| HIGHLIGHTS NFM 9M 2020 · Earnings: EPS advanced 466.7% from $0.03 to $0.17 · Performance Drivers: o Demand normalizes · Outlook: o Basic food item (flour) will likely provide some resilience amidst depressed demand surrounding COVID-19 · Rating: Maintained at NEUTRAL. AHL 9M 2020 · Earnings: EPS remained constant at $0.39 · Performance Drivers: o New product introduction o Shifts in demand to at home consumption o Closures of primary demand channels such as bars and restaurants o Higher production costs amid facility upgrades · Outlook: o Challenged ‘traditional’ distribution channels (bars, events etc.) o New Product launches (flavored rums, cocoa bitters) · Rating: Maintained at NEUTRAL. |

NFM, Angostura Revenues Grow

This week, we at Bourse review the financial performance of National Flour Mills Limited (NFM) and Angostura Holdings Limited (AHL) for the nine-month period ended 30th September, 2020 (9M 2020). Both companies reported revenue growth in a relatively challenged economic environment, with the relatively non-cyclical nature of their products supporting demand. Resultantly, NFM reported significant increases to its profitability, however AHL’s earnings remained flat. Could performance improvement continue into future periods? We discuss below.

National Flour Mills Limited (NFM)

NFM reported an Earnings Per Share (EPS) of $0.17 in the nine months ended September 30th 2020 (9M 2020), up 466.7% from $0.03 in the previous comparable period. Revenue for the period grew 2.1% to $309.8M from a prior $303.6M. Cost of Sales decreased by 5.6% to $224.6M from $237.8M. Resultantly, Gross Profit was up 29.6% to $85.2M and the Gross Profit Margin improved, moving from 21.6% to 27.5%. Selling and Distribution Expenses marginally increased by 0.68%, whilst Administrative Expense recorded a 3.3% decrease. Operating Profit was up 250.3%, from $9.0M to $31.5M. NFM saw a 408.9% surge in Profit Before Tax (PBT) in 9M 2020, from a previous $5.7M to $29.0M. Overall, NFM recorded a Profit After Taxation (PAT) of $20.1M, up 405.7% as compared to $4.0M reported in 9M 2019.

Revenue Rises

NFM’s revenue growth has fluctuated over the last 4 periods. Despite reporting a 2.1% growth rate in 9M 2020, NFM’s third quarter 2020 (Q3 2020) revenue was marginally lower than the comparable Q3 2019 by 0.1%. This potentially illustrates that demand for NFM’s offerings may be normalizing after widespread hoarding and panic buying in early 2020. As food businesses adapt to the ‘new normal’ by enhancing curbside and delivery options to facilitate social distancing, household demand for cooking/baking ingredients may begin to moderate. With restrictions still in place and traditional seasonal events being limited (ex. the Divali Nagar’s closure), NFM’s fourth quarter revenue could face some unique near-term challenges. Compounding a fairly obscure 4th quarter outlook is the impact of increasing unemployment/lower disposable household income on Christmas season activity. Nevertheless, the relatively inelastic nature of The Group’s product offerings should provide a degree of resilience compared to other, more sensitive product offerings.

Margins Recover

In FY 2019, NFM suffered from inefficiencies surrounding the cost of raw materials and the stagnant price of flour since 2008, which inflated its Cost of Sales and deflated its margins. NFM subsequently modified its operating, information and cost accounting systems to improve efficiencies. This has borne fruit, with Gross Profit Margins improving from 21.6% to 27.5% in 9M 2020, reflecting the better purchasing decisions and more efficient utilization of raw materials which reduced Cost of Sales by 5.6%. Despite recording marginally higher selling expenses due to increased provisioning of bad debt amid economic pressures, when coupled with lower overhead costs and a 39.7% increase in operating income, NFM’s Operating Profit Margin increased from 3.0% to 10.2%. Subsequently, Profit After Tax Margin moved from 1.9% to 9.3%.

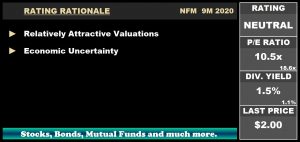

The Bourse View

At a current price of $2.00, NFM trades at a trailing P/E of 10.5 times, below the Manufacturing I sector average of 18.6 times and in line with its more recent trading multiples. The stock maintains a trailing dividend yield of 1.5%, above the sector average of 1.1%. With the spike in demand in the grains market, NFM may encounter a more dynamic raw materials environment. On the basis of relatively attractive valuations but tempered economic uncertainty, Bourse maintains a NEUTRAL rating on NFM.

Angostura Holdings Limited (AHL)

AHL reported an Earnings per Share (EPS) of $0.39 for the period ended 30th September 2020 (9M 2020) unchanged from the comparable period. Revenue for the period stood at $574.1M (up: 7.1%) from $536.2M recorded in 9M 2019. Cost of Goods Sold increased 15.2% to $305.1M from $264.9M. Resultantly, Gross Profit was marginally lower, sliding 0.8% to $269.0M. Selling and Marketing Expenses and Administrative Expenses recorded respective declines of 1.4% and 1.1%. Owing to COVID-19 induced economic pressures, an Expected Credit Loss Reversal on Trade Receivables of $2.1M was recorded. Results from Operating Activities was $106.9M, $2.2M (2.1%) lower than, $109.1M reported in 9M 2019. Improvements in Finance Income, up $2.6M from the prior year ($6.3M), contributed to Results from Continuing Operations which amounted $115.2M in 9M 2020, 0.03% lower than 9M 2019. Group Profit Before Tax for the period was $115.2M, 1.3% lower than $116.8M in 9M 2019. Taxation Expense in the period was 3.6% lower at $34.6M. Overall, AHL reported a Profit for the Period of $80.7M, relatively unchanged (down, $0.29M) from $81.0M in the prior period.

Revenues Improve

AHL’s revenue grew 7.1% in 9M 2020, driven by its ‘Rum’ and ‘Bitters’ segments, which grew 13.2% and 4.6% respectively. Both segments comprised of roughly 89% of AHL’s top line. The shifts in demand to at-home consumption and off-trade purchasing, along with the addition of Cocoa Bitters and flavoured Rum to its product portfolio, would have all supported revenue growth. On the other hand, the Group’s Bulk and LLB product line were challenged by lower global and regional demand, falling 23% and 19% respectively.

Despite not meeting self-imposed growth targets in foreign markets, AHL has nevertheless showcased relative revenue resilience prompted by the redirection of demand to domestic consumption. When factoring in the gradual easing of covid-19 mitigation measures, potential revenue improvement becomes more likely. However, with Carnival 2021 festivities in limbo and limitations likely to remain on social gatherings in the near term, AHL’s growth momentum could be stalled.

Margins Receded

AHL recorded higher production costs, likely influenced by added costs from works on AHL’s Water Resource Recovery facility and Anaerobic Digester facility (completed on August 3rd 2020). Productivity within this period was also reduced with the operations of its daily distillery contracting by an estimated 68%. Gross Profit Margin was 46.9%, below the 50.6% figure reported in the previous period. Margins are expected to improve in the upcoming periods, with AHL’s target to improve its production capabilities to 13,500 LOA (Litres of Alcohol) per day. Operating Profit Margin stood at 18.6% in 9M 2020, down from 20.4% in the prior period. Profit After Tax Margin was relatively unchanged (down: 1%) to 14.1% in 9M 2020, as support was lent by the increase in Finance Income and AHL’s strategic alignment of its products to meet the shift in consumer demand.

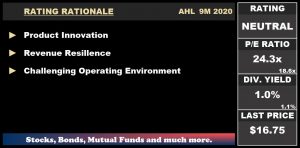

The Bourse View

AHL is currently priced at $16.75 and trades at a trailing P/E of 24.3 times, above the Manufacturing Sector average of 18.6 times. AHL offered a final dividend payment of $0.17 on 29th October, 2020. Resultantly, AHL offers a trailing dividend yield of 1.0%, below the sector’s average of 1.1%. With the gradual reopening of the economy tending to the normalization of entertainment channels, which account for a significant portion of AHL’s revenue, the Group’s top-line performance may be positively impacted. While inevitably being shaken by the closure of traditional distribution channels, new product launches and creative marketing campaigns (such as ‘how-to’ videos on making cocktails with its products) appear to have effectively stirred up interest in AHL. On the basis of product innovation, but tempered by relatively high valuations and adverse economic conditions, Bourse maintains a NEUTRAL rating on AHL.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”