HIGHLIGHTS

AMCL 9M2022

- Earnings: EPS 100.0% lower from $1.65 to $0.00

- Performance Drivers

- Higher Revenues

- Lower Operating Margins

- Non-Cash Mark-to-Market Losses in Investment Portfolios

- Outlook:

- Growth Opportunities

- Volatile Financial Markets

- Rating: Maintained as MARKETWEIGHT

AMBL 9M2022

- Earnings: Loss Per Share of $1.85 relative to an Earnings Per Share of $2.02

- Performance Drivers:

- Non-Cash Mark-to-Market Losses in Investment Portfolios

- Outlook:

- Colfire Acquisition

- ANSA Bank Rollout

- Volatile Financial Markets

- Rating: Maintained at MARKETWEIGHT

This week we at Bourse review the performance of Ansa McAL Limited (AMCL) and its subsidiary Ansa Merchant Bank Limited (AMBL) for their respective nine-month periods ended September 30th, 2022. AMCL and AMBL’s banking and insurance segments were adversely affected by heightened volatility in the global financial markets. With both entities experiencing a fall in performance, will this uncertain operating environment persist? We discuss below.

Ansa McAL Limited (AMCL)

Ansa McAL Limited (AMCL) reported Diluted Earnings per Share (EPS) of $0.00 for the nine months ended September 30th, 2022 (9M2022), compared to an EPS of $1.65 reported in 9M2021. Revenue amounted to $4.7B for 9M2022, up 14.1% or $581.4M. Operating Profit declined 67.7% from $494.6M in 9M2021 to $159.8M in 9M2022. Resultantly, the Group’s Operating Margin contracted to 3.4% from 12.0% in the prior period. Finance costs increased 6.8% to $37.2M. Share of Results from Associates and Joint Venture Interests expanded 721.4% to $16.5M (9M2021: $2.0M). Profit Before Tax declined 69.9% from $461.8M in 9M2021 to $139.1M in 9M2022, resulting in a fall in PBT Margin (9M2022: 2.9%). The Group taxation expense amounted to $125.4M in the current period under review relative to $126.7M in 9M2021. Overall, Profit for the Period dipped 95.9% from $335.2M reported in 9M2021 to stand at $13.7M in 9M2022.

‘Banking and Insurance’ sinks PBT

The Caribbean’s largest conglomerate reported Profit Before Tax (PBT) of $139M in 9M2022 relative to $462M in 9M2021. The Manufacturing, Packaging & Brewing PBT, its top-earnings segment, advanced 181.5% from $174M in 9M2021 to $316M in 9M2022, as a result of an uptick in economic activity. The Automotive, Trading & Distribution segment increased 38.5% to $124M relative to $90M in the prior comparable period. Banking and Insurance services swung from a PBT of $217M in the prior comparable period to a loss of $145M, as the Group continue to be adversely affected by volatile global financial markets and non-cash mark-to-market losses in their investment portfolios. The Media, Services, Retail and Parent Company segment experienced the sharpest decline to stand at a loss of $157M. However, this segment may be boosted in the near term, driven by Guardian Media Limited’s (GML) broadcast of the ongoing FIFA World Cup Qatar 2022.

AMCL posted an EPS of $0.00 in 9M2022, down from $1.65 in the prior year-ago period resulting in its trailing 12-month EPS falling to $1.80 in 9M2022. The Group’s Price-to-Earnings (P/E) multiple expanded from 19.3 times to 27.8 times in the current period.

The Bourse View

At a current share price of $50.00, down 16.0% year-to-date, AMCL trades at a trailing P/E of 27.8 times, above the Conglomerate sector average of 17.7 times. The stock offers investors a trailing dividend yield of 3.6%, above the sector average of 3.0%. AMCL has outlined its initiatives to achieve an ambitious objective of doubling its profitability by 2027. These initiatives appear to be broad-based, considering both organic and inorganic opportunities as well as existing and new markets. With AMCL’s relatively low leverage and access to domestic and regional capital markets, there remains capacity for growth through acquisitions should the right opportunities come along. On the basis of increased revenues and a relatively attractive dividend yield, but tempered by lingering financial market uncertainty, Bourse maintains a MARKETWEIGHT rating on AMCL.

ANSA Merchant Bank Limited (AMBL)

AMBL reported a Loss Per Share (LPS) of $1.85 for the nine-month period ended 30th September 2022, (9M2022), in stark contrast to the Earnings Per Share (EPS) of $2.02 reported in the previous period (9M2021).

Total Income declined 39.8%, from $788.2M in 9M2021 to $474.1M in 9M2022. Total Expenses increased 9.8% YoY, to $625.5M. Resultantly, Operating Loss stood at $151.8M in 9M2022, relative to an Operating Profit of $218.6M in the prior comparable period. Taxation expense decreased to $7.4M. Overall, a Loss Attributable to Shareholders of $158.8M was reported, relative to a Profit of $172.2M in 9M2021.

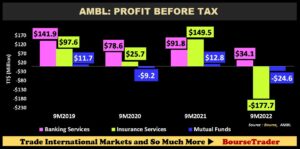

PBT Contracts

AMBL recorded a consolidated loss before tax of $151.3M for the nine-month period ended 30 September 2022, versus a profit before tax of $218.6 million for the same period last year.

The Insurance Services segment, comprising TATIL and TATIL Life led losses among the segments reporting a loss of $177.7M, versus a profit of $149.5M in 9M2021. This was primarily due to heightened volatile financial markets and non-cash mark-to-market losses in AMBL’s investment portfolios.

A release from AMBL dated November 1st 2022 advised that all regulatory approvals for the transaction to acquire 94.2% of Colonial Fire & General Insurance Company Limited (Colfire) have been received.

Banking Services PBT dipped 62.8% YoY, from $91.7M to $34.1M in 9M2022. The Group is expected to make Ansa Bank Limited the first digitally enabled commercial bank by early 2023, which will enable loan and customer growth.

The Mutual Funds segment reported a loss of $24.6M during the period, compared to a profit of $12.8M in HY 2021. Income generated by this segment contracted 34%, likely affected by lower investment income and elevated unrealized losses on investments, with expenditure increasing 156.9% YoY.

The Bourse View

AMBL is currently priced at $43.50 and the stock presently offers investors a trailing dividend yield of 2.8%, below the Non-Banking Sector average of 3.7%. AMBL’s ‘transformative digital commercial model’ is on track to be launched before the end of 2022, with expectations of capturing new and better serving current clients. On the basis of acquisition activity and execution of its digital banking strategy, but tempered by uncertain financial markets, Bourse maintains a MARKETWEIGHT rating on AMBL.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”