HIGHLIGHTS

Guiding investors Through Heightened Uncertainty

- What is Inflation?

- How is inflation calculated?

- What are the measures of inflation

- How should the Average Consumer Cope with Inflation?

- Make a Budget

- Product Substitution

- Reduce Consumption

- How should Investors Respond to Inflation?

- Investor Concerns

- Investor Opportunity

This week, we at Bourse address one of the most concerning topics for Consumers and Investors alike; Inflation. With countries across the world – including T&T – struggling to control the impact of rising prices on the global economy, we consider (i) the effect on the consumer, the effect on investors and (iii) how individuals can better cope in an inflationary environment.

What is Inflation?

Inflation is the economic term which refers to the general increase in the price level of goods/services over a set period of time. This increase in price, absent commensurate increases in earnings/wages, can be interpreted as either (i) the same ‘basket’ of goods costing more money, or alternatively (ii) being able to buy a smaller basket of goods with the same amount of money. Ultimately, inflation reduces the purchasing power of consumers.

In T&T, inflation is measured by the Retail Price Index (RPI), which is a weighted average of the proportionate changes in the prices of a specified set or ‘basket’ of consumer goods and services. The RPI tracks the prices of a fixed basket of goods and services across 15 categories. Data from the Central Statistical Office (CSO) showed that headline inflation remained at 4.9% year-on-year in June 2022. The major components of T&T’s RPI basket of goods include Housing (27.5%), Food and Non-Alcoholic Beverages (17.3%), Transport (14.7%) and Miscellaneous Goods & Services (8.5%)

The United States gauges inflation with the Consumer Price Index (CPI), a measure of the average change over time in the prices paid by consumers for a basket of goods and services. The U.S. CPI rose 9.1% in June 2022, the largest broad-based increase in 40 years.

Inflation and the Consumer

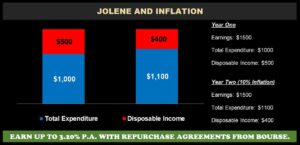

Let’s consider a simplified example of inflation.

Jolene earns $1,500 every year. Her annual non-discretionary or essential expenses (food, housing, transport etc.) come up to $1,000. This leaves Jolene with $500 in disposable income, which she can choose to either (i) spend on ‘nice-to-have’ or non-essential items or (ii) save and invest for the future.

One year later, prices increase by 10% or the inflation rate is 10%. Jolene’s annual essential expenses now increase to $1,100. She is now left with $400 in disposable income from her $1,500 annual income, meaning she has less to spend on non-essential items and/or invest.

So, what can Jolene and other consumers do to better manage in an inflationary environment?

Budgeting is a simple but effective tool to keep costs under control. While it may not reduce prices paid for goods/services, creating and adhering to a disciplined spending approach can help consumers to reduce some unessential spending and redirect those resources to savings/investment.

Product Substitution is another approach to coping in an inflationary environment. An example of product substitution could be switching from a more expensive, imported product to a local product which may be more cost effective on a per-unit basis. For instance, switching from foreign-produced ‘corn flakes’ to a locally manufactured version would reduce the price paid for the same good, despite minor differences in quality/taste.

Reducing Consumption – Perhaps the least popular measure for persons wishing to maintain savings/investment in an inflationary environment, reducing consumption can help to cope with rising prices. In this example, Jolene would – instead of spending $1,100 on the same-sized basket of goods – buy a smaller basket of goods with $1,000. For persons who are willing/able to cope with spending more on the same basket of goods, reducing consumption is often a last resort as it leads to an effective reduction in your standard of living.

Inflation and Investors

As inflation forces individuals to direct a larger portion of income towards a basket of commonly purchased goods, investors are left with the choice of either changing current spending patterns or reducing the amount of money invested on a monthly basis. What can investors do to minimize losses/maximize returns in an inflationary environment?

Get/Stay Invested. It is imperative to remain invested during inflationary periods, as this provides an opportunity for investors to gain a return on par with or above the rate of inflation, as opposed to being uninvested and losing purchasing power. Whatever the rate of inflation, individuals are better off earning some nominal rate of return through investing, as compared to passively saving with no return.

Pick ‘Inflation-Proof’ investments. While bonds typically fall in value as inflation/interest rates pick up, stocks may react differently depending on the nature of the underlying company’s business. Several publicly-listed companies on the Trinidad and Tobago Stock Exchange (TTSE), would be directly and indirectly affected by rising inflation, with some sectors likely to remain resilient while others are expected to face potential headwinds. Companies that produce/sell/finance Consumer Discretionary products may find an inflationary environment to be a more challenging one. ‘Big Ticket’ items such as homes, automobiles and major appliances, as well as luxury items (vacations, fine dining etc.) may be in lesser demand. By extension, companies/industries which provide financing for these goods/services (Banking, Non-Banking Finance) might also confront weaker credit/borrowing demand from consumers.

On the other hand, companies that provide essential or Consumer Non-Discretionary goods such as food items and other staples are likely to face fairly consistent demand for their goods and services, with more subtle changes to consumer spending patterns. The success of both Consumer Discretionary and Non-Discretionary providers would also depend on their ability to manage rising input costs in an effort to maintain profit margins.

Key Takeaways:

Whether looking through the lens of a consumer or an investor, inflation has a pronounced impact on how individuals utilize their income(s) to maintain their standard of living and/or build wealth. With some simple adjustments, a disciplined approach and smarter spending patterns, consumers and investors alike can make the best of the challenges arising from an inflationary environment.

We at Bourse are available to provide guidance to investors to make more informed investment decisions.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”