Energy Markets Rebound

HIGHLIGHTS

- HY 2020 Performance:

- WTI Crude ↓ 35.8% YTD

- Brent Crude ↓ 39.4% YTD

- Henry Hub Natural Gas ↓ 20.2% YTD

- Key Events:

- Supply glut

- Slow economic rebound

- Crude oil partially recovered to sustainable levels

- NGL prices improved

- ECPI records historic low of 41.6 locally

- Outlook:

- Likely short term continuation of energy price pressure

- Potential improvements to demand amid easing COVID-19 restrictions

- Energy companies set to release earnings

- Dividend uncertainty

This week, we at Bourse review the performance of the major energy commodity prices and the energy stocks for 2020 thus far. Lower economic activity and significantly restricted travel demand led to an oversupply of energy commodities in the first half of 2020. Investor and market panic resulted in a capitulation of energy prices, with WTI Crude Oil trading negative for the first time in history. Since then, coordinated supply adjustments by major global producers, in addition to reopening economies have since resulted in meaningful recovery for commodity prices. Will the recovery filter into local and international energy stock markets? Can the recovery last? We discuss below.

Oil, Natural Gas Prices Partially Recover

After hitting an all-time low of negative $37.63/barrel in April 2020, oil prices have since recovered to more sustainable levels for lower-cost producers. OPEC and OPEC+ oil producers set aside their differences, agreeing initially to a production cut of 9.7M barrels per day for May, June and July.

At OPEC’s July 15th Joint Ministerial Monitoring Committee (JMMC), a decision was made to ease production cuts to 7.7M barrels per day from the previous 9.7M on the basis of “encouraging signs of improvements in both physical and future markets and demand recovery”.

Natural Gas which is pegged to the price of crude oil has depreciated 18.5% year-to-date (YTD) showing relatively less volatility than WTI and Brent which have both depreciated more than 30% over the same period.

Domestic Energy Prices Improve after sharp decline.

The Energy Commodity Price Index, (ECPI) calculated and published by the Central Bank of Trinidad & Tobago, is a measure of average energy prices faced by domestic production, based on T&T’s top ten energy commodity exports. With international energy prices collapsing at the start of 2020 and later recording modest recovery, the ECPI followed a similar trajectory. The ECPI stood at a 76.8 in January 2020, before the effects of COVID-19 led it to decline to a low of 41.6 in April. As of June 2020, the ECPI stood at 57.3, highlighting some improvement in energy prices faced by local producers.

More Price Improvement Ahead?

The US Energy Information Administration (EIA) in its July 7th report forecast WTI spot prices to remain below $50 throughout 2021, or a yearly average of US$45.70 per barrel. Global benchmark Brent crude prices are forecast to rise to an average of US$50 per barrel in 2021. Natural Gas, meanwhile, is expected to recover to US$1.93 per MMBtu in 2020, further increasing to US$3.10 per MMBtu in 2021.

Notably, 2021 price projections for WTI and Brent are lower than levels recorded at the start of 2020. At the start of January, WTI was priced at US$61.18 per barrel and Brent was priced at US$66.25 per barrel, 25.3% and 24.5% respectively, greater than 2021 forecasts. Natural Gas is projected to climb 46% higher than its 2020 opening level throughout 2021.

Energy Companies trade lower

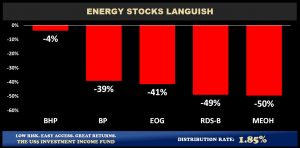

Stocks within the energy sector declined sharply YTD as investors reacted to the impact of COVID-19. The world’s largest Methanol producer, Methanex Corporation (MEOH) recorded a 50% YTD decline. In the same period, Royal Dutch Shell (RDS-B) fell 49%, followed by EOG Resources (EOG), BP PLC (BP) and BHP Group (BHP) which fell 41%, 39% and 4% respectively, at the YTD mark.

RSD-B made the decision to cut its first quarter 2020 dividends by 66% for the first time since 1945 whilst MEOH reduced its quarterly dividends by 90%. However, EOG and BP reported unchanged Dividends and the end of Q1. Both RSD-B and BP has hinted that second quarter dividends may trend lower as demand continues to remain suppressed.

Petrochemical Plant Closure

Ammonia

On December 31st 2019, Yara Trinidad Limited made the decision to permanently cease production at The Yara Trinidad Plant which has an annual capacity of 270,000 tonnes of Ammonia per year. Yara Trinidad Limited has deferred its decision to close its Tringen 1 Ammonia plant which has a production capacity of 500,000 tonnes per year, to August 2020 for maintenance works.

Nutrien, the world’s largest provider of crop inputs and services shut its Nutrien PCS 02 Ammonia Plant in May 2020 for a minimum of 3 months, in response to the market prices of Ammonia. Nutrien PCS 02 has an annual ammonia capacity of 600,000 tonnes. In June 2020, Nutrien closed its PCS 01 Plant for maintenance purposes, for a period of 14 days. However, management has revised this decision and opted to monitor the global markets for Ammonia and restart operations accordingly.

Methanol

On March 17th, MEOH made the decision to idle its Titan plant in Trinidad indefinitely. Collectively, both Titan and Atlas (MEOH’s plants based in Trinidad) supplies roughly 50% of Methanex Corporation’s total output. Titan has an annual production capacity of 875,000 tonnes per year). Methanol Holdings Trinidad Limited (MHTL), a part of the Proman Group of Companies has made the decision to idle both its TTMC II (M3) plant and its CMC (M2) plant in April and May 2020, respectively. M3 has a plant capacity of 577,500 tonnes per year and M2 has a production capacity of 525,000 tonnes per year.

Though temporary, the high cost of Natural Gas, the inability to reach agreements with the NGC Company and lower commodity prices on the international markets, continues to weigh negatively on the operational efficiency and profitability of the aforementioned companies.

Impact on T&T’s Economy

While diversification has been on the agenda of T&T’s economic reconfiguration for years, the energy sector remains integral to the long term growth and development of Trinidad and Tobago (T&T).

The closure of petrochemical plants could reduce the local demand for T&T’s natural gas by these downstream companies, leading to a reallocation of Natural Gas consumption by industry. In particular, less Natural Gas processed onshore could result in increased exports of Liquefied Natural Gas (LNG). Whether or not this benefits the economy would depend on the degree of value add generated from each use (LNG vs. Methanol vs. Ammonia production). The associated ‘trickle-down’ impact on energy services companies, as well as the fence-line and wider business communities is likely to weigh on economic activity.

Investor Considerations

Energy markets and their outlook are likely to remain closely linked to the forecast for global economic activity. In turn, any revival of the global economy will depend on COVID-19 vaccine progress, which will drive consumer sentiment towards global travel, generally increased movement and lifestyle ‘normalization’.

For equity investors locally, stocks that could stand to directly benefit from an improvement in energy commodity prices include Trinidad & Tobago NGL Limited (TTNGL) and National Enterprises Limited (NEL). The performance of TTNGL could improve with any recovery in the prices of Propane, Butane and Natural Gasoline. Year-to-date, Propane prices have advanced 24.8%, while Butane and Natural Gasoline prices are down 14.2% and 40.4%. With global production and travel embarking on the path towards normalization in Q2 2020, NGL prices are on the road to what seems like a recovery.

In addition to exposure to NGLs, NEL also has significant exposure to Ammonia prices through its 51% ownership of Tringen I and Tringen II. However, with ammonia prices lower and global market in excess supply, Tringen I is scheduled for a temporary close in August. NEL also has exposure to Liquified Natural Gas though its equity interest in Atlantic Train One, therefore it is likely to incur the effects of shifts in Natural Gas prices.

Internationally, improving energy price forecasts and the fact that energy sector of the S&P 500 has lagged far behind the broader market rally observed could lead energy stocks to outperforming the general market in subsequent periods. Currently, the Energy Sector, as represented by the Energy Select Sector SDPR (XLE) has fallen 37.5% year-to-date, in sharp contrast to the S&P 500 Index which is down just 0.4% over the same period.

Investors should be cognizant of the possibility of a second wave of COVID-19 and setbacks in the race for a vaccine. Together, these factors could lead to the reintroduction of lockdown measures, potentially derailing any economic recovery and cause the recent energy price rally to unwind. Investors considering acquiring Energy stocks should also be aware that that many energy stocks, traditionally favoured due to hefty dividend payments, have eliminated or significantly reduced dividends to shareholders. Additionally, there have been increasing bankruptcy events of energy producers in the international space, including notable names like Chesapeake Energy, Whiting Petroleum and Diamond Offshore.

While uncertainty is a part of investing, being selective in your investments can make the difference when it comes to investment success. In an ever-changing investment environment, be prepared to make adjustments if and when necessary, i.e., should your portfolio (and its components) move out of line with investment goals.

Investors are encouraged to consult a trusted and experienced advisor, such as Bourse, in order to position their portfolios for the year ahead.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”