MASSY Q12023

- Earnings: Earnings Per Share 1.8% higher, from $0.097 to $0.098

Continuing Operations: EPS $0.0975

Discontinued Operations: EPS $0.0009

- Performance Drivers

- Increased Revenues

- Acquisition Activity

- Outlook

- Geographical Diversification

- Portfolio Restructuring

- Rating: Maintained at OVERWEIGHT

GKC FY2022

- Earnings: Diluted Earnings Per Share 14.5% lower, from TT$0.36 to TT$0.31

- Performance Drivers:

- Increased Revenues

- Higher Expenses

- Lower Net Impairment Losses

- Outlook:

- Growth from Acquisition

- Margin Stabilization

Rating: Maintained at OVERWEIGHT

This week, we at Bourse review the performance of regional conglomerates, Massy Holdings Limited (MASSY) for its three-month period ended December 31st 2022 (Q1 2023) and GraceKennedy Limited (GKC) for its financial year ended December 31st 2022 (FY 2022). MASSY reported improved earnings owing to acquisition activity and margin growth in its integrated retail segment. GKC, meanwhile, was adversely affected by increasing operating expenses. Can both entities successfully navigate the lingering inflationary and supply chain challenges into 2023? We discuss below.

MASSY Holdings Limited (MASSY)

Massy Holdings Limited (MASSY) reported Earnings per Share (EPS) of $0.098 for the three-month period ended December 31st 2022 (Q1 2023), 1.8% higher than an EPS of $0.097 reported in Q1 2022.

Revenue from Continuing Operations grew 5.2% YoY, from $3.2B in Q1 2022 to $3.4B in Q1 2023. Operating Profit after Finance Costs advanced 11.6% to $293.0M, while Operating margin increased from 8.1% to 8.6%. Share of Results of Associates and Joint Ventures fell 46.5% to $6.5M (Q1 2022: $12.1M). Resultantly, Profit Before Tax (PBT) increased 9.1% to $299.5M. Income Tax Expense rose to $92.8M ($7.6M or 9.0% higher). Overall, profit Attributable to Owners of the Parent stood at $194.8M, a 1.8% increase compared to $191.3M reported in the previous period.

Improving Segment Performance

MASSY’S overall PBT expanded 9.1% for the period under review. The Group’s Integrated Retail segment (56.7% of PBT) posted the best year-on-year percentage gain, increasing 19.9% from $148.3M in Q1 2022 to $177.8M in Q1 2023 on account of strong growth in all regions and the acquisition of Rowe’s IGA. The Group’s retail business benefitted from a strong tourist season and improved product availability.

Gas Products (19.9% of PBT) fell 17.6% from $76M to $63M, affected by cooler performance in its Trinidad operations. The Group’s Motors and Machines segment (16.6% of PBT) increased 1.3% to $52M, with gains in Massy Motors Guyana and Trinidad partially offset by a 9.0% decline in Massy Motors Colombia.

Financial Services increased 7.9% from $22.6M to $23.5M, helped by strong growth in its Retail Lending Unit and ‘InstaLoan’ portfolio. The Group’s Remittance Services continues to expand its agent footprint with the launch of 8 new agent locations in Guyana, Saint Lucia and St. Vincent. The Real Estate segment reported a 58.9% decline in Q1 2023 from a loss of $0.8M to a loss of $1.8M.

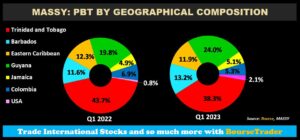

Guyana Contribution to PBT Increases

MASSY has been increasing its exposure across the Caribbean and Latin America as part of its regional diversification strategy. Guyana continues to grow in prominence in contributing to MASSY’S PBT, contributing 24.0% to PBT as the country continues along its path of economic growth and is projected to expand by 25.2% in 2023 (IMF October 2022 outlook). Colombia now accounts for 5.3% of PBT, relative to 6.9% in Q1 2022 as operations were negatively affected by a devaluation of the Colombian peso and lack of inventory in its Massy Motors business. Meanwhile, PBT contributed by the Eastern Caribbean fell to 11.9% while PBT contributed by Jamaica increased marginally to 5.1%.

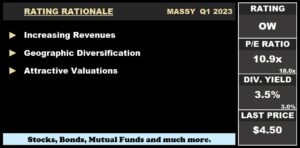

The Bourse View

At a current price of $4.50, MASSY trades at a trailing P/E of 10.9 times, below the Conglomerate Sector average of 18.0 times. Notably, MASSY’S P/E ratio ex-discontinued operations stand at 12.8 times. The stock offers investors a trailing dividend yield of 3.5%, above the sector average of 3.0%. According to MASSY, the Group expects improvements in its Motors and Machines and Gas Products businesses as supply challenges moderate and additional revenue opportunities are created. Growth could be further bolstered by the Group’s active acquisition strategy. On the basis of continued geographical diversification and revenue growth, but tempered by prevailing inflationary pressures, Bourse maintains an OVERWEIGHT rating on MASSY.

GraceKennedy Limited (GKC)

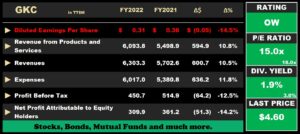

GKC reported Earnings per Share (EPS) of TT$0.31 for the financial year ended December 31st 2022(FY 2022), 14.5% lower than the EPS of TT$0.36 reported in FY 2021.

Product and Services Revenue improved 10.8% from TT$5.5B to TT$6.1B, while Interest Revenue advanced 2.9% to TT$209.5M. Overall, Total Revenue increased 10.5% to TT$6.3B in FY 2022 from TT$5.7B in FY 2021. Direct and Operating Expenses grew 11.9% to TT$6.0B, while Net Impairment Losses on Financial Assets contracted 21.4% to TT$15.3M. Consequently, Total Expenses expanded by 11.8%. Profit from Operations decreased 14.0% from TT$524.9M to TT$451.6M FY 2022. Resultantly, GKC’s Operating Profit Margin moved down from 9.2% to 7.2% in the period under review.

Interest Income from Non-Financial services was down 4.7% year on year (YoY), followed by an 2.0% increase in Interest Expense from Non-Financial Services. Share of Results of Associates and Joint Ventures advanced 62.2% to TT$29.7M. Profit Before Tax (PBT) amounted to TT $450.7M, down 12.5% from TT$514.9M in the corresponding period. Taxation expense was TT$115.8M relative to the prior TT$120.6M. Ultimately, Net Profit Attributable to Owners of GKC stood at TT$309.9, 14.2% lower than TT$361.2M reported in the prior period.

PBT Contracts

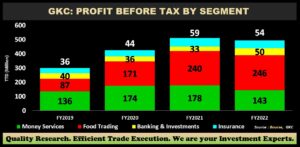

Food Trading, the largest contributor to PBT (50%) increased 2.5% from TT$240M in FY2021 to TT$246M in FY2022. GKC’s food distribution business achieved double-digit growth in revenues and PBT year-on-year in its primary jurisdiction of Jamaica, reflecting continued demand for its core products. On the other hand, GKC’s food manufacturing division PBT was impacted by global supply chain challenges and increased packaging costs. The Group’s international businesses were negatively affected by inflated distribution and logistics costs, leading to lower PBT and margin compression.

GraceKennedy Money Services (GKMS), the second largest contributor to PBT (29%) fell 19.5% to TT$143M, affected by lower remittance inflows as the disposable income of remittance customers had fallen as a result of inflationary pressures. Notwithstanding the fall in segment PBT, according to the Group, GKMS currency trading services business, ‘FX-Trader’ and bill payment business, ‘Bill Express’ achieved increased revenues and PBT.

Banking and Investments (10% of PBT) expanded 52.8% to TT$50M in FY2022, driven by its investment banking business and gains from successfully executed initial public offerings during the period. The Group’s commercial bank reported growth in both loans and deposits. GK Capital Management Limited’s partnership with the Trinidad and Tobago Unit Trust Corporation officially launched their new Collective Investment Scheme of three mutual fund offerings on March 6th, 2023 in the Jamaican market, two of which are denominated in Jamaican dollars with the third being a US-dollar denominated fund.

The Group’s Insurance Segment, which accounted for 11% of PBT fell 9.6% to TT$54M from a previous TT$59M, attributed to a combination higher-than-anticipated insurance claims.

Higher Expenses Compress Margins

Having improved its margins in the prior three (3) comparable periods, GKC’s margins fell in FY2022 owing to a challenging macro-driven environment, underpinned by inflationary pressures, increasing interest rates, inconsistent supply chains and increased distribution costs which collectively compressed margins. Operating Profit Margin fell from 9.2% in FY2021 to 7.2% in FY2022, while Profit Before Tax Margin moved from 9.0% in FY2021 to 7.2% in FY2022.

According to GKC, the Group has increased its emphasis on cost containment efforts, while at the same time implementing strategies to grow revenues and profits sustainably. The anticipated cooling of inflationary pressures and distribution costs could lead to margin stabilization in the upcoming periods.

GKC boosted by M&A Activity

The Group is awaiting regulatory approvals to complete its 100% acquisition of Scotia Insurance Caribbean Limited (SICL), which was announced in August 2022. Once this transaction is completed, this means that the Group would have expanded its life insurance business to a total of 13 Caribbean markets, further extending its insurance footprint in the region. In addition, the Group on February 14th, 2023 increased its stake in Catherine’s Peak Bottling Company Limited, owner of the Catherine’s Peak pure spring water brand, from 35% to 70%, subject to customary closing conditions. This transaction is consistent with GKC’s growth strategy in its foods division.

The Bourse View

At a current price of $4.60, GKC trades at a P/E ratio of 15.0 times, below the Conglomerate Sector average of 18.0 times. The Group announced an interim dividend of TT$0.02 payable on April 6th 2023 to shareholders on record by March 17th 2023. The stock offers investors a trailing dividend yield of 1.9%, below the sector average of 3.0%.

On March 1st, 2023, GKC’s announced a buy-back of its shares, subject to regulatory approvals. If approved, the proposed buy-back will be executed on the open market in Jamaica and Trinidad & Tobago – thus enhancing shareholders’ value and providing a boost to the financial metrics of the company. The Group is expected to continue its growth strategy by executing inorganic opportunities as they arise whilst placing emphasis on its cost containment initiatives. On the basis of revenue growth and acquisition activity, Bourse maintains an OVERWEIGHT rating on GKC.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”