HIGHLIGHTS

Budget, Growth and Debt

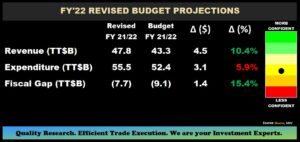

- Higher revised Revenue projection for 2022 of TT$47.8B

- Expenditure projection increased for 2022 at TT$55.5B

- Fiscal Deficit narrowing to TT$7.7B (initial estimate TT$9.1B)

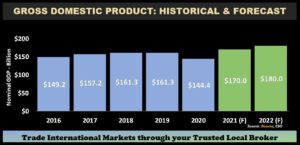

- GDP increased to $180B in May 2022 (Mof)

- In funding the Fiscal Deficit:

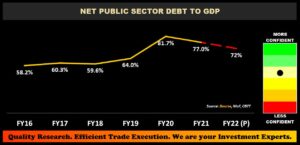

- Debt to GDP ratio currently stands at 72% (MoF)

- Deposit to be made to HSF

- No net new borrowings from December 2021- May 2022

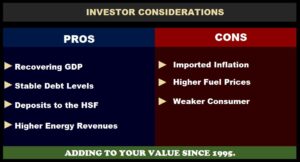

Investor Considerations

- Recovering GDP

- Deposits to the HSF

- Higher Energy Revenues

- Imported Inflation

This week, we at Bourse evaluate the 2022 Mid-Year Review delivered by the Honourable Minister of Finance, considering the information presented and its potential impact on investor sentiment and opportunities. A better-than-expected fiscal position at the halfway point of FY 2022 has been attributable largely to buoyant energy prices, while the lifting of Covid-19 restrictions would have also helped to improve economic activity. Could investor confidence in T&T be set to improve, or will domestic and global headwinds continue to weigh on sentiment? We discuss below.

Revenue and Expenditure Forecast to Increase

Total Revenue for the FY2022 period was initially forecast to be $43.3B, $12.6B of which would be derived from the energy sector based on an oil price of US$65.00/barrel and a natural gas price of US$3.75/MMBtu.

Energy commodity prices have significantly exceeded budget forecasts thus far during the fiscal year, with US WTI crude prices averaging $88/barrel and natural gas prices averaging $5/MMBtu during the period October 2021-April 2022. Supply shocks from the Covid-19 pandemic and the Russian invasion of Ukraine have kept prices high, leading to revised budgeted average prices of US$95/barrel for oil and US$5/MMBtu for natural gas.

The Honourable Minister of Finance stated during the mid-year review that the government expects additional revenue of $4.5B-$5.0B in FY2021/2022, largely attributable to increased energy commodity prices. Using the lower estimate of additional revenue ($4.5B), the forecast FY2022 figure for Revenue is projected to be $47.8B, 10.4% higher than initial projections.

Supplementary Appropriation of $3.1B for the FY2022 budget period was proposed to cover increased operational costs across ministries, the Tobago House of Assembly and other entities. This additional funding is required to meet largely recurrent expenditure including salaries, contracted services gratuities, legal fees, property lease/rentals and payments to service providers. Subsequently, Expenditure for FY 2022 is now estimated to amount to $55.5B. Based on the projected increases in Revenue and Expenditure, the Fiscal Deficit is expected to contract to -$7.7B, $1.4B (15.4%) lower than initial projections of -$9.1B.

Investor View: Despite the increase in recurrent expenditure, a forecast narrower fiscal deficit should be a positive development for investor sentiment.

HSF Inflow Imminent

The Heritage and Stabilization Fund (HSF) is set to receive a contribution for the first time since 2013, as announced during the mid-year review. During periods where estimated energy revenue exceeds budgeted energy revenue, in accordance with the HSF Act 2007 section 14(1), a minimum of 60% of the total excess petroleum revenues, must be deposited to the Fund. The deposit is expected within the first month after the quarter in which the excess is calculated, per section 13(2) of the act.

As at December 2021, the Net Asset Value (NAV) of the fund stood at US$5.62B, comprising an estimated US$4.17B in investment returns and US$1.46B in net contributions. The HSF reported its highest annual return to date of 11.75% for FY 2021, exceeding its Strategic Asset Allocation (SAA) benchmark by 3.0%. This was attributable to its exposure to the global equity markets subsequent to the Board’s tactical decision not to rebalance the fund and deviate from the asset allocation limit of +/- 5%. Net contributions, however, have fallen to its lowest level since initiation, with US$1.87B withdrawn during 2020 to 2021.

Investor View: A contribution to the HSF should be viewed as a positive development. The contribution may carry more significance, given the recent volatility of financial markets and the potential adverse impact to the HSF’s investment returns and Net Asset Value.

Nominal GDP Up, Debt Levels Stable

According to the Minister of Finance, Gross Domestic Product (GDP) for FY2021 was TT$170B as compared to an estimated TT$150B. (Note: Currently available Central Statistical Office, data on quarterly GDP at current prices suggests trailing GDP for FY 2021 to be in the vicinity of $157.5B). Combined with the news of debt levels currently ‘stable’ at or near $130B, T&T’s Debt:GDP ratio would have moderated to 77% from the initial estimate of 87% in FY 2021. According to the Minister, GDP is now estimated to approach TT$180B in FY 2022, with the Debt:GDP anticipated to further decline to 72% (suggesting no net new borrowing for the rest of Fiscal 2022).

Investor View: Stable debt levels and improving GDP are both favourable developments, which should be positive for investor sentiment and the country’s credit rating stability in the near-term.

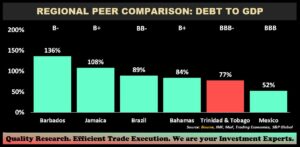

T&T Comparable to Regional Peers

Trinidad and Tobago’s estimated Debt-to-GDP of 77% FY 2021 compares favorably to its regional peers. Trinidad and Tobago is rated ‘BBB-’ by international credit rating agency, S&P Global Ratings (S&P). Among these peers, Mexico rated ‘BBB’ is the only other country rated as Investment Grade (‘BBB-’ and greater) with the lowest Debt-to-GDP of 52%. In contrast, post-restructuring under IMF programs, both Barbados and Jamaica carry the highest Debt-to-GDP levels exacerbated by the COVID-19 pandemic at 136% and 108% respectively with credit ratings of ‘B-‘ and ‘B+’ respectively.

T&T USD Bonds Continue to Trend Lower

Despite the potentially improved credit metrics of Trinidad and Tobago owing to the additional revenue from the rise in energy prices, T&T-issuer USD bond prices continued a downward trend. This is attributable to an incremental increase in interest rates at different intervals during 2022. This has the potential to offset the seemingly positive credit metrics as the most popular issuers (National Gas Company, Trinidad Petroleum Holdings Ltd, Trinidad Generation Unlimited, and the Government of the Republic of Trinidad and Tobago) are currently trading at the lower end of their respective trailing 52-week range yielding an average of 5.0% to 8.9%. Heritage 9.0% 2029, the refinanced version of TPHL 9.75% 2026, is an exception as this bond is trading just above par at $104.00 with a yield of 8.258%.

VAT Refunds to Boost Vitality

The Honourable Finance Minister, Colm Imbert announced the payment of VAT refunds to registered businesses in the amount of $4.0B for Fiscal 2022- 2023, with an injection of $1.7B of the supplemented expenditure for the period April 2022 to September 2022. This is financed by increased revenues derived from higher energy sector tax receipts, a spillover of amnesty tax payments from 2021 and higher withholding receipts.

This is a welcome relief for the private sector, especially the SME sector and it could assist in alleviating cost burdens and cash flow challenges allowing them to: (i) purchase raw materials and other inputs, (ii) invest in its manufacturing operations for the purposes of feeding the economy, (iii) pay outstanding salaries, (iv), deleverage and enhance financial position and (v) expand employment and business activities.

Should Investors be more Confident?

The Honourable Minister of Finance would have provided objective good news in the form of (i) higher energy revenues, (ii) additions to the HSF, (iii) stable debt levels and (iv) recovering GDP. On its own, investors should be more positive about economic prospects for T&T.

Within the wider context of global economic conditions including rising inflation, hawkish central bank policy and generally weaker investor sentiment, however, investors may still be thinking twice before becoming more aggressive in investing. Domestic headwinds including the recent increase in fuel prices, looming increases in water and power tariffs and broad-based inflation are all likely to result in a weaker T&T consumer.

Already, several publicly-listed companies on the Trinidad & Tobago Stock Exchange have reported muted financial performances for the year thus far, with some Non-Banking Sector stocks showing reduced earnings due to the rising interest rate environment and elevated market volatility. Companies in the Manufacturing, Conglomerate and Trading Sectors continue to face headwinds in the form of higher input costs, leading some to pass on increased costs to consumers in an effort to preserve margins. The Energy Sector meanwhile, comprising of lone stock Trinidad and Tobago NGL Limited (TTNGL), reported an improvement in performance as energy markets remain robust.

Overall, the mid-year review should come as a welcome relief from the challenging circumstances endured since the onset of the COVID-19 pandemic. However, investors may adopt a patient approach – seeking evidence of sustained and sustainable improvement – before turning fully positive on investment opportunities within T&T.

As always, investors should consult with an expert investment adviser like Bourse to make more informed investment decisions.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”