HIGHLIGHTS

Guiding investors Through Heightened Uncertainty

- Don’t Panic, Think Long-Term

- ‘Buy Quality, Sell hype’ and Embrace Opportunity

- Diversification Helps!

- Opt for Safety

This week, we at Bourse focus on investors who may need guidance in the current environment. In an investment landscape still fraught with uncertainty and with financial markets shouldering heavy losses, investors may be thinking of throwing in the proverbial towel to wait on the side lines until conditions improve. Under these challenging conditions, we provide some useful tips for investors to be better prepared when investing in choppy financial markets.

Tip #1: Don’t Panic, Think Long-Term

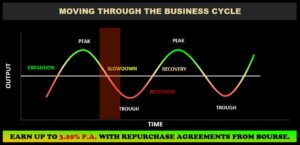

A useful point to remember when investing in volatile or choppy markets is to not Panic when markets head sharply lower. Business cycles naturally move through phases of relative booms and busts, often driven by changes in economic activity, fiscal and monetary policy, investor/consumer sentiment and the occasional extraordinary events. Changes to business conditions, the economic environment and consumer/investor – whether positive or negative – are often reflected in the prices of financial assets.

In the current context, (i) higher global rates of inflation, (ii) supply chain concerns compounded by the Russia/Ukraine war, (iii) moves to increase interest rates by major Central Banks and (iv) the prospect of a US recession are all factors that have investors nervous and uncertain. This uncertainty is being filtered into asset prices, as both bond and stock markets feel the pain of less-confident investors.

So, should an investor – in these circumstances – just not panic and hold his/her current portfolio? Part of not panicking involves evaluating your current holdings for any risks/weaknesses specific to a particular company/issuer(s).

Ask questions of the holdings in your portfolio such as: ‘Is this stock/bond performing worse than its peers?’, ‘Is there any company-specific news that is causing my stock/bond to underperform, or is it in line with general market movements?’ and/or ‘Do I still feel confident in the business of the company that issued this stock/bond?’. The answers to these questions, once honest and properly informed, will provide a much better guide as to what, if any, portfolio changes you may wish to make in choppy markets.

After evaluating your portfolio and with renewed confidence in each of your holdings, the next step to help investors not panic in choppy/down markets is to think longer-term with respect to your investment horizon.

While periods of economic and financial market stress/weakness are often more painful to endure, they are also typically shorter relative to periods of expansion and growth. As an example, we look at the S&P500 Index from 1980 to June 2022. Despite multiple extraordinary events (wars, financial crises, the ‘Dot Com’ bubble, ‘9/11’ etc.), economic cycles and changes to fiscal/monetary policies, the S&P500 Index grew at an average annualized rate of 8.7% (excluding dividends) over the period. Put differently, an investor buying $100,000 in the index at the start of 1980 – with a longer-term view – would have a position worth approximately $3,190,000 at the end of June 2022. So, when markets get a bit shaky, stay calm, take logical actions and think longer-term about your investment portfolio.

Tip #2: ‘Buy Quality, Sell hype’

When investor sentiment across financial markets changes quickly, it can often feel that there is no place to hide. Indeed, the stocks and bonds of even well-run companies endure falling prices, despite still having strong operations and business models. The age old saying, ‘don’t throw the baby out with the bathwater’ comes to mind. So, in a market where all asset prices come under pressure, what can investors do to protect/enhance their portfolios? Another tip to remember is to simply Buy Value and Sell Hype. How can investors distinguish between investments that offer Value, versus investments that may be mostly based on Hype? While there is no clear distinction, here are a few things to look for.

Some indicators of Value-oriented investments may include but not be limited to:

- Businesses with wide economic moats. Made popular by renowned investor Warren Buffet, an economic moat refers to features of a company’s business which allows it to preserve a competitive advantage over others in the industry.

- Industry/Sector leaders. As an example, Microsoft Corporation (MSFT) is a clear industry leader in the provision of computer software, hardware and related services. This is reflected in MSFT’s wide network and significant market share.

- Proven performance at better prices. Companies with long track records of profitable performance, even in periods of market distress, may sometimes be available at ‘cheap’ prices relative to normal market conditions. Proven financial performance could look like stable/consistently growing profits, strong (investment grade) credit ratings throughout business cycles and/or the ability to pass on higher prices to consumers. For companies with proven performance, being able to buy-in at cheaper prices in choppy markets is a compelling proposition.

Investors who might be considering selling hyped investments may look for indicators including but not limited to:

- Business models with limited competitive advantages. In such instances, where there may be little/no unique product attribute and/or low hurdles to entry for competitors, it might be best to err on the side of caution. An example of such might be Bumble (BMBL), the online dating app which went public in February 2021. With no discernable difference to other more established dating apps, BMBL’s stock has fallen approximately 56% from its debut price.

- Companies at the center of investor fads/trends. Perhaps the most publicized investor fad/trend in recent history were so-called ‘meme stocks’, stocks of companies which received heightened awareness, investor attention and buying pressure because of mass social media movements. An example would be Bed Bath and Beyond (BBBY), whose stock price would have quickly risen from $19 to $35 in early 2021 as the ‘meme-stock’ movement exploded. This price change came without any meaningful improvement in company performance. Since then, however, the BBBY’s prices has fallen to around $5, reflecting the dangers of making investments based on hype.

- Companies with limited/no financial history. While every investor’s dream is ‘getting in on the ground floor’ of a company that is destined for success, in choppy markets caution can often be a more sensible approach. Companies that may be ‘pre-revenue’, ‘pre-profit’, or at an even earlier stage, despite having a potentially good idea/concept, may not be the best positions to hold in your portfolio in volatile markets. Changing economic conditions, consumer preferences and other factors can quickly erase value from these highly speculative positions.

Related to Buying Value and Selling Hype is the concept of Embracing Opportunity in choppy markets. Falling prices and portfolio values often make investors feel a bit shy about adding exposure to stocks, bonds and other investment instruments. With lower prices on offer for quality companies, however, it can actually be the perfect time for investors to add to their portfolios and build wealth. Particularly for investors adopting a longer-term outlook, short-term price fluctuations should be embraced as an opportunity to pick up great positions at more attractive prices. After all, the fundamental concept of successful investing is buying low and selling high.

Tip #3: Diversification Helps!

In choppy markets, a well-diversified portfolio can mitigate risks and reduce volatility. Regardless of asset class (stocks, bonds etc.), greater diversification can help investors feel a little more comfortable when prices swing wildly. With the evolution of financial products and services, ‘buying’ diversification has become much more affordable and convenient. Exchange Traded Funds or ETFs, in addition to traditional Mutual Funds, provide investors with easy avenues to quickly diversify their investment portfolios.

For example, investors seeking to diversify the equity portion of their portfolio could consider any of several growth or equity mutual funds available by broker-dealers in Trinidad & Tobago. Thinking of diversifying your international equity holdings? Investors can consider ETF’s which diversify by sector, country or even investment region (Asia, Latin America, US, Europe etc.). When diversifying the bond portion of a portfolio, investors can purchase ready-made diversification using Income & Growth funds or even Bond ETFs. Investors could also develop their own diversified portfolios by purchasing multiple stocks and bonds, though this approach usually requires more intense monitoring on the part of the investor. It can sometimes also be a more expensive route of achieving diversification when considering transaction costs.

Tip #4: Opt for Safety

For investors who still feel uneasy after (i) Not panicking and thinking longer-term, (ii) Buying Value, Selling Hype and Embracing Opportunity and (iii) Diversifying your portfolio, as a final measure you can Opt for Safety. Investors still nervous about participating in unsettled, volatile markets can always reallocate their portfolios to lower risk (and lower return) investment solutions.

Investment solutions such as income mutual funds, repurchase agreements, other fixed-rate deposit type investments and even short-term government (or other high credit quality) bonds may make it more palatable to stay invested in even the choppiest of markets. The trade-off is, of course, potentially missing any sharp recoveries in markets.

Whether markets are calm or choppy, investors should consider their individual needs and as always, consult a trusted and experienced advisor, such as Bourse, in order to make better-informed investment decisions.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”