AHL Q2 2021

- Earnings: EPS 35% higher from $0.20 to $0.27

- Performance Drivers:

- Increased Investment Income

- New product introductions

- Improved Operating Efficiency

- Closures of primary demand channels such as bars and restaurants

- Outlook:

- New Product launches

- Maximizing global opportunities

- Economic Uncertainty

- Rating: Maintained at NEUTRAL

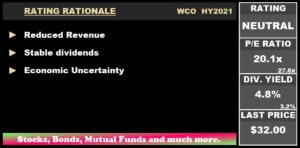

WCO Q2 2021

- Earnings: Earnings Per Share of $0.74 a decline from Earnings Per Share of $0.77

- Performance Drivers:

- Reduced Revenue

- Consistent Profit Margins

- Outlook:

- Economic Uncertainty

- Rating: Maintained at NEUTRAL

This week we at Bourse review the financial performance of Angostura Holdings Limited (AHL) and The West Indian Tobacco Company Limited (WITCO) for the respective half-year periods ended June 2021 (HY2021). AHL delivered improved earnings with modest revenue growth and stronger cost management. WCO, meanwhile, confronted a continued weak demand environment. How will both companies fare in the months ahead? We discuss below.

Angostura Holdings Limited (AHL)

AHL reported an Earnings per Share (EPS) of $0.27 for the period ended 30th June 2021 (HY 2021), a 35% increase over the $0.20 reported in the prior comparable period.

Revenue for the period climbed 3.3% to $370.4M, from $358.5M recorded in HY 2020. Cost of Goods Sold increased 1.1% to $194M from $192M. Resultantly, Gross Profit advanced 5.8% to $176.3M. Gross Profit Margin rose from 46.5% to 47.6%. Selling and Marketing Expenses and Administrative Expenses for the Group increased 14.9% and 7.3% respectively, while the impact of improving international markets on revenue and credit expectations led to a reversal in Expected Credit Loss on Trade Receivables of $4.2M. This was in stark contrast to the Expected Credit Loss of $8.4M recorded in the prior comparable period.

Results from Operating Activities was $66.4M, an increase of $10M or 17.7% than $56.4M reported in HY 2020. A 46% increase in Finance Income to $8.1M from the prior year ($5.5M).

Group Profit Before Tax for the period was $74M, 20.2% greater than $61.5M in the comparable period. Overall, AHL reported a Profit for the Period of $55.6M, advancing upwards of 36.1% or $14.7M from $40.8M in the prior period.

Revenue Improves, Margins Recover

According to AHL, the Group confronted more headwinds to domestic revenue growth. This was likely driven by extended closures of ‘traditional’ channels and the cancellation of T&T carnival among other factors. Notwithstanding these local hurdles, the Group managed to deliver revenue growth of 3.3% in HY2021 with stronger international market performance. Gross Profit Margin in HY 2021 was 47.6% relative to 46.5% in the prior period, owing to the improvement in the efficiency of the waste water treatment facility and the normalization of distillery alcohol production in 2021 compared to 2020.

Operating Profit Margin increased to 17.9% from a prior 15.7%, supported by Expected Credit Loss reversals. Profit After Tax Margin advanced to 12% from 11.4% in HY 2020.

The Bourse View

AHL is currently priced at $16.45 and trades at a trailing P/E of 21.1 times, below the Manufacturing Sector average of 27.6 times. AHL recommended an interim dividend of $0.09 per share with a record date of 6th October, 2021 and payment date on 25th October, 2021. Resultantly, AHL offers a trailing dividend yield of 2.4%, below the sector’s average of 3.1%. The gradual reopening of the T&T economy, including entertainment channels which traditionally account for a significant portion of AHL’s revenue, should bode well for the Group’s future performance. The pace of reopening, however, would likely depend on the rate of vaccination of the local population as well as emerging threats of the highly virulent Delta variant.

AHL continues to rollout new products (such as the recently-launched White Oak Pineapple) as well as revamp its branding. Angostura LLB has since been rebranded to Angostura Chill to support new and existing product launches of Blood Orange and Sorrel & Bitters drinks respectively. Initiatives such as these could support AHL’s profitability, keeping the brand fresh and consumers engaged. On the basis of product innovation, but tempered by relatively high valuations and near-term challenges to revenue growth, Bourse maintains a NEUTRAL rating on AHL.

The West Indian Tobacco Company Limited (WCO)

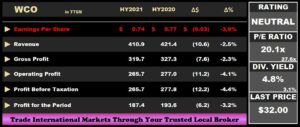

The West Indian Tobacco Company Limited (WCO) reported Earnings Per Share of $0.74 for the six-month period ended June 2021 (HY2021), 3.9% lower than the EPS of $0.77 reported in HY2020. Revenue fell 2.5% year over year from $421.4M in HY2020 to $410.9M in HY2021. Cost of sales declined to $91.2M, 3.2% lower than $94.2M in the prior year. Gross profit fell from $327.3M in HY2020 to $319.7M in HY2021. Operating Profit contracted to $265M, 4.1% lower than $277.8M in HY2021. Profit before taxation decreased by $12.2M or 4.4% to $265.7M. Overall, the company reported a profit for the period of $187.4M, $6.2M lower than a Profit of $193.6M in the previous period.

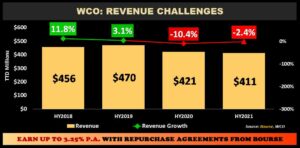

Revenue Challenged

WCO’s revenue generation continues to be affected by the ongoing pandemic, with revenues declining for two consecutive periods, albeit at a slower rate. The closure of key demand channels was a major driver for reduced demand of the company’s offerings. WCO recorded a 2.4% contraction in revenue in HY2021. Moreover, the company’s operations were unavoidably halted for the month of May 2021, resulting from the reintroduction of lockdown measures in Trinidad and Tobago. This negatively affected WCO’s ability to export to CARICOM and contract markets. In addition to these factors, WCO continues to face competition from lower priced substitutes and illicit goods.

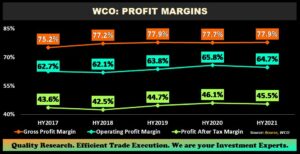

Margins Stable

Despite the multiple challenges to Revenue, WCO continues to consistently maintain high margins. Gross Profit Margin advanced slightly over the period by 0.2% due to reduced cost of sales. Meanwhile, Operating Profit Margin declined 1.1% as other operating expenses, administrative expenses and distribution costs all increased over the period. The company’s Profit After Tax Margin decreased 0.6% as finance income declined by $1M over the period.

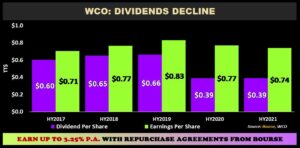

Dividends Decline

WCO reported lower dividends per share for the past two periods, on account of considerable uncertainty associated with the COVID 19 pandemic. Despite the decrease in dividends, WCO currently has one of the highest trailing 12-month dividend yields (4.8%) on the Trinidad and Tobago Stock Exchange.

The Bourse View

At a current price of $32.00, WCO trades at a trailing P/E of 20.1 times, below the manufacturing sector average of 34.1 times. The company approved an interim dividend of $0.39 to be paid on August 30th 2021. The stock offers investors a trailing dividend yield of 4.8%, above the sector average of 3.1%. Despite slightly declining margins over the period, WCO’s performance could be poised to recover as lockdown measures are gradually being lifted with the long term goal of reopening the economy. This is dependent on a successful vaccine rollout and a decline in the spread of COVID 19. On the basis of fairly stable margins and strong pricing power, but tempered by ongoing economic challenges, Bourse maintains a NEUTRAL rating on WCO.

DISCLAIMER: “This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”