HIGHLIGHTS

MASSY 9M 2021

- Earnings: Earnings Per Share of $4.85 increase from Earnings Per Share of $3.44

- Performance Drivers:

- Increased Revenues

- One-off sale of operations

- Outlook:

- Geographical Diversification

- Economic Uncertainty

- Rating: Maintained at NEUTRAL

AMCL HY 2021

- Earnings: EPS 131.3% higher from $0.48 to $1.11

- Performance Drivers

- Improved Investment Income from rebound in financial markets

- Higher revenues in operational segments excluding Integrated Retail

- Outlook:

- Continued robust growth

- Economic Uncertainty

This week we at Bourse review the performance of two locally-based groups on the Conglomerate sector of the Trinidad & Tobago Stock Exchange (TTSE), Massy Holdings Limited (MASSY) for the nine-month period ended June 30th 2021 and Ansa McAL Limited (AMCL) for the half-year period ended June 30th 2021. Will both groups continue to successfully navigate the challenging economic environment activity caused by the pandemic? We discuss below.

Massy Holdings Limited

Massy Holdings Limited (MASSY) reported Earnings Per Share (EPS) of $4.85 for the nine-month period ended June 30th 2021 (9M 2021), 41% higher than an EPS of $3.44 reported for 9M 2020. Revenue from continuing operations increased 5.7% to $8.57B from $8.11B in the prior comparable period. Operating profit after finance costs increased 23.7% to $601M. Profit Before Tax increased 20.1% year-on-year (YOY), from $635.4M to $529.3M. Resultantly, Profit for the period advanced 21.8% from $354.6M to $432.1M. Overall, Profit Attributable to Equity holders stood at $477.2M, a 41.7% increase compared to $336.8M reported in the previous period.

Improving Segment Performance

MASSY reported a 20.1% increase in Profit Before Tax (PBT), largely driven by its Financial Services segment with a reported 38% increase in PBT. Integrated Retail’s PBT improved 15%, Gas Products advanced 4%. The Group’s Motors and Machines segment suffered a significant setback as a result of the reintroduction of lockdown measures in Trinidad and Tobago with operations unavoidably halted from May 3rd 2021 to July 12th 2021. Despite commendable results from Massy Motors Colombia (148% increase in revenue), the Motors and Machines segment reported a 19% decline compared to the prior period.

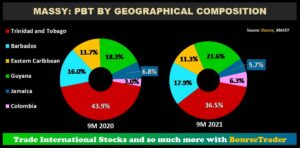

Geographic Diversification Improves

As part of its geographic diversification strategy, MASSY has been increasing its exposure across the Caribbean and Latin America. Trinidad and Tobago remains MASSY’s core contributor to PBT, contributing 36.5% in 9M 2021 compared to a contribution of 43.9% in 9M 2020. Barbados, which represented 16.0% of PBT in 9M 2020 accounted for 17.9% of PBT in 9M 2021. Meanwhile, Colombia increased its contribution to PBT to 6.3% after strong performance by Massy Motors Colombia. Guyana also increased their contribution to PBT to 21.6% as the country continues along its path of economic growth and is expected to expand 16.4% (IMF April 2021 outlook).

Relaxation of lockdown measures in the primary operating jurisdiction of Trinidad and Tobago could positively impact earnings, especially in its Motors and Machines segment after being closed for 70 days due to lockdown measures. The Group’s Integrated Retail segment continues to be resilient throughout the pandemic, though this could be tested as consumers confront inflationary and other macro-economic challenges. The Gas Products segment could experience some near-term reversal in results, as health-related demand for gases such as oxygen abates.

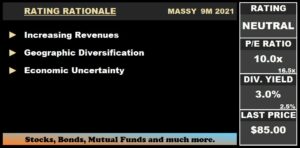

The Bourse View

At a current price of $85.00, MASSY trades at a trailing P/E of 10.0 times, below the Conglomerate sector average of 16.5 times. It should be noted that MASSY’s P/E ratio ex-discontinued operations stands at 17.3 times. The sale of the Group’s 50.5% stake in Roberts Manufacturing, as well as the sale of Massy Pres-T-Con Holdings Ltd, contributed $0.74 to the 9M 2021 EPS, or approximately 15% of reported earnings for the period. The stock has appreciated 39.4% year-to-date and offers investors a trailing dividend of 3.0%, above the sector average of 2.5%.

On May 10th 2021, the Group announced its decision to cross-list on the Jamaican Stock Exchange (JSE) and is currently anticipating a January 2022 arrival to the JSE. It remains to be seen if MASSY will consider a stock split, to enhance its appeal to the Jamaican investment community. While Increasing vaccine drives in MASSY’s operational jurisdictions could aid regional economic recovery, new viral strains have clouded the near-term outlook for developed and developing countries alike. On the basis of improving overall performance and increasing geographic diversification, but tempered by economic uncertainty as it relates to the emergence of COVID-19 variants, Bourse maintains a NEUTRAL rating on MASSY.

Ansa McAL Limited

Ansa McAL Limited (AMCL) reported a Diluted Earnings per Share (EPS) of $1.11 for the six months ended June 30th 2021 (HY 2021), 131.3% higher than an EPS of $0.48 reported in HY 2020.

Revenue for the period amounted to $2.7B in HY 2021, down marginally 2% or $58.4M as reported in the prior period. Operating Profit advanced 108.6% to $316.9M in comparison to $151.9M in HY 2020. Resultantly, the Operating Margin rose to 11.8% from 5.4% Year-on-Year(YoY). Profit Before Tax (PBT) experienced an 107% improvement for the period, from $146.9M to $304.5M.

There was a 33.8% decline in Share of Result of Associates and Joint Venture Interests to $10.4M from $15.7M. PBT Margin advanced 11.4% as Finance Costs increased 9.7% or $2M. The Group recorded taxation expenditure of $79.5M, with the Effective Tax Rate moving from 34.3% to 26.1%. Consequently, Profit for the Period improved 133% from $96.6M reported in HY 2020 to stand at $225M in HY 2021.

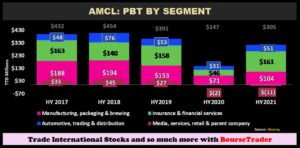

Segments Recover, Media Lags

AMCL’s main contributor to PBT for HY 2021 – Insurance and Financial Services (52.7%) – reported growth of 248% to $161M, likely attributable to financial market recovery. The second largest contributor to revenue – Manufacturing, Packaging and Brewing (34.2%) experienced 46.2% improvement up from $71.1M to $104M in HY 2021 owing to an expansion in their brewery operations. Segment PBT, however, fell short of AMCL’s HY2019 level of $153M. Brewery volumes were impacted by the restriction on the sale of alcoholic beverages at restaurants, bars, and other entertainment and recreation establishments in Trinidad and Tobago.

The Automotive, Distribution and Trading segment, accounting for 16.7% of PBT, grew 63.5%. While demand for vehicles is likely to remain challenged in the upcoming periods, other segment offerings including pharmaceuticals, food and beverages in the trading and distribution segment further supported AMCL’s revenue.

The Media, Services, Retail and Parent Company segment experienced the sharpest decline of 618.7% mostly due to the fallout of advertising revenues from customers. This segment could experience some seasonal benefits driven by Guardian Media Limited’s (GML) broadcast of the Caribbean Premier League (CPL) Tournament in August/September 2021.

The Bourse View

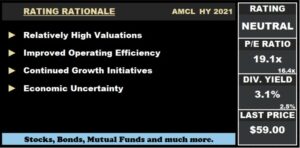

At a current price of $59.00, AMCL trades at a trailing P/E of 19.1 times, above the Conglomerate sector average of 16.4 times. The stock offers investors a trailing dividend yield of 3.1%, above the sector average of 2.5%. With more clarity on the ongoing COVID-19 situation, AMCL declared an interim dividend of $0.30, to be paid on September 8th 2021.

With Trinidad and Tobago being the Group’s primary revenue contributor, there was an overall slowdown of business activities this quarter attributable to the Country’s State of Emergency with curfew hours, with possible extension for a further three-month period. The measures, intended to limit movement and control COVID spreads, could prolong the route to economic recovery. While the gradual reopening of the T&T economy should bode well for the Group’s future performance, the pace of reopening will depend on the rate of vaccination of the local population as well as emerging threats of the highly contagious Delta variant. This new strain of virus could lead to the reinforcement of restrictions within T&T and potentially other key jurisdictions for AMCL.

On the basis of recovering financial performance, but tempered by relatively high valuations, an uncertain near-term outlook and tepid economic activity in its major operating jurisdiction Trinidad & Tobago, Bourse maintains a NEUTRAL rating on AMCL.

DISCLAIMER: “This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”