GKC 9M 2022

- Earnings: Earnings Per Share 8.3% lower from $0.25 to $0.23

- Performance Drivers:

- Increased Revenues

- Increased Distribution Costs

- Outlook:

- Cost Containment Initiatives

- Rating: Maintained at MARKETWEIGHT

AGL FY 2022

- Earnings: Earnings Per Share 42.0% higher from $2.05 to $2.91

- Performance Drivers

- Continued Segment Growth

- Improved Margins

- Outlook:

- Growth from Acquisition Activities

- Rating: Maintained at MARKETWEIGHTThis week, we at Bourse review the financial performance of GraceKennedy Limited (GKC) for the nine-months ended September 30th, 2022 and Agostini’s Limited (AGL) for its financial year ended September 30th, 2022. AGL reported improved earnings owing to increased demand and successful acquisition activity. GKC, meanwhile, was adversely affected by increased operating expenses. Can both Groups successfully navigate lingering inflationary and supply chain challenges, as they move into 2023? We discuss below.

GraceKennedy Limited (GKC)

For the nine-months ended September 30th, 2022 GKC reported Earnings per Share of TT$0.23 relative to TT$0.25 in the prior period, a decline of 8.3%.

Revenue from Products and Services improved 12.6% from TT$4.07B to TT$4.59B, while Interest Revenue advanced 0.9% to TT$152.1M. Overall, Total Revenue increased 12.2% to TT$4.74B in 9M 2022 from TT$4.22B in 9M 2021. Direct and Operating Expenses grew 13.8% to TT$4.49B and Net Impairment Losses on Financial Assets contracted 45.7% to TT$9.4M. Consequently, Total Expenses expanded by 13.6%. Profit from Operations fell 10.5% from TT$379.1M to TT$339.2M. Resultantly, GKC’s Operating Profit Margin moved from 9.0% to 7.2%. Interest Income from Non-Financial services fell 2.2% year on year, followed by a 7.1% increase in Interest Expense from Non- Financial Services. Share of Results of Associates and Joint Ventures expanded 46.4% to TT$23.8M. Profit Before Tax (PBT) amounted to TT$341.2M, down 9.4% from TT$376.6M in the corresponding period. Taxation expense was TT$92.1M relative to the prior TT$101.7M. Ultimately, Net Profit Attributable to Owners of the Group stood at TT$230.2M, 8.1% lower than TT$250.4M reported in the prior period.

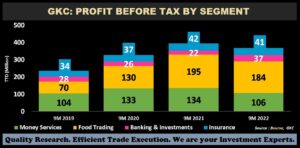

PBT Falls

Food Trading, the largest contributor to PBT (50%), fell 6.0% during the period to TT$184M. Demand for GKC’s core products remained strong in its main jurisdiction of Jamaica, with all businesses showing growth in revenues and PBT year-over-year. On the other hand, the Group’s international businesses were negatively affected by increased distribution costs, leading to lower PBT and margin compression.

GraceKennedy Money Services (GKMS), the second largest contributor to PBT (29%) fell 21.0% to TT$106M. According to GKC, the impact of high inflation on the disposable income of remittance customers in sending markets led to lower transaction volumes and reduced foreign exchange gains. Notwithstanding the fall in segment PBT, the Group reported growth in its cambio business due to an uptick in trading activity in both retail and commercial portfolios.

Banking and Investments (10% of PBT) expanded 63.5% to TT$37M over the period, driven by its investment banking business and gains from initial public offerings during the period. The Group’s commercial bank reported double digit loan growth and implemented strategies to navigate the high interest rate environment. GK Capital Management Limited’s partnership with the Trinidad and Tobago Unit Trust Corporation on mutual fund offerings is currently in its finalization stages, subject to regulatory and operational completion

The Group’s Insurance Segment, which accounted for 11% of PBT fell 1.5% to TT$41M from a previous TT$42M. This was attributed to a combination of lower-than-projected returns on investment income and higher-than-anticipated insurance claims.

Margins Deteriorate

Having improved its margins in the prior three (3) comparable periods, GKC’s margins fell in 9M 2022 owing to a challenging macroeconomic environment, underpinned by rising inflation, supply chain constraints and increased shipping costs which collectively weighed on margins. Operating Profit Margin fell from 9.0% in 9M 2021 to 7.2% in 9M 2022, while Profit Before Tax Margin moved from 8.9% in 9M 2021 to 7.2% in 9M 2022.

According to GKC, the Group has increased its emphasis on cost containment efforts, while at the same time implementing strategies to grow revenues and profits sustainably. The anticipated reduction in inflationary pressures and distribution costs could lead to margin improvement in subsequent periods.

GKC Acquires Scotia Insurance Caribbean Limited

On August 30th 2022, the Group announced that it came to an agreement with The Bank of Nova Scotia to acquire 100% of Scotia Insurance Caribbean Limited (SICL) with the transaction subject to regulatory approvals. SICL currently operates in Barbados, Belize, British Virgin Islands, Cayman Islands and Turks & Caicos Islands. In addition to last year’s acquisition of Scotia Insurance Eastern Caribbean Limited (SIECL), the acquisition of SICL would mean that the Group expanded its Life Insurance business to a total of 12 markets in less than two years, further enlarging its insurance footprint in the region.

The Bourse View

At a current price of $4.12, GKC trades at a P/E of 12.1 times, below the sector average of 17.2 times. The Group declared an interim dividend of TT$0.03 payable on December 15th, 2022 to shareholders on record by November 25th, 2022. The stock offers investors a dividend yield of 2.1%, below the sector average of 3.0%. Despite recording improved revenues during the period, investors may be keeping an eye on the Group’s ability to contain costs and preserve margins, given persistent inflationary pressures. On the basis of revenue growth and acquisition activity, but tempered by lower margins, Bourse maintains a MARKETWEIGHT rating on GKC.

Agostini’s Limited (AGL)

Agostini’s Limited (AGL) reported an Earnings Per Share of $2.91 for the year ended September 30th 2022(FY 2022), 42.0% higher than $2.05 in the previous period. Revenue advanced 13.5% to $4.1B from a previous $3.6B. Operating Profit rose a noteworthy 40.1% to $431.0M, compared to $307.7M in FY 2021. Finance Costs were $3.2M (10.4%) higher, at $33.7M in the current period. Profit Before Taxation climbed 43.5% from $276.8M to $397.3M in FY 2022. Taxation Expense was $122.4M relative to the prior $83.4M, increasing 46.8%. Profit Attributable to Owners of the Parent stood at $201.4M, 41.9% higher than $141.9M reported in the prior period.

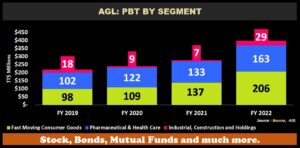

PBT Expands

Fast Moving Consumer Goods (FMCG) which accounted for 51.9% of PBT, grew 50.3% year-on-year, driven by strong performances in its distribution and manufacturing operations with Vemco and Peter & Company rounding out as the two outstanding performers within the sector.

Pharmaceutical & Health Care, (40.9% of PBT) improved 22.5%, aided by improved profitability, greater customer engagement and operating efficiencies derived from synergies created from the Group’s recent acquisitions of Smith Robinson, Oscar Francois and Intersol Limited. SuperPharm also reported sales and revenue growth during the period as customers continued to trust the brand and its offerings.

Industrial, Construction and Holdings, which contributed 7.2% of PBT, expanded 326.2% in FY 2022. According to the Group, the acquisition of Process Components Limited strengthened its position in the energy services sector, allowing the Group to deliver enhanced products and services to customers.

Margins Improve

AGL’s Operating and Profit Before Tax margins both continued to improve, accompanying revenue growth in FY 2022. Operating Profit Margin grew to 10.5% in FY 2022 from 8.5% in FY 2021, reflecting the Group’s continued efforts to improve its operations and cost management initiatives. This filtered into Profit Before Tax Margin, which moved to 9.7% relative to 7.7% in the prior period.

Acquisitions Progress

On December 5th, 2022 Agostini’s Limited announced that all conditions precedent for the acquisition of Collins Limited and Carlisle Laboratories Limited were met. The acquisition of the Barbados-based pharmaceutical distribution and manufacturing companies were completed on December 1st,2022 and is expected to be accretive to earnings in the new financial year.

The Bourse View

At a current price of $44.00 and having appreciated 35.4% year-to-date, AGL trades at a Price to Earnings Ratio of 15.1 times, above the sector average of 11.8 times. The Group announced a final dividend of $0.95 payable on February 1st, 2023 to shareholders on record by January 3rd, 2023. The stock offers a trailing dividend yield of 3.0%, above the sector average of 2.6%. Investors may be confident about the Group’s resilience and future prospects, given its ability to navigate ongoing economic pressures through expense management and pass-through pricing power. Additionally, AGL’s focus on growth via acquisitions may serve as a platform for continued earnings growth to complement organic sources. On the basis of acquisition activities and improving margins but tempered by relatively elevated valuations, Bourse assigns a MARKETWEIGHT rating to AGL.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”