BOURSE SECURITIES LIMITED

17th February, 2020

MASSY Improves, AGL Stable

This week, we at Bourse review the results of Massy Holdings Limited (MASSY) and Agostini’s Limited (AGL) for the first quarter ended December 31st, 2019 for fiscal year (FY) 2020. MASSY delivered higher earnings driven by improved operational efficiencies and strong margins. AGL, on the other hand, remained relatively unchanged as Net Finance Costs and higher taxation dampened earnings. We discuss the performance of both companies and provide a brief outlook.

Massy Holdings Limited (MASSY)

Massy Holdings Limited (MASSY) reported a Basic Earnings per Share (EPS) of TT$1.57 for the first quarter ended 31st December, 2019, a 14.6% improvement over $1.37 reported in quarter one (Q1) FY 2019.

Group Revenue grew 1.6% year on year(YoY) increasing to $3.26B. Operating Profit after Finance Costs stood at TT$222.0M, a 12.6% increase over the prior comparable period at TT$197.2M. Share of Results of Associates and Joint Ventures was down 18.1% from Q1 2019 to $27.6M for Q1 2020. Profit Before Tax advanced 8.1% Year on Year (YoY) to TT$249.5M from TT$230.9M. Overall, MASSY recorded a Profit for the Period of TT$167.2M, up 13.1% from the prior period’s TT$147.8M.

Outlook

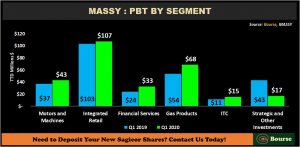

During its fiscal year ended 30th September 2019, MASSY announced its decision to amend its operational segmentation, with emphasis being placed on three main segments: Integrated Retail, Motors and Machinery and Gas Products. The Group has asserted that this decision factors into improvements made in PBT across business segments. At the end of Q1 2020, MASSY benefitted from increases to PBT generated by Gas Products and Motors and Machinery of 27% and 15% respectively. Integrated Retail, the Group’s largest contributor to PBT (43%), increased 4% YoY despite MASSY’s implementation of IFRS 15 and IFRS 16 which negatively impacted the Group’s Revenues and Expenses for the segment.

MASSY has a 10% stake in the 1,000,000 Tons/Year Methanol and Dimethyl Ether plant, Caribbean Gas Chemical Limited (CGCL), which is expected to commence operations within the coming months. The operationalization of CGCL could bring benefits in the

form of USD cash flows and additional profits to MASSY.

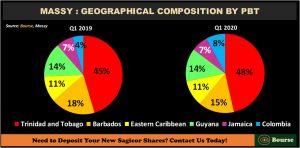

MASSY’s core profit region remains in Trinidad and Tobago; in Q1 2020 the Group’s PBT within the country increased 6.5%. Barbados, the Group’s second largest geographical segment, reported a 1.7% decline in PBT. Nevertheless, across the Eastern Caribbean and Colombian markets, MASSY showcased greater performance growth with PBT increasing YoY 3.3% and 86.6% respectively.

Strong Margins

MASSY’s improving operating efficiency continued into Q1 2020, evidenced by its PBT Margin which has increased on a consecutive basis since Q1 2018. In Q1 2020, MASSY was able to record a PBT Margin of 7.6%, up from 7.2% recorded in Q1 2019. The Group’s PAT Margin also experienced an uptick due to a reduction in the Effective Tax Rate. Resultantly, the PAT Margin moved from 4.6% in Q1 2019 to 5.1% in Q1 2020.

The Bourse View

At a price of $62.07, MASSY currently trades at trailing P/E of 10.4 times, below the Conglomerate sector average of 14.3 times. The stock also offers investors a trailing dividend yield of 3.7%, above the Conglomerate sector average of 2.9%. Through improving operational efficiency, MASSY has been able to generate measurable earnings growth with marginal increases in Revenue. On the basis of attractive valuations and expansion initiatives into higher-growth markets, Bourse maintains its BUY rating on MASSY.

Agostini’s Limited (AGL)

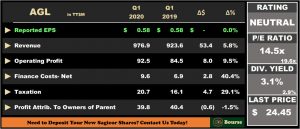

Agostini’s Limited (AGL) reported an Earnings Per Share (EPS) of $0.58 for the first quarter ended December 31st 2019, consistent with its reported EPS of $0.58 in the prior comparable period.

Revenue from contracts with customers improved 5.8% Year on Year (YoY), from $923.6M in Q1 2019, to $976.9M in Q1 2020. Operating Profit advanced 9.5% during the period from $84.5M to $92.5M, while Net Finance Costs increased substantially at 40.4% YoY to $9.6M. Consequently, Profit Before Taxation (PBT) stood at $82.9M, 6.8% up from $77.6M recorded for the previous year. Taxation for the period moved up from $16.1M to $20.7M, resulting in a marginally higher overall Profit for the Period of $62.2M, 1.0% up from $61.6M. Profit Attributable to Owners of the Parent, however, fell 1.5% to $39.8M in Q1 2020. AGL adopted the new IFRS 16 standard which changes the accounting treatment of leases, resulting in a non-cash negative impact to the income statement of $2.3M before tax and an increase of $223M in both non-current assets and liabilities on its balance sheet for Q1 2020.

Outlook

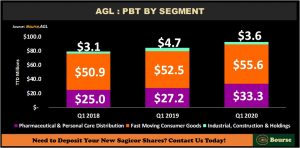

The Fast Moving Consumer Goods (FMCG) segment continues to be largest contributor of Revenue and Operating Profit for AGL. For the Q1 2020 period, the FMCG segment reported a 5.85% increase in Operating Profit YoY (from $52.5M to $55.6M), larger than the 3.14% increase from Q1 2018 to Q1 2019. The Pharmaceutical & Personal Care Distribution Segment’s Operating Profit also followed an upward trend over the past three comparable quarters, improving 22.37% (from $27.2M to $33.3M) in Q1 2020, and 8.8% in the Q1 2019 period YoY. AGL attributed the improvement to expansionary activities and continued strength in these operating sectors. On the other hand, the smallest segment, Industrial, Construction & Holdings recorded a 23.9% decline in Operating Profit to $3.6M following the 51% uptick from the previous year, on the basis of continued depressed activity within the sector. At the end of December 2019, AGL would have closed two Agostini Interior outlets and relocated its paint and ceiling fan lines to another retailer. In an attempt to deal with the issue of foreign exchange availability, the Group has signalled its intent to shift its focus to initiatives that will ultimately reduce the reliance on foreign exchange in the medium to long term. In 2020, AGL expects a boost in consumer spending in Trinidad and Tobago as a result of increased government expenditure as it is a General Election year, as well as in Guyana due to looming energy sector growth.

Expansion in Guyana

In order to capitalize on the energy sector expansion in Guyana, the Group has begun the process of establishing a warehouse and office complex in the Houston area. Additionally, operations of a company, similar to that of Agostini Building Solutions, which will distribute building supplies and industrial products and offer contracting services are set to commence this month. AGL also maintains a 51% ownership stake in ‘DeSinco Limited’ which is positioning to become a major distributor in the country.

Dividends Improve

Historically, AGL’s dividend payment has remained stable until increasing in FY 2018, and further in FY 2019, supported by consistent growth in EPS for the past five full year periods. From 2016 to 2018, the Group’s pay-out ratio has been relatively steady, with an increase in 2019 to 44.9%. AGL currently maintains a Trailing EPS of $0.79, and a Trailing Pay-out Ratio of 44.9%, despite an unchanged EPS from Q1 2019 to Q1 2020.

The Bourse View

Currently priced at $24.45, AGL trades at a trailing Price to Earnings ratio of 14.5 times, below the Trading sector’s average of 19.6 times. The stock also offers investors a trailing Dividend Yield of 3.1%, just above the sector’s average of 2.9%. On the basis of relatively attractive valuations, but tempered by muted growth, Bourse maintains a NEUTRAL on AGL.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”