BOURSE SECURITIES LIMITED

21st August 2017

MASSY, AMCL Earnings Dip

This week, we at Bourse review the most recent financial results of two companies within the Conglomerate sector – Massy Holdings Limited (MASSY) and Ansa McAL Limited (AMCL). Both companies reported subdued earnings, primarily due to sluggish economic activity in its main operating territories. We take a close look at the results and offer some insight into possible sources of value for investors.

Massy Holdings Limited

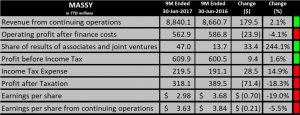

MASSY Holdings Limited (MASSY) reported Earnings per Share (EPS) of $2.98 for the nine-month period ended June 2017, a 19.0% reduction from the EPS reported in the corresponding period in 2016. Excluding one-off items (discontinued operations), MASSY would have delivered EPS of $3.63, a decline of 5.5%.

MASSY’s revenue from continuing operations grew to $8.8B from $8.6B over the comparable prior period. Despite this increase in revenue, Operating Profit after finance costs fell to $562.9M, a decline of $23.9M. Notably, Share of results of associates and joint ventures increased to $47.0M from $13.7M in 2016. The improvement in Share of results from associates and joint ventures contributed to an increase in Profit before Tax to $609.9M, from $600.5M. Profit after Tax from continuing operations fell to $390.4M, a decline of 5%. From discontinued operations, a loss of $72.3M was incurred at the end of the period due to the sale of an IT services company in Costa Rica and Massy Communications Ltd to TSTT.

Outlook

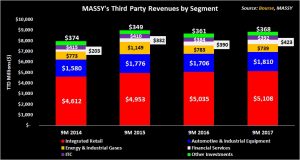

Despite economic headwinds in its primary markets, MASSY was able to grow Third Party revenues by 2.0% (9M 2017 vs. 9M 2016). Third party revenue from MASSY’s Integrated Retail segment increased by $72.4M (1.4%), followed by the Automotive and Industrial Equipment and Financial services segment which increased $103.5M (6.1%) and $32.7M (8.4%) respectively over comparable periods. The Integrated Retail segment maintained its dominance, accounting for 57.8% of Third party revenue followed by the Automotive and Industrial Equipment segment (20.5%) at the end of the nine-month period 2017.

Over the four year period (2014-2017) all segments experienced a decline in Profit before Tax (PBT), except the Financial services segment which advanced 203%.

Despite acquisitions of car dealerships in Colombia and 61.0% growth in the PBT of Massy Motors Colombia, PBT for the Automotive and Industrial Equipment fell 14.4% year-on-year. According to data from the Central Bank of Trinidad & Tobago, new motor vehicle sales declined 19.6% for the period January to June 2017 when compared to the same period in 2016. In contrast, PBT in the Energy & Industrial Gases and Integrated Retail segments grew 18.9% and 2.5% respectively over the comparative period. During the second quarter, MASSY sold Massy Communications Ltd (MCL) to the Telecommunications Services Company of Trinidad and Tobago. This sale would have formed part of MASSY’s discontinued operations at the end of the third quarter.

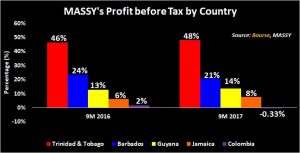

Diversification efforts have contributed to MASSY growing Profit Before Tax, insulating the company from declining revenues from its main market Trinidad and Tobago. MASSY has had success in increasing Third party revenues from operating territories such as Barbados and the Eastern Caribbean, Colombia and Guyana. This should prove to be beneficial for MASSY, particularly with prospects of improving economic fortunes in countries such as Guyana and Jamaica.

The Bourse View

At a current price of $48.95, MASSY trades at a trailing P/E of 11.1 times, which is below the Conglomerate sector average P/E of 14.4 times. MASSY provides investors with an attractive trailing dividend yield of 4.3%, above the sector average of 2.8%. On the basis of relatively attractive valuations, but tempered by adjustments to changing economic realities across its main operating territories, Bourse maintains a NEUTRAL rating on MASSY.

ANSA McAL Limited

ANSA McAL Limited (AMCL) reported diluted Earnings per Share (EPS) of $1.50 for the six-month period ended June 2017, a decline of 15.7% from the EPS of $1.78 reported in the prior period.

AMCL’s revenue improved $12.3M (0.4%) to $2.89B at the end of the six-month period 2017. Operating Profit declined 5.9% to $440.0M. Profit before Tax decreased to $432.0M, a reduction of 6.4% compared to the equivalent period in 2016. Profit after Tax fell to $307.1M, a decline of 13.0% compared to the corresponding period in 2016.

Outlook

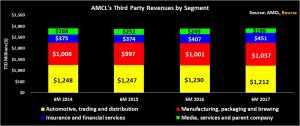

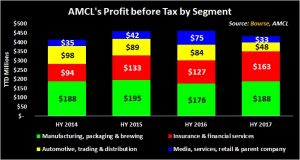

Economic pressures in AMCL’s primary market Trinidad and Tobago have weighed on the Group’s performance. AMCL’s Automotive, trading & distribution segment (41.8% of total Third party revenue), experienced a revenue decline of 1.5% year-on-year. Furthermore, this segment’s contribution to total PBT was 11.2% despite accounting for a relatively large proportion of revenue. PBT also declined 42.4% year-on-year.

Given the downturn in the domestic economy, sales of new automobiles nationwide have declined 25.6% from H1 2014 to H1 2017. This segment should continue to face challenges, with economic activity in Trinidad and Tobago likely constrained over the near-term.

On a brighter note, the Manufacturing, packaging and brewing segment, AMCL’s second biggest contributor to Third party revenue (35.8%), reported an improvement in Third party revenue of 3.6% over comparable period. In terms of PBT, this segment accounted for 43.4% of total PBT, the highest of any segment.

Third party revenue from the Insurance and Financial Services segment improved 10.9%. While accounting for only 15.6% of total Third party revenue, this segment produced 37.6% of total PBT. The performance of the segment would have been impacted by the positive six-month results of Ansa Merchant Bank Limited, which reported a 31.7% increase in Total Income and a 40.9% improvement in Profit after Tax. Most the AMBL’s improvement in PBT was driven by improvements in its Life Insurance segment.

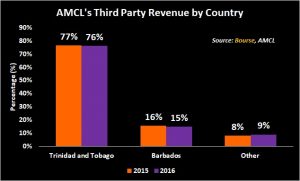

The majority of AMCL’s third party revenue stems from Trinidad and Tobago (76%), with Barbados accounting for the second largest contribution (15%). Given the current environment of these two territories, AMCL will most likely place more focus on its ‘Other’ regions, as evident by its recent acquisition in the USA.

The Bourse View

At a current price of $66.00, AMCL trades at a trailing P/E of 16.5 times, above the Conglomerate sector average of 14.4 times. The dividend yield is currently 2.3%, below the sector average of 2.8%. With ongoing economic headwinds in AMCL’s primary markets and above-average valuations, Bourse maintains a NEUTRAL rating on AMCL.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”