AGL HY2023

- Earnings:

- Earnings Per Share (EPS) 27.5% higher from $1.53 to $1.95

- EPS inclusive of one-off non-cash adjustments: 98.0% higher from $1.53 to $3.03

- Performance Drivers

- Continued Segment Growth

- Improved Margins

- Outlook:

- Growth from Acquisition Activities

- Rating: Maintained at MARKETWEIGHT

WCO Q12023

- Earnings: Earnings Per Share fell 63.9% to $0.13

- Performance Drivers:

- Reduced Revenues

- Lower Margins

- Outlook:

- New Investments

- Rating: Maintained at MARKETWEIGHTThis week, we at Bourse review the performance of Agostini’s Limited (AGL) for its six months ended March 31st, 2023 (HY2023) and West Indian Tobacco Company Limited (WCO) for the three months ended March 31st, 2023 (Q12023). AGL reported improved earnings owing to increased margins and ongoing acquisition activity. Meanwhile, WCO continue to grapple with a weak demand environment. How will both companies fare in the months ahead? We discuss below.

Agostini’s Limited (AGL)

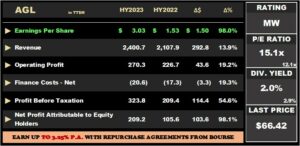

Agostini’s Limited reported an Earnings Per Share of $3.03 (inclusive of a one-off non-cash adjustment) for the six months ended March 31st, 2023 (HY2023), 98.0% higher than $1.53 reported in the previous period. Revenue expanded 13.9% to $2.4B from the previous $2.1B. Operating Profit rose 19.2% to $270.3M, compared to $226.7M in HY2022. Finance Costs increased 19.3% to $20.6M (HY2023). Profit Before Taxation increased 54.6% from $209.4M to $323.8M, aided by a $77M net gain on acquisitions. The revaluation of investment property resulted in a $2.8M loss. Taxation expenses were $69.1M, up from $63.2M in the prior comparable quarter. Profit Attributable to Parent Owners was $209.2M, a 98.1% increase over the prior period’s profit of $105.6M. Excluding the one-off gain from acquisitions, AGL delivered a commendable 27% increase in Profit Attributable to Shareholders.

PBT Advance

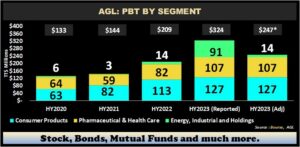

Consumer Products which accounted for 39.1% of PBT, grew 11.8% year-on-year to $127M. On May 5th, 2023 – AGL’s subsidiary, Caribbean Distribution Partners Limited purchased 80% of the outstanding shares of Chinook Trading Canada Limited, a Canadian-based consumer products business with trading operations primarily in the Caribbean region. According to the Group, this acquisition will expand its footprint to new customers across the Caribbean, and to new North American based suppliers.

Consumer Products which accounted for 39.1% of PBT, grew 11.8% year-on-year to $127M. On May 5th, 2023 – AGL’s subsidiary, Caribbean Distribution Partners Limited purchased 80% of the outstanding shares of Chinook Trading Canada Limited, a Canadian-based consumer products business with trading operations primarily in the Caribbean region. According to the Group, this acquisition will expand its footprint to new customers across the Caribbean, and to new North American based suppliers.Pharmaceutical & Health Care, (32.9% of PBT) improved 29.1% from $82M in HY2022 to $107M in HY2023, mainly due to synergies created from the acquisition of Collins Limited and Carlisle Laboratories which was completed in December 2022. On May 10th, 2023, AGL acquired 100% of the outstanding shares of the Jamaican pharmaceutical distribution company, Health Brands Limited. This transaction has received regulatory approval and it is nearing completion with expected finalization by the end of June 2023, allowing further segmental growth.

Energy, Industrial and Holdings, which contributed 28.0% of PBT, expanded a noteworthy 559.1% over the period to $91M from a prior $14M, likely due to a one-off non-cash gain on acquisitions. Excluding the one-off non-cash gain, the segment remained unchanged YoY at an estimated $14M.

Margins Expand

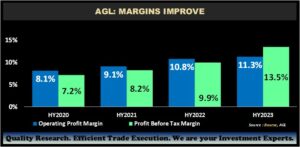

AGL’s Operating and Profit Before Tax margins both continued to improve, accompanying revenue growth in HY2023. Operating Profit Margin grew to 11.3% in HY2023 from 10.8% in HY2022, reflecting the Group’s continued efforts to improve its operational efficiency. This filtered into Profit Before Tax Margin, which jumped to 13.5% relative to 9.9% in the prior period. PBT margin would have been positively influenced by the one-off gains from acquisition recorded, with a subsequent normalization of this ratio in future periods. Nonetheless, AGL’s ability to consistently improve its margins may serve as an indicator for longer-term sustainable growth.

AGL’s Operating and Profit Before Tax margins both continued to improve, accompanying revenue growth in HY2023. Operating Profit Margin grew to 11.3% in HY2023 from 10.8% in HY2022, reflecting the Group’s continued efforts to improve its operational efficiency. This filtered into Profit Before Tax Margin, which jumped to 13.5% relative to 9.9% in the prior period. PBT margin would have been positively influenced by the one-off gains from acquisition recorded, with a subsequent normalization of this ratio in future periods. Nonetheless, AGL’s ability to consistently improve its margins may serve as an indicator for longer-term sustainable growth.The Bourse View

- At a current price of $66.42 and having appreciated 32.8% year to date, AGL trades at a Price to Earnings (P/E) Ratio of 15.1 times, above the Trading Sector average of 12.1 times. Excluding one-off gains from acquisitions, the P/E ratio stands at 19.9 times. The stock offers a trailing dividend yield of 2.0%, below the sector average of 2.9%. times. The Group announced an interim dividend of $0.40 per share payable on June 30th, 2023 to shareholders on record by June 5th, 2023.

AGL continues to grow its three segments through organic growth and importantly strategic acquisitions, allowing for greater geographical diversification within the Group. On the basis of acquisition activities and improving margins but tempered by relatively elevated valuations, Bourse maintains a MARKETWEIGHT rating on AGL.

The West Indian Tobacco Company Limited (WCO)

- The West Indian Tobacco Company Limited (WCO) reported Earnings Per Share of $0.13 for the financial year ended March 31, 2023 (Q12023), a 63.9% decline from $0.36 in the prior comparable period (Q12022). Revenue fell 38.2% Year on Year (YoY) from $202.1M to $124.9M. Cost of Sales was marginally lower by 2.4% year on year to $52M from $53M in Q12022. This resulted in a drop in Gross Profit by 50.8% to $73.4M from $149.3M (Q12022). In comparison to the previous year, distribution costs climbed by 56.9% to $1.7M, while administrative expenses increased by 22.8% from $13.4M (Q12022) to $16.6M in Q12023. Other Operating Expenses increased 61.1% year on year (YoY) to $8.7M from $5.4M. Operating Profit fell 64.1% from $129M in Q12022 to $46.4M in Q12023. Finance Income increased $1.1M in Q1 2023. Finance Costs increased 189.5% year over year to $110M. Profit Before Taxation decreased 63.3% from $129.2M to $47.4M in Q1 2023. Taxation dropped by 64.1% to $13.4M for the period under review, from $37.2M. Profit for the Period fell 63.0%, from $92.0M to $34.0M in Q12023.

Revenue Dilemma Persists

- WCO’s revenue declined sharply in Q12023, after showing signs of stabilization Q12022, as the Group continues to confront multiple headwinds to demand for its products. Total Revenue contracted from $202M to $125M in Q12023, as consumer purchasing patterns changed characterized by the increased presence of substitutes and illicit products. WCO has announced the reintroduction of its regular-sized Lucky Strike Red and restructured its product portfolio in an effort to turnaround its performance.

Margins Decline

- Usually a model that of operating efficiency and margin stability, WCO’s profitability margins declined considerably relative to prior comparable periods. WCO’s Gross Profit Margin significantly declined in the current period to 58.8% from 73.9% in Q12022, following the decrease in revenue due to challenges in the local market. Operating Margin saw the largest deterioration as administrative and other operating expenses increased, moving from 64.0% to 37.1% in the current period. Consequently, Profit After Tax Margin fell to 27.2% in Q12023 relative to a prior 45.6%. Whether this deterioration is transitory, or longer-lasting in nature, is unclear at this time.

The Bourse View

- At a current price of $13.00, WCO trades at a P/E of 16.1 times, below the Manufacturing sector average of 31.3 times. The stock’s sharp decline in price and performance has been surprising, particularly given the ‘sticky’ nature of its product offerings. WCO’s earnings performance highlights the challenges it faces from illicit and/or substitute products, with the company’s response to these challenges critical to its future success.

WCO decided to not pay an interim dividend given the current operating circumstances. The stock offers investors a trailing dividend yield of 7.5%, well above the sector average of 3.2%, excluding UCL’s special dividend. This dividend yield could, however, face downward pressure should lacklustre earnings persist in future periods.

On the basis of relatively attractive valuations, but cognizant of lower margins, lower revenue and higher threats to its core business, Bourse maintains a MARKETWEIGHT rating on WCO.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”

Consumer Products which accounted for 39.1% of PBT, grew 11.8% year-on-year to $127M. On May 5th, 2023 – AGL’s subsidiary, Caribbean Distribution Partners Limited purchased 80% of the outstanding shares of Chinook Trading Canada Limited, a Canadian-based consumer products business with trading operations primarily in the Caribbean region. According to the Group, this acquisition will expand its footprint to new customers across the Caribbean, and to new North American based suppliers.

Consumer Products which accounted for 39.1% of PBT, grew 11.8% year-on-year to $127M. On May 5th, 2023 – AGL’s subsidiary, Caribbean Distribution Partners Limited purchased 80% of the outstanding shares of Chinook Trading Canada Limited, a Canadian-based consumer products business with trading operations primarily in the Caribbean region. According to the Group, this acquisition will expand its footprint to new customers across the Caribbean, and to new North American based suppliers. AGL’s Operating and Profit Before Tax margins both continued to improve, accompanying revenue growth in HY2023. Operating Profit Margin grew to 11.3% in HY2023 from 10.8% in HY2022, reflecting the Group’s continued efforts to improve its operational efficiency. This filtered into Profit Before Tax Margin, which jumped to 13.5% relative to 9.9% in the prior period. PBT margin would have been positively influenced by the one-off gains from acquisition recorded, with a subsequent normalization of this ratio in future periods. Nonetheless, AGL’s ability to consistently improve its margins may serve as an indicator for longer-term sustainable growth.

AGL’s Operating and Profit Before Tax margins both continued to improve, accompanying revenue growth in HY2023. Operating Profit Margin grew to 11.3% in HY2023 from 10.8% in HY2022, reflecting the Group’s continued efforts to improve its operational efficiency. This filtered into Profit Before Tax Margin, which jumped to 13.5% relative to 9.9% in the prior period. PBT margin would have been positively influenced by the one-off gains from acquisition recorded, with a subsequent normalization of this ratio in future periods. Nonetheless, AGL’s ability to consistently improve its margins may serve as an indicator for longer-term sustainable growth.