Pre-Budget Review – Can Revenue Be Revived?

| HIGHLIGHTS

Revenue 2019/2020

|

This week, we at Bourse review the revenue side of the budget equation in anticipation of the FY2020/2021 National Budget scheduled for October 05th 2020. Revenues have remained challenged in recent fiscal years, primarily as a result of waning energy sector fortunes. With revenue generation under pressure even before COVID-19, what is the outlook given the current environment? Can revenues be sustainably increased, despite tenuous short-term prospects? We discuss below.

Revenue: Energy vs. Non-Energy

The global Covid-19 pandemic has heavily weighed on the energy sector slashing both price and demand within the market. In the first nine months of fiscal year (FY) 2020, energy revenues amounted to TT$5.9B, a 43.1% decline from $10.4B reported in the prior comparable period. Although, energy prices have shown some stabilization, energy revenue in FY 2020 is likely to remain muted, further re-emphasized by the closure of several petrochemical plants in T&T.

Global and National coronavirus mitigation policies altered productivity and trade, ultimately eroding the revenue-generating abilities of the business sector and affecting employment levels. Consequently, non-energy revenues contracted between the period October 2019 to June 2020, amounting to $18.7B, 11.8% lower than $21.2B recorded in the previous comparable period.

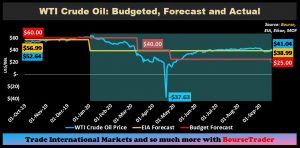

Energy Prices Stabilize

Budgeted Revenue for FY 2020 was initially predicated on an oil price of US$60.00/barrel, marginally higher than the Energy Information Administration’s (EIA) 2019 price forecast of US$56.99/barrel. However, with the destabilization of energy markets in early 2020, the budgeted oil price was revised downwards to US$40/barrel in March, and subsequently to US$25/barrel in April. According to the EIA, the current WTI price forecast for 2020 is US$38.99/barrel, relative to an average market price of US$38.26/barrel over the course of the year, thus far.

The FY 2020 budget was based on a natural gas price of US$3.00/MMBtu, above the EIA’s forecast of US$2.60/MMBtu. The Natural Gas budgeted estimate was adjusted to US$1.80/MMBtu in April, less than the EIA’s current forecast of US$2.16/MMBtu in 2020. Thus far for 2020, Natural Gas has traded at an average price of US$1.91/MMBtu (Henry Hub).

Outlook

In 2021, the EIA projects Natural Gas to average US$3.19 per MMBtu, while WTI is forecast to average US$49.07. At the Mid-year budget review, the Honourable Minister of Finance alluded to an oil price of US$45/barrel and a Natural Gas price of US$2.90/barrel for FY 2021. In the short-term, however, both production and price of energy and energy commodities are more likely to remain lackluster.

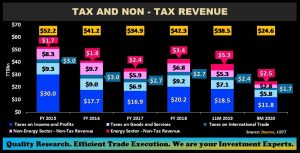

Revenue: Tax vs. Non-Tax

Tax Revenue fell 18.2% to $24.6B in 9M 2020 from $30.1B in 9M 2019. The largest component of Tax Revenue, Taxes on Income and Profits (2018: 62.9% of Tax Revenue) declined by 29.1% from 9M 2019 to 9M 2020. Tax Revenue on Goods and Services, the 2nd largest contributor to Tax Revenue (2018: 28.6%), grew by 4.1% from 9M 2019 to 9M 2020. Meanwhile Taxes on International Trade (2018: 8.5% of Tax Revenue) declined by 10.7% from 9M 2019 to 9M 2020.

For the Fiscal 9M 2020, Non-Tax Revenue accounted for roughly 21% or TT$5.3B of the TT$25.0B Total Revenue collected, 20% lower than TT$6.6B (9M 2020). The Non-Energy Sector is the largest contributor of T&T’s Non-Tax Revenue, which comprises of proceeds from Rental Income, Interest Income, Royalties, Profits from Non-Financial Enterprises and from Public Financial Institutions, Fines and Forfeitures and revenue from the payment of Administrative Fees and Charges for government services.

Revenue Pressures Persist

Total Revenue declined 19.5% YoY in 9M 2020, attributed to conditions of suppressed economic activities and energy demand. The Mid-Year Review pointed to a shortfall of $9.2B from the initial projection of $47.75B in revenue. Despite higher budgeted prices of oil and natural gas, revenue projections for FY 2021 are likely to be well below FY 2020’s initially budgeted figure of TT$47.75B. Contributing to the likely lower revenue take would be factors including weaker consumer activity, falling corporate profits, elevated unemployment and lower regional/international trade activity.

Possible Revenue Generation Initiatives

In the light of lower revenue projections, what can the T&T economy expect to drive revenue?

In the latest post cabinet media briefing, The Honorable Finance Minister underpinned the commitment to the implementation of the Revenue Authority, aimed at increasing collections efficiency. The Property Tax was also mentioned as an additional source of state revenue. Despite these initiatives being intended to bolster Government revenue, additional taxes would likely have the effect of reducing discretionary income levels of consumers, adversely impacting ‘traditional’ tax sources such as taxes on good and services and well as taxes on international trade. While diversification has been on the agenda for T&T’s economic reconfiguration for some time, potential revenue generating opportunities away from the energy sector will require a gestation period and significant investment.

There may be little alternative, in the near-term, to putting assets of the state up for sale to bolster revenue. Within the first 9 months of fiscal 2020, Capital Revenue of $383.1M was recorded, a 60% decline from $971.4M reported the prior comparable period, a consequence of lower proceeds from asset sales. Capital revenue was initially budgeted at $950M in 2020; with 3 months left unaccounted for in the fiscal year, it remains to be seen what proportion of the $566.9M shortfall can be recaptured. Dipping into national savings, in particular the Heritage & Stabilization Fund (HSF), would also be likely under the current challenging circumstances.

Next week, we consider the expenditure side of the budget equation in part 2 of our 3-part series focused on the upcoming FY2020/2021 budget for Trinidad & Tobago, to be delivered on Monday October 5th.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”