Bond Markets to Recover in 2021? This week, we at Bourse recap the fortunes of local and international bonds markets in 2020 and offer our perspective on the outlook for Fixed Income Investors for the coming year. Within the context of the COVID-19 pandemic initial panic, extraordinary policy response both in T&T and globally provided much-need support across bond markets. Will bonds continue to hold their value in 2021, or could there be a correction in the coming months? We discuss below. Monetary Policy Helps Local Bonds With Covid-19 threatening the stability of the local bond market, the Central Bank of Trinidad and Tobago (CBTT) brandished its monetary policy tools to cushion the impact of the pandemic. The CBTT implemented drastic changes, lowering the repo rate to 3.50% from 5.00% and the primary reserve requirement to 14.00% from 17.00%. These initiatives served to push bank lending rates lower, while sharply increasing excess liquidity in the domestic financial system. For investors, bond prices remained relatively stable during even with these significant policy shifts. TT Yield Curve Steepens, Inflation in Check

The initiatives undertaken by the CBTT led to a so-called ‘steepening’ of the Central Government’s yield curve. Short-term yields (<2 years) were markedly lower in December 2020 compared to December 2019. Notably, the 2-year yield declined by 0.54% from 3.10% to 2.56% year-on-year (YoY). Longer-term yields, meanwhile, were higher YoY. The benchmark 10-year rate increased to 0.26% while the 30-year rate recorded a 0.58% increase from 6.31% to 6.89%. The steepening yield curve could be a reflection of investors’ higher inflation expectations in future periods. Disruptions to supply chains and closure of businesses propelled food inflation to 4.5% as at December 2020 compared to 0.4% in January. Food inflation, coupled with the recovery of energy prices, nudged headline inflation to 0.8% from 0.7% for the comparable period, while core inflation remained muted at 0.0%. Commercial Excess Reserves Balloon

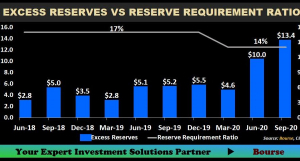

Average excess reserves for Commercial Banks increased substantially in 2020 compared to 2019, driven by the aforementioned changes to the Primary Reserve Requirement. Despite the substantial increase in excess reserves year on year, demand for credit remained subdued. Year-on-year credit growth was flat at 0.60% as at September 2020, while business credit contracted by 4.60% over the same period. 2021 Local Outlook

The scarcity of foreign currency along, with looming reviews of utility rates (water, electricity) and the liberalization of fuel markets in T&T could lead to increases in the cost of living over the coming months. Should this materialize, investors could expect heightened inflationary pressures in the year ahead and possible higher interest rates on new bond issues coming to market. Potentially offsetting this upward pressure on bond yields/rates would be the persistent overhang of excess liquidity in the financial system. Much like 2020, the movement of several variables clouds the outlook for the domestic bond market in 2021. Also similar to 2020 is the relatively limited access to new bond issues to the general public. New bond issuances which took place in 2020 were done almost exclusively via private placements, meaning the average investor would have constrained access to participating in these issuances. Private placements are generally favoured by bond issuers (as opposed to public issuances) for their ability to quickly raise large sums. With Government and Corporate bond issuers seeking speed and flexibility in their fundraising initiatives, private placements are likely to remain the preferred method of issuance. International Bond Markets Advance

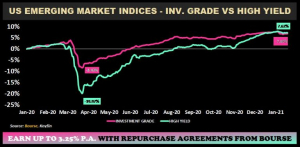

The accommodative low interest rate environment and continuous stimulus provided by major global central banks led to an impressive recovery of Emerging Markets (EM) in 2020. EM Investment Grade (IG) and High Yield (HY) bonds defied the odds to advance in 2020, generating total returns of 7.60% and 7.62% respectively, after falling to lows of -8% and -20% in March 2020. As international stimulus efforts, quantitative easing and excess liquidity persist (including the US Federal Reserve’s maintenance of near-zero interest rates), global bond markets could remain well supported in the year ahead. US Interest Rates Stay Low, Bond Yields Climb

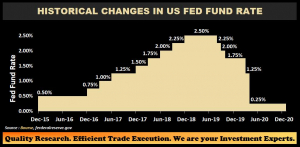

The Federal Open Market Committee (FOMC) acted swiftly in March 2020 to cut the fed rates twice to a range of 0.00%-0.25%, where it has been maintained to date. The Federal Reserve (Fed) has indicated that rates are to remain low until 2023, despite predictions of a rise in inflation. US inflation is estimated to reach 1.7% by the end of 2021, still below the Fed’s target inflation rate of 2.0%. US Treasury Yields Recover

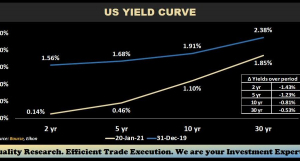

The sudden cut in the Fed Fund rate and resultant uncertainty from the panic triggered a flight to safety by investors in 2020. The 2-year US Government Treasury yield plummeted from 1.56% at the beginning of 2020 to 0.14% as at January 20th, 2021. The 10-year and 30-year Treasury yields sharply fell to lows of 0.50% and 0.94% respectively, both yields falling below 1% for the first time. Long-term yields have since rebounded with the 10-year Treasury yield at 1.10% and 30-year Treasury yield at 1.85%, as of January 2021. T&T USD Bonds Bounce

Among the vast wave of countries downgraded last year, Trinidad and Tobago received a one-notch downgrade by international credit rating agency Standard and Poor’s Global Ratings to ‘BBB-’ in March 2020, maintaining its status in the investment grade category. Despite this downgrade, the majority of USD bonds have made a substantial recovery, currently trading at or near all-time highs. The National Gas Company of Trinidad & Tobago’s (NGC) 6.05% USD bonds due 2036, for example, traded as low as $87 per $100 face value (a yield of 7.50% in March 2020) before recovering to its current level of $106 (5.46% yield). While 2021 is expected to be slow recovery of economies, bond prices and markets have seemingly stabilized at pre-pandemic trends with extraordinary fiscal and monetary support. 2021 International Outlook

Internationally, US interest rates are expected to remain low with subdued inflationary pressures. Additional stimulus and monetary support is likely in 2021, as countries grapple with multiple waves of the pandemic. In 2020, many issuers took advantage of the low interest rates to refinance its outstanding debt, resulting in a more manageable debt profile with lower interest costs while pushing maturities further into the future. While conditions remain supportive of bond prices in the near-term, any shift in investor sentiment could lead to a sudden unravelling of bond markets. Potential drivers to change in sentiment include the still out of control COVID-19 spread (including ne virus strains), as well as newly-instated US President Biden’s and Nominated Treasury Secretary Janet Yellen’s seemingly tougher stance on China. Investor Considerations

With anticipated increased local bond issuance needed to finance T&T’s FY2021 deficit, private placements of bonds are expected to continue in the year ahead, with no news thus far of pending public issuance. Investors should be even more selective of additional risk, paying attention to the credit quality of bond issuers in their search for higher yields. In the current environment of low yields and elevated risk, investors may be tempted to purchase longer-term or lower credit quality bonds to achieve higher returns. For investors who are able to resist this temptation, a perhaps more-conservative approach to generating income would be considering shorter-term investment alternatives until bond markets become more attractive. These alternatives would include (i) an array of income funds (in US$ or TT$) or (ii) Repurchase Agreements available investment services providers such as Bourse. For bond investors willing to face the higher risks of the current environment, it is always useful to consult with a trusted an investment adviser to make better informed decisions. “This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.” |

Weekly Review