BOURSE SECURITIES LIMITED

February 05th, 2018

Banks deliver positive results

This week, we at Bourse take a closer look at the financial results reported by several banks on the Trinidad & Tobago Composite Index (TTCI) for the first quarter ended 31st December, 2017. Republic Financial Holdings Limited (RFHL), NCB Financial Group (NCBFG) and First Citizens Bank Limited (FIRST) have all reported positive earnings, supported by different income drivers. While RFHL’s and FIRST’s share price has remained unchanged for the year, NCBFG’s share price has increased 5.3% year-to-date.

Republic Financial Holdings Limited (RFHL)

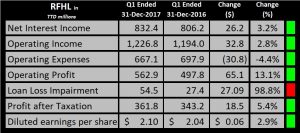

Republic Financial Holdings Limited (RFHL) reported Diluted earnings per share (EPS) of $2.10 for the first quarter ending 31st December 2017, a 2.9% increase over $2.04 reported in Q1 2017.

RFHL’s Net Interest Income for Q1 2018 increased 3.2% to $832M from $806.2M in the comparable period 2017. Operating Income was up 2.8% to $1.2B while Operating Expenses declined 4.4% to $667.1M. Share of Profit/ loss of associated companies stood at $3.1M representing a 91.7% increase over the comparable period 2017. As a result, Operating profit closed 13.1% higher at $562.9M for the period. Loan impairment expense, net of recoveries was 98.8% higher than Q1 2017’s $27.4M. Overall, Net Profit after Tax increased 5.4% to $361.8M while Profit Attributable to Equity holders of the parent was up 3.1% to $339.9M.

Outlook

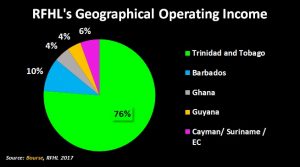

While RFHL continues to improve Operating Profit, it continues to be negatively impacted by economic challenges in its main market. RFHL continues to diversify its geographical operations through its 1% increase in HFC (Ghana) Ltd. It should be noted however, that Trinidad and Tobago remains RBL’s main market of operations, accounting for approximately 76% of operating income. . Additionally, the 5% increase in corporate taxation, from 30% to 35% could weigh on bank earnings.

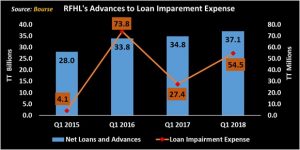

Over the past four years (from Q1 2015 to Q1 2018) RFHL has been able to marginally improve the performance of their loan portfolio. However, Loan Impairment expense increased 98.8% for Q1 2018 on the heels of a sharp decline in Q1 2017. This was due to a $34M loan impairment expense reported by the Trinidad and Tobago subsidiaries.

The Bourse View

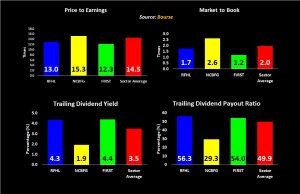

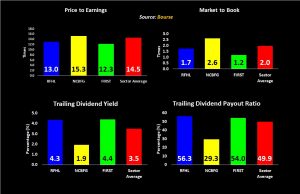

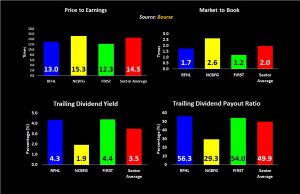

At a current price of $101.50, RFHL trades at a trailing P/E of 13.0 times (below the Banking sector average of 14.5 times) and pays a trailing dividend yield of 4.3% (trailing 12-month dividends of $4.40). On the basis of stable earnings and a relatively attractive dividend yield, but tempered by a modest economic outlook for its main revenue-generating jurisdiction, Bourse maintains a NEUTRAL rating on RFHL.

NCB Financial Group (NCBFG)

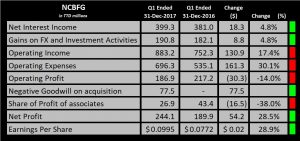

NCB Financial Group (NCBFG) reported Earnings per Share (EPS) of TT$0.099, a 28.9% improvement over TT$0.077 reported in Q1 2017. Adjusted EPS was approximately $0.068 or 0.11.9% lower than the reported value in Q1 2017.

NCBFG’s Net Interest Income grew by 4.8% to TT$ 399.3M supported by growth in the loan portfolio. Gain on FX and investing activities rose 82.7% to TT$164.9M for the first quarter 2018. As a result, Operating Income grew from TT$752.28M in Q1 2017 to TT$883.19M in Q1 2018, representing a 17.4% increase year on year. A 57.5% (TT$312.7M) jump in staff costs was the major contributor to the 30.1% (from TT$535.1M to TT$696.3M) increase in Operating Expenses. As a result Operating Profit closed 13.9% lower at TT$186.9M. The Group benefitted from Negative goodwill of TT$77.54M, which supported the improvement in earnings for the period. Overall, Net Profit increased by 28.5%, toTT$244.1M from TT$ 189.9M.

Outlook

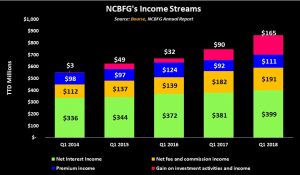

One of the key drivers for NCBFG’s performance was an 82.7% improvement in Gain on FX and investing activities. This improvement would have been positively influenced by the strengthening of the Jamaican dollar in 2017, coupled with increased demand for Jamaican assets. The Treasury and Company Banking accounted for 40% of the Groups’ Operating Profit in the first quarter 2018 followed closely by the Life Insurance and Pension Management segment, which accounted for 34%. Over the past few years NCBFG’s improved earnings have been driven mainly by gains on FX and Investing Activities. As such, any negative shift in the performance of this segment going forward would have a negative impact on earnings.

NCBFG has revised the closing date of its roughly US$170 Million bid to acquire and additional stake in GHL. The Offeror is restricted from taking up any GHL shares until such time as all approvals are obtained and therefore, in order to prevent the offer from lapsing before such approvals are obtained, the Offeror has elected to extend the closing date to February 23rd, 2018 at 4:00pm.

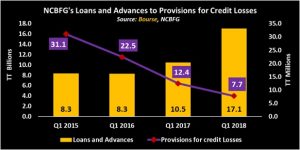

NCBFG reported improvements in loans and advances over the past four years with the largest increase occurring in Q1 2018 (up 63% to TT$17.05B). The 2018 increase was driven by the consolidation of Clarien Group and improved performance in the retail portfolio. Conversely, Provisions for credit losses has been trending downward. The simultaneous effect of Growth in Loans & Advances and declines in Provisions for Credit Losses are expected to continue through 2018 on the backdrop of positive economic conditions in their main market (Jamaica).

The Bourse View

At a current price of $6.60, NCBFG trades at a trailing P/E of 15.3 times (above the Banking sector average of 14.5 times) and offers a trailing dividend yield of 1.9% (trailing dividend TT$0.13). On the basis of improving corporate performance, but tempered by an aggressive increase in share price and reduced dividend yield, Bourse maintains a NEUTRAL rating on NCBFG.

First Citizens Bank Limited (FIRST)

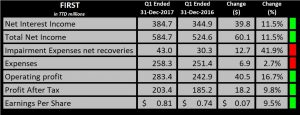

FIRST generated Earnings per Share of $0.81 for the first quarter of 2018, up 9.5% over $0.07 reported in the comparable period 2017.

Net interest income improved by 11.5% ($39.8M) year-on-year, from $344.9M to $384.7M, stemming from an increase in investments and loans to customers by 7.6% ($1.1B) and 2.4% ($0.4B) respectively. Total Net Income increased 11.5% for the period, bringing it to a close at $584.7M. Impairment expenses increased by 41.9%, while non-interest expenses increased moderately by 2.7%. The combined effect resulted in a 16.7% increase in operating profit. Additionally, Share of profits of associates contributed $41.19M to the company’s bottom-line. This was offset by a 36.9% ($85.4M) increase in taxation expense. As a result, Net Profit after Tax closed at $203.4M, 9.8% higher than $185.2M reported in Q1 2017.

Outlook

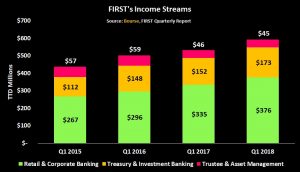

Despite economic challenges in its main market, FIRST has reported improvements in two segments, Retail& Corporate Banking and Treasury & Investment Banking with mixed performance in Trustee & Asset Management. The Treasury & Investment Banking segment has shown the best performance over the past four years, improving 54.5% from Q1 2015 to Q1 2018. The Retail & Corporate Banking segment also improved by 40.1% over the same period. While FIRST continues to demonstrate resilience, growth within its main segments may be constrained by low economic activity in 2018.

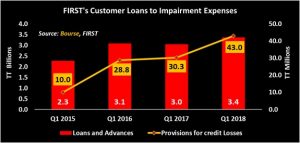

Over the past three years, FIRST has reported mixed performances in Customer loans, while Impairment Expenses have been trending upward. This trend is expected to continue in 2018, under prevailing recessionary conditions in the local market. Additionally, like other commercial banks with high exposure to the Trinidad and Tobago market, the 5% increased taxation is expected to weigh on earnings.

The Bourse View

At a current price of $32.00, FIRST trades at a trailing P/E of 12.3 times, below the Banking sector average of 14.5 times. The stock offers a trailing dividend yield of 4.4%. By resolution of the Directors on January 30, 2018, the Board of Directors of the company have agreed to change the frequency of dividend payment from semi-annually to quarterly. This change has been made for the benefit of the company’s shareholders and become effective immediately, with quarterly dividends to be paid on profits of the company for the financial period 2017-2018. FIRST has declared an interim dividend of $0.36 per share, payable on February 28, 2018. With attractive valuations, tempered by the current muted economic outlook Bourse maintains a NEUTRAL rating on the stock.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”