BOURSE SECURITIES LIMITED

21st January 2019

Bond Markets more attractive in 2019

This week, we at Bourse review the 2018 performance of both local and international fixed income markets. While activity in the local bond market remained rather subdued last year, 2018 proved to be quite a challenging year for investors holdings US dollar bonds. We also examine the key drivers behind the outlook for both markets going forward and take a closer look at potential opportunities for fixed income investors.

TTD yields inch higher

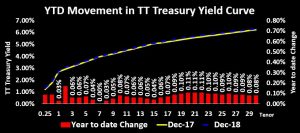

The TT Treasury Yield Curve trended upward in 2018, with the yields on both short-term and long-term TT dollar Government bonds increasing. The 1-year TT dollar Government bond yield increased from 2.72% in December 2017 to 2.75% in December 2018. Similarly, the 10-year TT dollar Government bond yield increased from 4.34% to 4.42% over the same period. This modest upward movement in yields might have been influenced factors including an increase in the Central Bank of Trinidad Tobago’s (CBTT) main policy rate (the repo rate) and the expectation of increased Government borrowing on the horizon.

In June 2018, the CBTT increased the repo rate from 4.75% to 5.00%. The decision was based on signs of a pickup in the energy sector, growth in private sector lending and low inflation. This increase may have benefitted investors by influencing an upward movement in short-term TT dollar bond yields. Borrowers, however, would have been negatively impacted through a commensurate increase in the prime lending rate from 9.00% in December 2017 to 9.25% in December 2018. Commercial banks’ excess reserves increased from TT$3.0 billion in December 2017 to TT$3.5 billion in December 2018. The persistent level of excess liquidity may have tempered the increase in bond yields.

Activity on the domestic bond market was fairly muted in 2018, with one notable public bond offering of TT$4.0 billion issued by the National Investment Fund Holding Company Limited (NIF). The bond, which was issued in three tranches, was welcomed by local investors, receiving total subscriptions of TT$7.3 billion (82.5% oversubscription).

Mixed outlook for local interest rates

Going forward, further increases in the repo rate could push interest rates higher. Moreover, aggressive Government borrowing could lead to a deterioration in the credit quality of the sovereign. This is likely to put upward pressure on interest rates, as investors demand a higher return to hold bonds issued by the Government to compensate for the additional risk.

Nonetheless, investors can currently earn a positive real return investing in TTD bonds, that is, the rate of return after adjusting for inflation. Inflation – the rise in average price levels – typically erodes the value of investments over time. Headline inflation is currently 1.00% (November 2018), as compared to the benchmark 10-year TT dollar Government bond yield of 4.43% (November 2018). The low inflation environment makes it relatively attractive for investors to take advantage of TT dollar bond opportunities.

While public bond auctions have been a rare occurrence, investors could look forward to the proposed National Investment Fund II, as mentioned by the Honourable Minister in the 2018 Budget Statement.

With a paucity of bond options, the income-focused investor may also consider alternative investment options. Low-risk, shorter-term investors could consider investing in money market funds and repurchase agreements, which offer a fixed and predictable return. Investors searching for yield with a higher risk appetite could also look at high dividend yielding equities such as Trinidad and Tobago NGL and the CLICO Investment Fund, which offer trailing dividend yields of 5.15% and 4.95% respectively.

Will USD Interest Rates Peak in 2019?

The US Federal Reserve (Fed) continued on its monetary policy normalization, hiking interest rates 4 times by 25 basis points in March, June, September and December of 2018. Recent comments from the Chairman of the US Fed, Mr. Jerome Powell, has suggested that interest rates could peak in the year ahead. This could spell good news for bond investors, with a peak in interest rates providing an attractive investment window.

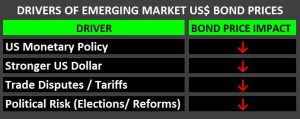

The increase in interest rates was one of the main drivers for a fall in emerging market (EM) US dollar bond prices during 2018, as bond prices have an inverse relationship with interest rates. Other factors that weighed on bond markets included the US-China trade dispute, geopolitical risk from elections in several major emerging markets and weaker-than-expected growth rates in China.

The total return (capital gains and coupon interest) for benchmark EM US dollar bonds was negative for both investment grade (IG) bonds, down 1.1% and high-yield (HY) bonds, down 4.7% for 2018. This is in stark comparison to the positive total returns of 7.3% in 2017 and 6.5% in 2016 for IG bonds and total returns of 9.5% in 2017 and 15.9% in 2016 for HY bonds.

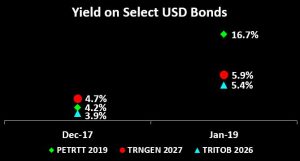

More ‘familiar’ US dollar bonds – such as the Government of the Republic of Trinidad and Tobago (TRITOB) maturing in 2026, Trinidad Generation Unlimited (TRNGEN) maturing in 2027 and Petrotrin (PETRTT) maturing August 2019 – have experienced a correction in prices and commensurate increase in yields, presenting a possible entry for bond investors. In December 2017, yields were 3.9% for TRITOB 2026, 4.7% for TRNGEN 2027 and 4.2% for PETRTT 2019. Currently, yields are around 5.4% for TRITOB 2026, 5.9% for TRNGEN 2027 and 16.7% for PETRTT 2019. The yield for PETRTT 2019 would have also increased during 2018, on account of the uncertainty surrounding the future operations of the company and its ability to repay outstanding debt.

While many factors could affect the direction of bond prices in the year ahead, 2019 – from a return perspective – would appear to present a more rewarding menu of opportunities for fixed income investors. Investors are encouraged to consult a trusted and experienced advisor, such as Bourse, to make a more informed investment decision.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”