accumulation of almost $1.2M.

How can I start?

With a better idea of how much you should be saving, are there financial products available which can meet your needs?

Like other annuity-type products, Individual Retirement Funds (IRFs) provide investors with a professionally managed pool of funds.

In addition to the personal income tax allowance of $72,000 per annum, an investor can further claim up $50,000 per annum in tax allowable deductions by contributing to a registered retirement plan. This means that contributions up to the maximum of $50,000 can reduce taxes payable by 25% of the same amount, equating to tax savings of up to $12,500 per annum for the investor.

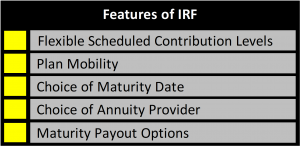

Other attractive benefits of IRFs include:

- Investors have the opportunity to choose their frequency of contribution, i.e. whether monthly, quarterly or annually, or even a lump sum.

- If you have already been investing with another provider, you can transfer to another provider without incurring cost.

- The investor has the opportunity to choose a preferred maturity date.

- At maturity, the investor can choose one of two options:

- (i) Lump sum plus annuity – 25% as a tax-free lump sum and the remaining 75% used to purchase an immediate annuity, which will generate monthly income for life

OR

- Total annuity pay-out – 100% of the plan value used to purchase an immediate annuity, which will generate monthly income.

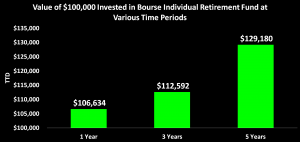

As highlighted above, the rate of return generated by your retirement fund could have a significant impact on the value of your investment at maturity. As a result, the smartest option would be choosing the plan which can offer the highest rate of return. For example, the Savinvest Individual Retirement Fund (IRF), managed by Bourse, generated cumulative returns of 6.6% over one year, 12.6% over 3 years and 29.1 over 5 years. Put differently, if you had invested $100,000 in the IRF 5 years ago, your investment would have been worth $129,108 today.

Whatever the investment product, securing your financial future should by your priority. As always, it makes good sense to consult with your trusted investment services provider to help find an approach which best suits you.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto